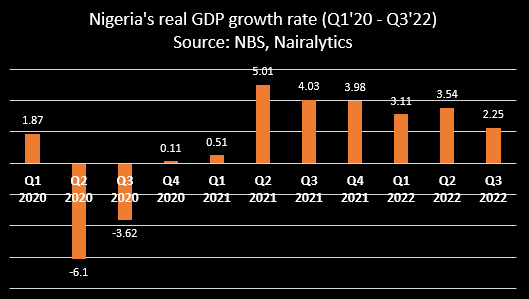

Nigeria’s gross domestic product (GDP) grew by 2.25% year-on-year in Q3 2022, marking the slowest growth since the Covid-19 pandemic.

This information is according to the latest GDP report by the National Bureau of Statistics (NBS).

According to the NBS, the slow growth is attributable to the base effects of the recession and the challenging economic conditions that have impeded productive activities.

The Q3 2022 growth rate decreased by 1.78% points from the 4.03% growth rate recorded in Q3 2021 and 1.29% points relative to 3.54% in Q2 2022.

In nominal terms, aggregate GDP stood at N52.26 trillion in the quarter under review, representing a 15.83% growth compared to N45.11 trillion recorded in the corresponding period of 2021. Q3 2022 growth is higher compared to 15.03% and 15.41% recorded in Q2 2022 and Q3 2021 respectively.

The Oil Sector: This sector recorded -22.67% (year-on-year) as of Q3 2022, indicating a decrease of 11.94% points relative to the rate recorded in the corresponding quarter of 2021.

Also, the growth rate decreased by 10.91% points compared to the 11.77% contraction recorded in the previous period.

- The Oil sector contributed 5.66% to the total real GDP in Q3 2022, down from the figures recorded in the corresponding period of 2021 and the preceding quarter, where it contributed 7.49% and 6.33%, respectively.

- In the third quarter of 2022, Nigeria recorded an average daily oil production of 1.20 million barrels per day (mbpd), lower than the daily average production of 1.57mbpd recorded in the same quarter of 2021 by 0.37mbpd.

- It is also lower than the 1.43 mbpd recorded in the previous quarter.

Non-oil Sector: On the other hand, the non-oil sector grew by 4.27% in real terms during the reference quarter (Q3 2022). This rate was lower by 1.18% points compared to the rate recorded same quarter of 2021 and 0.50% points lower than the second quarter of 2022.

Growth in the non-oil sector was driven mainly by Information and Communication (Telecommunication), Trade, Transportation (Road Transport), Financial and Insurance (Financial Institutions), Agriculture (Crop Production). and Real Estate, accounting for positive GDP growth.

In terms of contribution to GDP, the non-oil sector contributed 94.34% to the total GDP, an increase from 93.67% recorded in the previous sector, while the oil sector contributed 5.66% to the aggregate real GDP for the period.

Further breakdown of the report showed that the agricultural sector contributed 29.67% to the aggregate GDP, an increase from 23.24% recorded in the previous quarter and a 29.94% decline compared to the same period in 2021.

Industries, on the other hand, recorded a decline in their contribution from 19.4% in Q2 2022 to 18.37% in the review quarter. Meanwhile, services contributed 51.96% to the national GDP, a significant drop from 51.35% in Q2 2022.

What this means: The decline in Nigeria’s GDP growth indicates a drop in productivity in the economy due to the recurrent contraction in the oil sector and the low growth in key non-oil sectors such as transportation, banking, and education.

- This implies that Nigeria’s economic activities grew in the third quarter compared to the corresponding period of 2021, albeit at a slower pace compared to the previous period.

- The Q3 2022 growth (2.25%) represents the slowest GDP growth in the last six quarters.