The Central Bank of Nigeria (CBN) said it would release some strategic grain reserves to combat the adverse effects of the flooding across the country and checkmate food inflation.

The CBN Governor Godwin Emefiele stated this during the 288th meeting of the Monetary Policy Committee (MPC) held in Abuja yesterday.

Impact of flooding: Emefiele acknowledged that Nigerian farmers have lost a lot to the floods. He also noted that Nigeria should brace up for higher food inflation in the months to come. He said:

- “The flooding of this year happens to be the worst in the last five years in Nigeria. 32 out of the 36 states of the country were affected adversely by the floods. This meant that farmers lost their crops, and food prices and other agricultural products would go up.

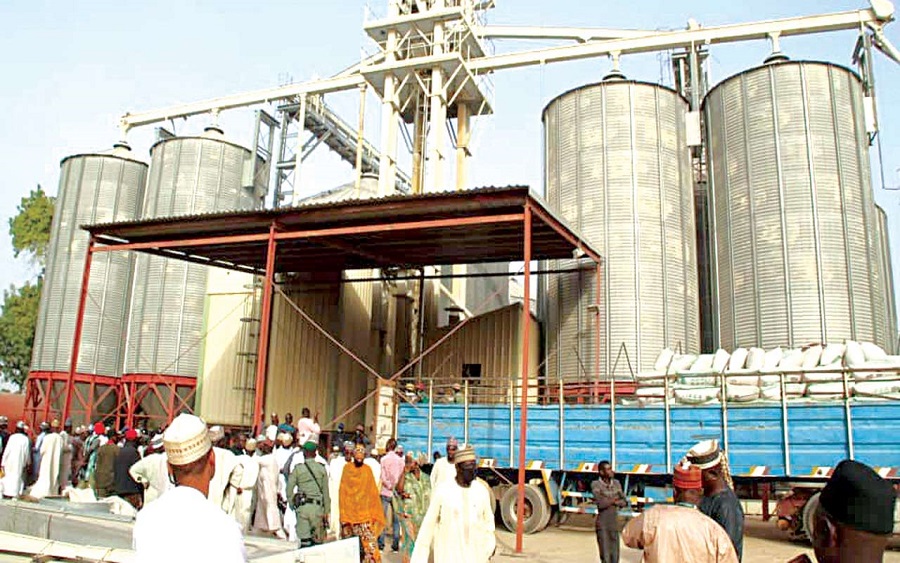

- “From our side at the CBN and the Federal Government, we have our strategic reserve, particularly for rice and for grains like maize, which we will use to moderate prices.”

The strategic grain reserves: The CBN Governor claimed that the strategic reserve had been kept by the apex bank for the previous three years. He added that the CBN would also support farming during the dry season. He said:

- “Since the flooding is beginning to recede, we will aggressively go into the dry season program. This will make sure that the impact of the rising food prices does not linger for too long so that we can have control of prices of agricultural produce and other consumer goods.”

For the record: As you may know, the floods devastated Nigeria between September and August, submerging hectares of farmlands and displacing many from their homes. Many people also lost their lives.

The United Nations Children’s Fund (UNICEF) said the recent flooding incidents across the country displaced 840,000 Nigerian children.

Considering the economic impact of the floods, the International Monetary Fund (IMF) recently revised Nigeria’s GDP growth projection from 3.4% to 3%. IMF stated that the slowdown in growth reflects year-to-date weaknesses in oil production and the adverse effects of recent flooding.