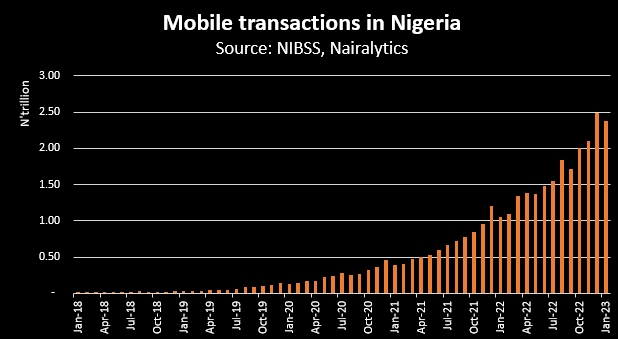

Nigerians registered mobile transactions worth N2.37 trillion in January 2023, representing a staggering 125% increase over the same period the previous year despite the country’s ongoing cash shortage.

This is according to recent data from the Nigeria Inter-Bank Settlement Systems (NIBSS). Furthermore, the volume of mobile transactions in the largest African economy increased by 55% year on year to 108.1 million, compared to 32.6 million transactions in January 2022.

Whilst the value rose by 125% year on year, it fell slightly when compared to the December 2022 transaction value of N2.48 trillion the highest on record.

- It should be noted that the month of December is also known for higher spending due to the Christmas and New Year’s celebrations in most parts of the country.

- Transaction volume and value have surged by over 50% and 18% respectively since the announcement to introduce new naira notes was announced.

- Total transaction volume and value was N709 billion and N2trillion at the end of October 2022.

Instant Payments

- In particular, the value of NIP (NIBSS Instant Payments) increased by 46% to N38.77 trillion in January 2023, up from N26.65 trillion in the same period in 2022. It fell by 7.7% when compared to the previous year’s figure of N42.03 trillion.

- The volume of NIP transactions increased by 55% year on year to 541.65 million, up from 348.4 million in January of last year.

- In the same month, POS transactions in the same currency increased by 41% to N807.16 billion. In the same period in 2022, it stood at N573.7 billion.

Cash Shortages

Nigerians have faced severe cash shortages in recent weeks as a result of the central bank’s decision to redesign higher naira denominations and phase out old notes. The original deadline for using the old notes was January 31, 2023, but this was later extended.

- However, due to the limited number of new notes in circulation, cash transactions have been difficult to come by in the country, with many people having to wait in long lines at banking halls, ATMs, and point of sale (POS) machines to obtain cash.

- Some have had to pay up to 30% more to withdraw money from POS machines across the country.

- Due to the country’s cash shortage, Nigerians were forced to use alternative banking methods such as mobile banking, NIP, and the Point of Sale.

Banking infrastructure deficit

On the other hand, growth could have been higher than what was recorded in January, given the need for Nigerians to complete transactions despite a lack of cash.

- However, the banking sector’s deficit has frustrated many Nigerians in the last two weeks, as they have experienced significant delays with their mobile transactions, including unsuccessful debited transfers, inability to access bank mobile apps, and network failures, among other things.

- The frequent downtime in bank applications was caused by increased usage, leaving Nigerians with few options but to switch to alternative payment methods.

- But, the majority of the infrastructure of banks and FinTechs is insufficient to handle the volume of traffic.

This reduced the number of transactions that would otherwise have been recorded in January 2023. As cash scarcity persists, the current month appears set to outperform the previous month.

Why this matters? The CBN has taken an aggressive approach to increase the adoption of cashless transactions in the country, by reducing the volume of higher denominations in the economy, lowering the over-the-counter withdrawal limit, and redesigning the new currency notes in general.

- As a result, it is critical to constantly monitor the adoption of alternatives in Nigeria in order to assess the success of the apex bank’s policy.

- It is, however, critical for banks and other sham banks to expand and improve their infrastructure in order to accommodate more Nigerians who want to use cashless transactions.

Some banks are charging on intra bank transfers within their network. This is absurd. It will create the appetite to open account in many banks. I don’t know how this would aid financial inclusion. The banks are short changing customers. The same they cheated many savers on their interest earnings. Nigerians live for the banks considering the numerous charges on their services. CBN should harmonize this and give the decision wider publicity.