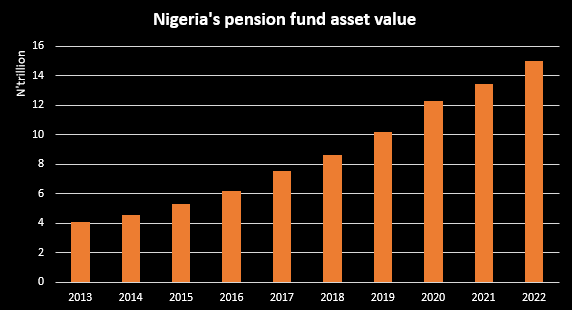

Nigeria’s Pension Fund Assets Under Management rose to N14.99 trillion as of December 2022, representing a gain of N1.5 trillion (11.7%) compared to N13.42 trillion recorded in 2021.

This is contained in the recently released pension industry report by the National Pension Commission (PenCom).

The gain recorded in 2022 (N1.5 trillion) is 40.2% higher than the N1.12 trillion increase recorded in the previous year. However, when compared to 2020, the gain was 24.9% lower than the N2.09 trillion increase recorded.

In the same vein, the number of Retirement Savings Account (RSA) registrations increased by 333,002 to stand at 9.86 million as of December 2022.

Key highlight: Investments in federal government securities increased by N870.55 billion to stand at N9.64 trillion, most of which were in form of FBN bonds (N9.22 trillion).

- Corporate debt securities as of the end of the year stood at N1.66 trillion, representing an increase of 75.99% (N716.86 billion) compared to N943.34 billion recorded as of the same period in 2021.

- Investment in money market instruments declined marginally by 2.07% to stand at N1.98 trillion.

- Real Estate received a sum of N60.81 billion in additional investments from the pension contributory scheme in 2022, bringing its cumulative investments to N217.6 billion at the end of the year.

Meanwhile, the existing scheme stood at N1.48 trillion as of December 2022, N124.8 billion higher than the N1.35 trillion recorded as of the beginning of the year. The closed pension fund administrators increased slightly by N46.98 billion to stand at N1.57 trillion at the end of the review year.

Fund I stood at N74.229 trillion, while the Fund II category, which has the giant share compared to the other fund stood at N6.5 trillion, presenting an increase of N621.98 billion compared to N5.88 trillion recorded as of December 2021.

The Fund III category also increased by N606.74 billion to stand at N4.15 trillion. The breakdown of the other fund categories is Fund IV (N1.19 trillion), Fund V (N374.94 million), Fund VI (N32.26 billion), and Fund VI retiree (N33.94 billion).

Why this matter: The Nigerian pension industry is an important sector of the Nigerian economy considering its importance in the retirement plan of the citizens and workers.

- The growth recorded in the Nigerian pension industry in recent years has been impressive, gaining over N4.7 trillion in net assets in just three years.

- The industry also witnessed some restructuring in the form of acquisitions and mergers in 2022, in a bid to create a more competitive pension industry.

- Meanwhile, compared to the value of the nation’s economy, Nigeria’s pension contributory scheme only contributes about 20.3% to the real GDP.