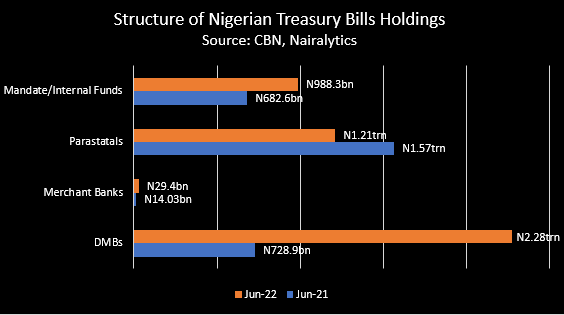

Deposit Money Banks increased their holdings in Nigerian Treasury Bills by N1.55 trillion between July 2021 and June 2022 to stand at N2.28 trillion.

This is contained in the financial market half-year 2022 activity report, released by the Central Bank of Nigeria (CBN).

Commercial banks accounted for 50.5% of the total N4.5 trillion Nigerian treasury bills held as of June 2022, compared to 24.4% recorded as of the corresponding period 2021.

- Last year, parastatals accounted for more than half of the total.

- The increase in banks’ exposure to fixed securities is due to rising volatility in other variable assets and incentives to venture into risk-free government securities rather than corporate or variable debt securities.

Breakdown of NTB structure: Deposit Money Banks (DMBs) accounted for 50.5% of the total after increasing their holdings from N728.9 billion recorded as of June 2021 to N2.28 trillion at the end of June 2022.

- The holdings of merchant banks in Nigerian Treasury Bills as of the review period stood at N29.38 billion, representing 0.7% of the total. It however increased by 109.4% compared to N14.03 billion recorded as of the corresponding period of 2021.

- Parastatals accounted for 26.9% with N1.21 trillion, representing a decline of N354.28 billion from N1.57 trillion recorded as of June 2021 while mandate and internal funds with N988.26 billion as of the end of the first half of 2022 accounted for 21.9% of the total treasury bills holding.

Specific bank statements: A look at the financial statements of NGX-listed commercial banks showed that Access Bank had about N203.35 billion in treasury bills as of June 2022, while First Bank had about N425.75 billion in treasury bills and eligible bills, excluding pledged T-bills.

- GT Bank had about N568.3 billion in treasury bills, N279.49 billion in FG bonds, N3.3 billion and N24.2 billion in corporate bonds and Eurobonds, respectively.

- According to the bank, the Group’s investment in risk-free Government securities constitutes 98.1% of the debt instruments portfolio (December 2021: 99.9%). Investment in Corporate and State Government bonds accounts for the outstanding 1.9%.

- Stanbic IBTC said its trading assets classified as treasury bills stood at N149.5 billion as of June 2022.

- Meanwhile, Zenith Bank stated N926.8 billion as of the same period for Treasury bills (FVTPL), while N1.16 trillion was stated at amortized cost.

More details to note: No new issue of the Federal Republic of Nigeria Treasury Bonds (FRNTBs) was recorded in the first half of 2022. Consequently, the outstanding stock remained unchanged at N75.99 billion as of the end of June 2022.

- A breakdown of the outstanding showed that the CBN held N14.29 billion, while N61.7 billion was held in the Sinking Fund. In the corresponding period of 2021, the CBN accounted for N18.01 billion, while N82.98 billion was held in the Sinking Fund.

- In the review period, FGN Bonds worth N1.13 trillion were offered, while public subscription and sale stood at N2.85 trillion and N1.81 billion, respectively.

- The amount offered comprised new issues and re-openings. In the corresponding period of 2021, FGN Bonds issue, subscription and allotment were N900 billion, N1.72 trillion and N1.42 billion, respectively.

- The increase in the amounts offered, subscribed to and sold in the first half of 2022 was attributable to the government’s drive to fund the budget deficit from the domestic market.

- Consequently, the total value of FGN Bonds outstanding in end-June 2022 stood at N15.63 trillion, compared with N15.19 trillion in end-June 2021, indicating an increase of N426.95 billion or 0.28%.

- A breakdown of the holding structure of FGN Bonds outstanding showed that commercial banks held N9.53 trillion or 60.99%, the non-banking public held N5.96 trillion or 38.16%, and merchant banks held the balance of N132.63 billion or 0.85%.

Meanwhile, the treasury bills rate has witnessed a significant increase in recent times on the back of multiple MPR upward adjustments by the CBN. Recall that the Central Bank increased the monetary policy rate to 16.5% in its last policy meeting in a bid to tame the rising rate of inflation in the country.

Specifically, the CBN’s one-year treasury bills rate for November jumped to 14.84% from 12% recorded in September 2022.