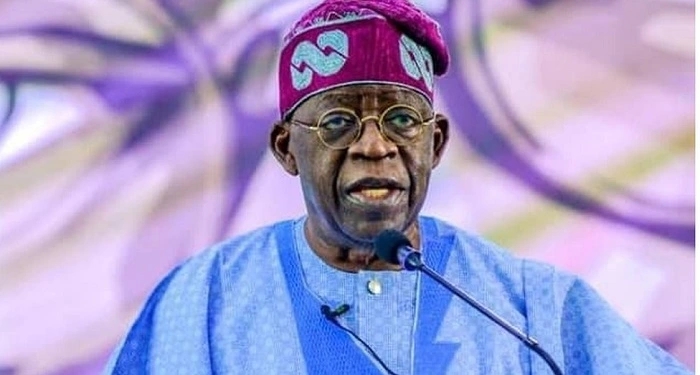

Bola Ahmed Tinubu, the Presidential candidate for the All Progressives Congress (APC), expressed his support for the removal of fuel subsidy, a move the other main candidates also express.

Tinubu disclosed this on Friday in a meeting with the Nigerian Economic Summit Group (NESG) in Lagos, laying out his economic vision.

He stated that Nigeria needs to remove subsidy as it has outlived its importance.

Removal: Tinubu noted that the subsidy needs to be removed as it had outlived its shelf life and is used as a tool to subsidise neighbouring countries’ fuel consumption. He added:

- “The subsidy money will not be ‘saved’ because that means elimination from the economy.

- “Instead, we will redirect the funds into public infrastructure, transportation, affordable housing, education, health, and strengthen the social safety net for the poorest of the poor, thus averting increased security challenges.

Address insecurity: Tinubu urged that Nigeria must address insecurity challenges as no country can excel with such levels of violence.

- “First, to achieve the economy we seek, we must resolve the pressing security issues. No nation can flourish with terrorists and kidnappers in their midst.

- “My core belief is that the private sector must be the prime driver of economic progress.

- “However, the government establishes the framework within which the private sector must operate.

- “If that framework is sound, the private sector will flourish but if the framework is frail or incomplete, then the private sector will struggle”.

New budget standard: Tinubu also called for new budgetary standards that remove the budget from dollar-denominated oil revenues.

- “Fiscal policy will be the main driver while monetary policy is weaker and a less effective instrument.

- “Thus, we must steadily remove ourselves from the fiction of tying our budgets to dollar-denominated oil revenues.

- “This is effectively pegging our budget to a dollar standard. It is as outdated as the fuel subsidy itself.

- “It is also restrictive and ties the economy to slow growth.

- “Just as the common man must mentally sever the cord to the subsidy, the elite must cut the cord to this artificial fiscal restraint”.

What you should know

At the Channels Television’s Townhall series on Sunday, Peter Obi the Presidential candidate for the Labour Party stated that his administration will remove fuel subsidies and send the proceeds into social development areas including health and Education citing the FG subsidy payments are a “bloated scam”.

Atiku Abubakar, the presidential candidate of the People’s Democratic Party has also stated that Nigeria’s fuel subsidy removal is inevitable, but has to be accomplished through negotiations with organized labour.

Also, Nigeria’s Minister of Finance, Mrs Zainab Ahmed, revealed only N3.36 trillion was earmarked for fuel subsidy in Nigeria’s 2023 budget.

The minister said fuel subsidy payments will remain up to mid-2023, based on the 18-month extension announced in early 2022. This means fuel subsidy payments will be stopped in June 2023, after a new administration has been inaugurated following the outcome of the general elections in February-March 2023.