With commendations from the private sector on the government’s decision to suspend the proposed increase in excise duty rates, it is not surprising to see why.

The Nigerian beer manufacturing industry could suffer a significant downturn, on the back of persistent economic headwinds and government multiple taxations on the companies.

This was confirmed by expert reviews and reports on the proposed review of the excise tax on beverages and notes for key considerations for optimal outcomes.

Experts specifically noted that the Nigerian beer manufacturing companies could see their profit before tax reduced by a massive 137% in 2022 if the proposed or suspended excise duty increase pushes through or is revisited.

The covid-19 pandemic of 2020 worsened the situation of the Nigerian economy, which had been suffering from several underlying infrastructures and socio-economic factors, including insecurity, ease of doing business, inflationary pressure, and persistent currency depreciation amongst others.

Aside from the PwC report, a cursory review of available financial data of the publicly quoted companies showed that the beer manufacturers were one of the worst-hit industries in the Nigerian economy, printing an aggregate net loss of N31.39 billion between 2019 and 2020.

This is further exacerbated by the proposed increases in the excise duty rates on tobacco, alcoholic, and non-alcoholic beverages as part of the 2023 Fiscal Policy Measures and Tariff Amendments. According to the PWC report, companies in the beer sector may suffer a profit decline of 137% in 2022 due to high taxes, high costs of sales, and operational costs.

Specifically, according to the report, “based on the financial performance of the major players in the beer sector between July and September 2022, and extrapolated to year-end, the quantity of products to be produced is set to decrease by -25%. The Turnover is set to decrease by -10%, gross profit by -33% and profit before tax by a massive -137%”.

The report however noted that the beer manufacturing sector started the year on a good note and recorded a measurable recovery from the recession and the COVID-19 pandemic. However, the recovery in financial performance has remarkably slowed following the implementation of the 2022 Fiscal Policy Measures (FPM).

Inflationary pressure overwhelms revenue: Although the industry has been grappling with the crippling bottom line since before the pandemic largely attributed to operational headwinds, supply chain issues, access to foreign exchange, and multiple tax expenses, recent developments threaten to put the industry at a more precarious position.

- Nigeria’s inflation rate surged to a record 17-year high of 21.47% in the month of November, while inflation on alcoholic beverages, tobacco, and cola also hit its highest level in over 15 years.

- This is coupled with other structural problems ravaging the Nigerian economy, including port congestion, insecurity, and eroding the purchasing power of citizens amongst others.

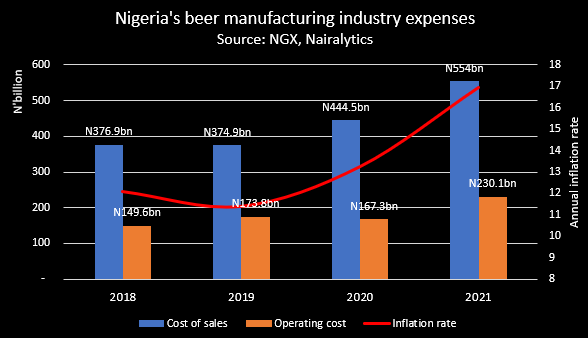

- Media reports suggested that the industry is raking in a fortune in revenue, however, high costs of sales and operational expenses have crippled the profitability of the companies operating in the industry.

- Taking a helicopter view of the finances of the four listed companies on the Nigerian Exchange over the past four years, the industry generated a sum of N2.63 trillion as revenue between 2018 and 2021, while the cost of raw materials gulped a total of N1.75 trillion, leaving a gross profit of N875.8 billion.

This means that the companies recorded an aggregate of 33.3% gross profit margin while operating costs over the four years cleared out N720.8 billion, and post-tax profit stood at N1.51 billion. This is significantly less than what a bank earns as profit in a single quarter of the year.

The data presents even more insights when considered on an individual basis, with Nigerian Breweries spending over N400 billion on operating costs in the four-year period, followed by International Breweries with N161.96 billion.

Notably, local haulage is now over twice the cost of international shipment to Lagos Port, while its lead time has grown from an initial 1 day to 3 days. Similarly, insecurity and surge in diesel prices in various areas of the country have pushed local transportation costs high by as much as 300%.

What you should know: The beverage sector contributes relatively more tax revenue to the government and bears a significantly higher tax burden than the average for other sectors. Indicating that the sector is already bearing a high tax burden.

- Imposition of higher excise taxes without an alignment with the economic indices would not result in a win for government revenue and consumers’ health. The industry analysis before and after the implementation of the 2022 FPM shows that an excise increase is not always a win for government revenue.

- The rates of increase as already presented in the 2022 FPM are significantly higher than the rate of increase proposed year on year in most other African countries where similar products are manufactured, the report says.

- Considering that the demand for beer and non-alcoholic drinks is elastic, many consumers will replace these drinks with illicit substitutes and unhealthy alternatives.

- The report highlighted that a win for healthcare will only occur when consumers are discouraged from excessive consumption of the products rather than replacing their consumption with illicit products.

Upshot

- Given the numbers and performance of the industry in recent years, which has been marred by the covid-19 pandemic, depreciation of the local currency, the surge in the cost of raw materials, and a significant increase in operational expenses, it is easy to understand why the sector has been recording a loss in the past of a couple of years.

- Excise duties have also been a major factor responsible for the crunch in the profits of these companies. Recall that the Nigerian federal government charges an excise duty on beer and stout, wines, spirits, cigarettes, and homogenised tobacco manufactured in or imported into Nigeria at 20%.

- A review of the data shows an inverse movement in the amount paid by the industry on excise duties and the net profits declined by the companies. Interestingly, excise duty paid by the industry in 2017 stood at N33.8 billion in 2017 while net profit was N43.5 billion.

- However, since 2018, the net profit has been on a decline amidst an increase in excise duties. In 2019, excise duty payment stood at N60.2 billion as against a net loss of N7.5 billion. The margin got wider in 2021 with excise duties at N61.2 billion and a net loss of N19.1 billion.

- This is coupled with income taxes and value-added taxes paid by the companies to the federal government, all of which have jointly affected the ability of these businesses to print impressive bottom lines, hence crippling productivity in the industry.

- The current roadmap does not send the right signals for foreign direct investment at a time when retaining investor confidence in Nigeria is crucial.

Written by Olugbenga Aina

This insightful thanks olugbenga