Nigerian crypto startup, Nestcoin, may have lost all its assets in cash and stablecoins to the collapse of FTX, the second-largest cryptocurrency exchange in the world.

With this development, Nestcoin said it will have to lay off some of its staff as it re-strategises to keep the business going.

The company, however, stressed that the incident has no impact on its customers financially, adding that the products Nestcoin has released to date are Defi protocols & non-custodial in nature. As such, it has never held customer funds.

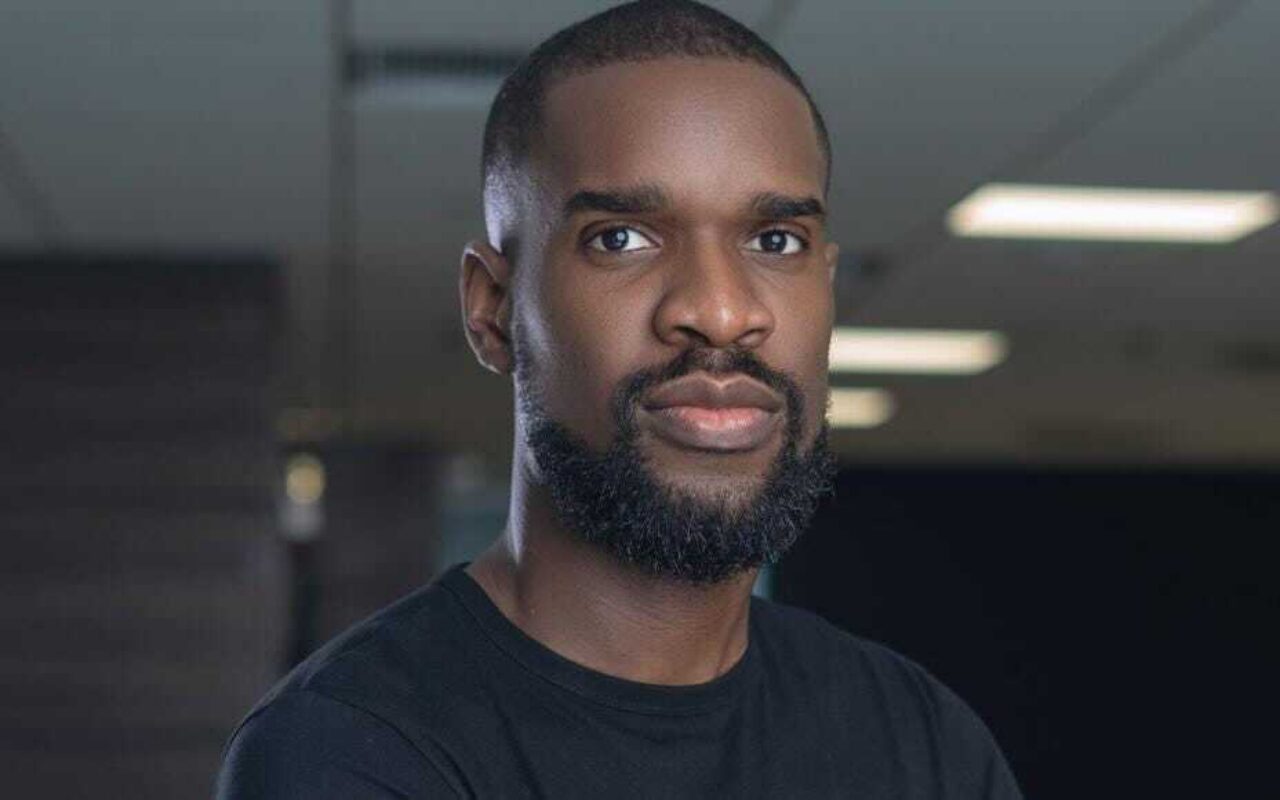

In a message to investors, the Co-founder of Nestcoin, Yele Bademosi, described the situation as challenging for the company and the entire crypto industry.

Here’s what happened: The company said it stored a significant proportion of its stablecoin investment on the FTX Exchange and that its hope of recovering them is now hanging in the balance.

Giving an update on the impact of FTX’s collapse on Nestcoin, Bademosi explained:

- “Last year, Nestcoin raised capital from a range of investors, including Alameda Research. For context, Alameda’s equity is less than 1%. We used the closely-associated exchange, FTX, as a custodian to store a significant proportion of the stablecoin investment we raised – 1.e. Our day-to-day operational budget.”

- “However, last week’s events have had an impact on us, as we held our assets (cash and stablecoins) at FTX to manage our operational expenses. We were not undertaking any trading, but simply custodied our assets on the FTX exchange.

- “While there are uncertainties including the outcome of our assets held at FTX, we as a company have to adjust our plans, rethink our strategy and take steps to better position ourselves for the future. Unfortunately, this means saying goodbye to some of our very talented Nesters,” he added.

Imminent job losses: While the number of workers that will be let go was disclosed, Bademosi said the immediate priority for Nestcoin’s leadership team is to conduct the tough task of laying off workers in a compassionate manner. He said:

- “While this is a challenging time for us and the industry as a whole, we see this as a wake-up call to focus on building a more decentralized crypto future where no one organization or person can amass enough power to influence a nascent industry that has the potential to do good.

- “In the past few days, I’ve strengthened my resolve and remain committed to “doing crypto” in line with its true spirit and founding ethos. At Nestcoin we have a renewed sense of purpose – we realize that for crypto to truly go mainstream, we must accelerate the transition to self-custody by building compelling trustless crypto products. To succeed, we will remain relentless, resourceful, and flexible as we navigate these hard times.”

Why not self custody and then why FTX rather than Binance? Was it part of the terms of investment with Alameda to custody funds at ftx? Ftx wasn’t so popular with Nigerians compared to Binance

Why Keep your stablecoin at an exchange, where as you can store it in a cold wallet or decentralized exchange, or maybe they just using ftx crash as means to keep money to themselves lol.