Nigeria’s industrial sector shrank to its lowest value as a contribution to GDP in 7 years, data from the National Bureau of Statistics (NBS) reveal.

Nigeria’s Industrial Sector includes the mining and quarrying sector (oil and gas included), the manufacturing sector, electricity (including gas, steam, and air-conditioning), the construction sector, water sewage, and waste management.

This is also the 6th consecutive quarterly recession having recorded another contraction in the third quarter of 2022. Data from the NBS also reveal Nigeria’s Industrial sector reported a GDP contraction of -8% in the third quarter of 2022.

What the data is saying: The sector has seen its real GDP value go from about N14.9 trillion at the end of 2016 to N14.2 trillion (derived by summing the real GDP of the 4th quarter of 2021 and the first three quarters of this year).

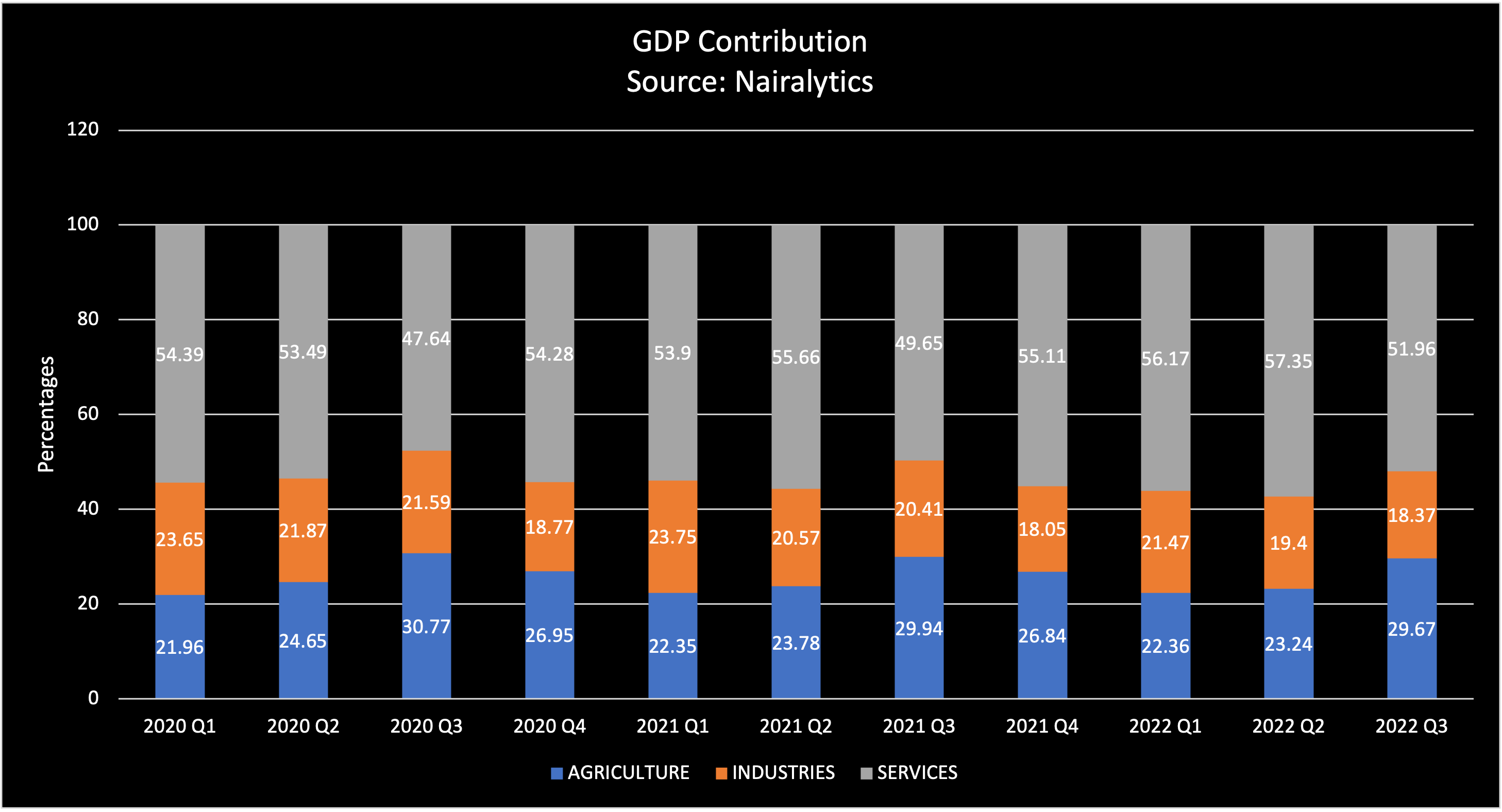

- In addition, the contribution of the Industries sector to GDP has shrunk from 23.7% to just 18.37%, the lowest since Q4 2021.

- Nigeria’s Industrial sector contributed 24% to the country’s GDP as of the first quarter of 2016. It contributed 20.57% in the corresponding quarter of 2021.

- Apart from the oil and gas sector which has led the fall over the years, construction and manufacturing have also recorded massive declines.

- For example, oil refining as a percentage of GDP fell to just 0.01% this quarter, while construction has dropped to below 4% of total GDP. Manufacturing also fell to 8.59% this quarter compared to 8.96% in the corresponding quarter in 2021.

Nigeria has had to rely on the services sector to eke out economic growth since it slipped into a recession in 2020. However, to achieve faster economic growth it will need the industrial sector to grow

Why it is falling? A closer look reveals the sector’s decline is largely due to the fall in crude oil mining and production.

- Crude oil and natural gas contributed as much as 10% to Nigeria’s GDP in 2016 but has now shrunk by 43.5% to just 5.66%

- The manufacturing sector has also declined from 9.5% to 8.6% over the same period.

- The two sub-sectors dominate industrials in terms of size and contribute to the decline we have seen over the years.

- Nigeria recorded a GDP Growth rate of 2.25% in the third quarter of 2022 confirming a general slowdown in the Nigerian economy.

The causative factors for the fall stem from the drop in crude oil prices over the last five years which has stifled investments.

- While oil prices have also risen this year to 8-year highs, Nigeria is yet to benefit due to high cases of crude oil theft.

- The country also faced challenges over the years from pipeline vandalism and insecurity in oil-producing areas.

- On the macro-economic front, the exit of foreign investors from emerging economies like Nigeria triggered an outflow of foreign exchange which has further decimated the value of the naira and elicited draconian forex policies.

- The result is a lack of access to forex for most manufacturers leading to limited outputs amidst rising cost of production. Inflation has also impacted their cost of operations forcing them to survive by increasing prices despite limited growth in output.

- Important to also add that insecurity and logistics bottlenecks have also affected the industrial sector considering that they need to transport goods from one location to the other to make sales.

Why this matters: The government through the central bank has poured trillions of naira in intervention funds all geared towards resuscitating the industrial and agriculture sector.

- The data also reveals Nigeria is increasingly a service-oriented economy while the government’s efforts to boost the agriculture sector are also working.

- The agriculture sector contributed 29% of the GDP compared to 22% in 2016. It now appears efforts to engineer growth in the industrial sector have not worked out as planned despite policies aimed at stifling imports.

- While growth has been recorded in nominal terms, the sector has lagged behind the Agriculture and Services sectors over the years.

- In fact, the services sector has recorded strong growth every quarter since the first quarter of 2021 when it contracted.

What this means: The GDP data is evidence that hopes that Nigeria’s industrial sector will be the engine of growth for the economy is gradually been eroded.

- The Nigerian economy appears to favor service-based businesses as they rely less on the country’s road network to increase output.

- For example, the financial services sector, telcos, and even trade rely more on technology and mobility to increase sales and push volumes.

- The sectors are likely to continue growing since they rely more on population growth to gain more growth.

- We also observe that the agriculture sector has also grown over the years largely on the back of the government’s support.

- It also means sectors that have the full backing of the government often fare better.

Outlook: It is likely that the central bank will slow down drastically on its intervention funds in the industrial sector. The governor of the central bank, Godwin Emefiele, confirmed this when he took questions at the last MPR meeting.

- According to Emefiele, intervention funds will stop as the country battles rising inflation that is yet to deliver on growth.

- He however did maintain that intervention in the agricultural sector will likely continue as the government pushes for local production of food.

- As inflation continues to rise and the central bank reacted with contractionary monetary policy measures, we expect the industrial sector to shrink further in the near term.

2020 – 2022 Q3

Source: Nairalytics

“Crude oil and natural gas contributed as much as 10% to Nigeria’s GDP in 2016 but has now shrunk by 43.5% to just 5.66%” – The decrease is actually 3.34%, you don’t calculate the percentage decrease of percentage, its already in percentage so you minus it.