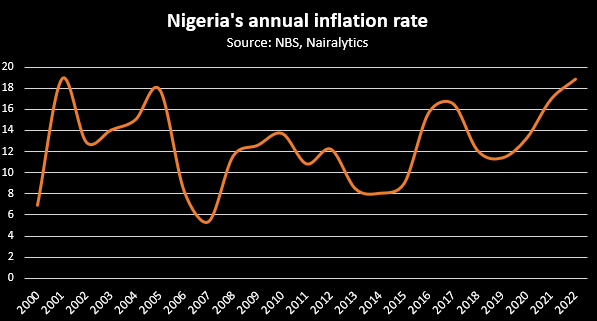

Nigeria recorded an annual headline inflation rate of 18.85% in 2022, in what was a remarkable year ravaged by several economic headwinds. According to the research website, Nairalytics, Nigeria experienced its worst inflation rate in the last twenty-one years.

The last time Nigeria recorded an annual inflation rate higher than 18.85% was in 2001 when the consumer price index rose by an average of 18.87%.

The African giant, just recovering from the covid-19 pandemic and the ripple effect from the #EndSARS movement in 2020, faced further hardship due to Russia’s invasion of Ukraine in February 2022 which was followed by inflationary woes.

A cursory look at the monthly trend showed that Nigeria’s inflation rate bridged a 17-year ceiling of 21.47% in November, largely attributed to the global energy crisis, depreciation of the exchange rate, food crisis, and surge in transportation cost amongst others.

Effect on poverty level: A trend analysis of the data gives an indication of how Nigeria’s inflation trended significantly upward in the last three years, increasing by over 700 basis points between 2019 and 2022.

- The rising inflationary pressure in the county pushed more Nigerians below the poverty line, as the purchasing power of citizens was severely eroded, without a corresponding increase in income level.

- The World Bank estimated that over 5 million Nigerians were pushed into poverty in 2022, bringing the total number to 95 million as of the end of the year.

- On the other hand, statistics from the National Bureau of Statistics (NBS) revealed that about 133 million were multidimensionally poor in 2022, representing 63% of the population.

Nigeria’s inflation rate leapt over 18% despite an estimated projection of 11.95% by the federal government. Considering the massive leap, it is imperative to consider the factors that shaped the movement of Nigeria’s inflationary quagmire in 2022.

Russia-Ukraine war: The year was set to be one for economic recovery and resilience, at least, according to the budget by President, Muhammadu Buhari during his presentation to the joint session of the National Assembly on 8th October 2020.

- However, in February 2022, Vladimir Putin, the President of Russia ordered the invasion of his troops into Ukraine, setting the course for a historic global price shock. This led to the rise in energy costs across the world, Nigeria inclusive.

- The price of diesel increased from less than N300 per litre at the beginning of the year to over N800, triggering a surge in transportation costs.

- Food items like durum wheat soon became significantly expensive, since Russia and Ukraine are major players in the exportation of the agro-product.

Flooding/food crisis: One of the unusual events of 2022 included floods in food-producing areas of the country.

- A report from the National Emergency Management Agency (NEMA), revealed that 27 states in Nigeria were hit by flooding caused by heavy rains and the release of water from the Lagdo Dam in neighbouring Cameroon.

- Nigeria suffered a food supply crunch during this period, which saw prices surge drastically, on the backdrop of destroyed farmlands and produce.

- Food inflation during the year averaged 20.82% compared to the 12-month moving average of 20.49% recorded in the previous year.

Exchange rate volatility: Nigeria’s exchange rate at the black market depreciated by 23.1% in 2022 in a dramatic fashion, trading as high as N900/$1 during the year before settling at N735/$1.

- The increased volatility in the exchange rate market was due to increased demand for greenbacks, following the Japa syndrome and the need to invest and save in foreign currencies.

- Also, the lack of FX in the Nigerian economy, put a strain on the exchange rate for the most part of the year, despite interventions by the CBN to ensure the stability of the local currency.

- At the official market, the exchange rate also depreciated by 5.7% during the year to close at N461.5/$1.

Money supply: Nigeria’s money supply surged to an all-time high of N51.8 trillion in November 2022, resulting in an N7.97 trillion increase in the first eleven months of the year.

- According to the CBN, the increased money supply and currency in circulation fuelled the rising rate of inflation in the country, on the back of interventions by the apex bank to cushion the impact of the pandemic on the economy.

- Data from the CBN showed that 84% of the total currency in circulation as of November 2022 was outside of banks’ vaults. And this is believed to have contributed to Nigeria’s rising inflation rate.

- Although, the CBN has dished out several policies during the year intending to tame inflation, some of which include raising interest rates by 500 basis points to 16.5%, reducing the maximum OTC withdrawal limit, and redesigning higher denominations amongst others.

- Meanwhile, in the last month of the year, the inflation rate eased for the first time in eleven months, despite the expected increase in spending during the festivities.

Energy crisis/transportation cost: Following the Russia-Ukraine crisis, the cost of energy in the global market surged to unprecedented levels, which affected the landing cost of petrol and other petroleum products in Nigeria.

- The cost of diesel increased by over 200%, since it is not a regulated item, while petrol moved from an average of N168/litre to as high as N250 and N400 depending on the location. This led to a surge in transportation costs, and a significant increase in the operating costs of businesses.

- The increase in diesel prices forced many Nigerian businesses to ration their operating periods, in a bid to minimise their operational cost. Air transport costs also surged following the increase in aviation fuel.

Meanwhile: It is worth adding that the fact that 2022 was an electioneering year, that is, a year preceding an election, which is dubbed to be a historic one, at least a certainty that there will be a change in administration.

This has also impacted the state of the economy, as Nigerians and investors alike are waiting to see who wins the coming presidential election, which will inevitably determine the direction of the country for the next four years, at the least.

Meanwhile, Nigeria is not isolated in the issue of rising inflation rate in 2022, as many other countries suffered a similar fate, with the likes of the US, United Kingdom, France, Canada, Ghana, and Egypt facing unprecedented levels of inflationary pressure.