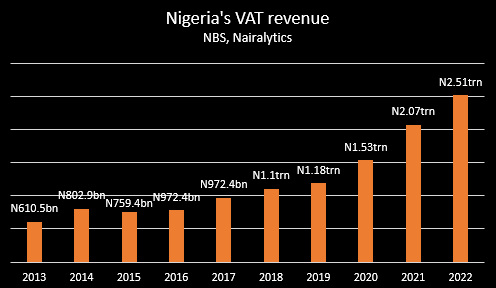

Nigeria generated a sum of N2.51 trillion as Value Added Tax (VAT) in 2022, marking a 21.2% increase compared to N2.07 trillion recorded in the previous year.

According to the recently released VAT report by the National Bureau of Statistics (NBS), N1.48 trillion was generated as local non-import VAT, N510.8 billion was generated as foreign non-import VAT, and Nigeria Customs Service (NCS) remitted N521.5 billion VAT.

Recommended reading: How To Register For VAT in Nigeria

Further breakdown of the data showed that the highest VAT was recorded in the fourth quarter at N697.38 billion, followed by N625.39 billion recorded in Q3 2022. Meanwhile, a sum of N600.15 billion was generated in Q2 2022 while N588.59 billion was recorded in the first quarter.

Nigeria’s VAT revenue has grown significantly in recent years, following the increment of the VAT rate from 5% to 7.5% in 2020. Since the review of the VAT rate, Nigeria’s revenue from VAT collection has doubled. Interestingly, the N2.51 trillion recorded in 2022 is the highest on record.

VAT remittance by sector: According to the NBS report, the manufacturing sector remitted the highest value-added tax in 2022 at N477.43 billion, accounting for 19% of the total VAT collection in the review year.

- In the same vein, the information and communication sector, which houses some of the largest quoted companies followed by VAT remittance of N268.84 billion, represents 10.7% of the total collection in 2022.

- The mining and quarrying industry accounted for 6.3% of the total VAT collection, having remitted a sum of N158.5 billion, while the public administration remitted N128.67 billion. The financial industry however followed with a sum of N109.25 billion VAT remittance.

- On the flip side, household activities, extraterritorial, and water/waste management recorded the least VAT remittance in the review year with N332.7 million, N882.9 million, and N1.6 billion respectively.

Calls for more VAT increase: Nigeria’s federal government has been grappling with a persistent fiscal deficit, largely as a result of shrinking revenue collection amidst increasing government expenditure.

- The 2023 budget comes with an over N11 trillion deficit, which is expected to be funded through more borrowings, despite a debt stock of $101.1 billion.

- Considering the recent call for fiscal restructuring, the federal government is set to remove petrol subsidy payments by the middle of the year, which gulps over N4 trillion annually.

- However, the International Monetary Fund (IMF) has advised the federal government to review the VAT rate upward, to shore up revenue and manage fiscal imbalance.

- The international agency noted in their Article IV Staff mission in November last year, that the federal government should increase the VAT rate from 7.5% to 15%, as well as remove petrol subsidy in a bid to better manage the fiscal economy of the country.

Why this matter: VAT is a major component of the non-oil revenue of the federal government, which has been instrumental in recent years following the dwindling inflows from oil export sources.

It is imperative for the government to increase its tax bracket in a bid to improve tax collection and ensure a better fiscal number, especially considering that a new administration is set to take over by the end of May 2023.