The Vice President of the Lagos Chamber of Commerce and Industry (LCCI), Gbenga Ismail, said that only 0.5% of SMEs in Nigeria have an insurance policy, compared to the 54% global average.

Ismail stated this during a live webinar jointly hosted by leading insurance firms Coronation Insurance Plc and Coronation Life Assurance Limited on Tuesday, November 1, 2022.

The webinar with the theme Importance of Insurance for SMEs: Insurance Requirements for a Growing Business, also dealt with the risks and challenges SMEs face and how to mitigate them.

The webinar was attended by a host of participants from the insurance industry and Coronation Insurance Plc’s small business clients.

The keynote speech: The first segment of the webinar commenced with a presentation by the keynote speaker, Gbenga Ismail. He set the scene by highlighting the significance of Nigeria’s 40 million SMEs for the growth, development, and future security of the Nigerian economy.

On the challenges facing SMEs, Ismail noted that most new SMEs struggle to scale quickly enough to realize the opportunities for which they were created. According to him, Nigeria lost 2 million SMEs to the Covid-19 pandemic.

Irregular and delayed payments are also critical challenges facing SMEs. And it often causes SMEs to fail within 18 months of many startups.

Potentials of SMEs: He noted that even though 90% of Nigerian SMEs currently not paying taxes, they still represent a huge potential to drive economic inclusion, broaden prosperity, and power the future growth of the Nigerian economy. As such, Ismail argued that it is imperative to provide SMEs with the support they need to survive in their critical growth years.

SMEs and insurance: Ismail revealed that only 0.5% of Nigeria’s SMEs have an insurance policy, compared with the 54% global average. He added that the country should focus squarely on developing an insurance environment that is more accommodating of and appealing to SMEs.

He explained that insurance represents a key financial cushion to manage shocks and build financial resilience in the first years of SME growth.

SMEs face risks: An expert panel consisting of Adebowale Adesona, an executive director at Coronation Life Assurance Limited, Louis Alozie, the country manager of Wordplay, and Ayo Olojede, head of Emerging Business at Access Bank Plc, agreed that Nigerian SMEs face risks. Some of these risks include damage to business property and vehicles, legal liability and general product, key persons and goods-in-transit risks. All of these could cost SMEs dearly. Therefore, by insuring just a few of these basic risks, Nigerian SMEs could save billions annually and improve survival rates significantly.

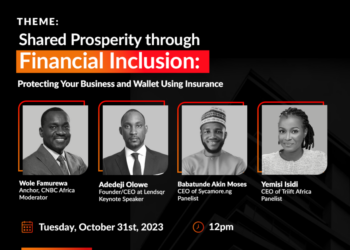

The panel discussion was expertly moderated by Wole Famurewa, CNBC’s West Africa Markets Editor.

Consult insurance professionals: The panellists agreed that since not all SMEs are exposed to all risks, it is important for these businesses to consult insurance professionals to identify only those risks that are critical to their business survival. Insuring only one to two key risks does not cost a lot of money but could make a difference in the failure or survival of a business.

Types of risks: The panel identified that would also help SMEs to understand the difference between external risks such as flood and fire, and internal risks which usually arise from the people SMEs employ or the systems they use.

They agreed that while technology, for example, is a great leveller for SMEs helping them compete effectively, it can also expose them to cybercrime and other information security risks. Knowing customer processes was also important in helping SMEs identify and mitigate client risk.

Seeking the right advice on people processes and systems could also help manage fraud or employee risk – often by simply training staff to understand and observe basic internet security protocol. One of the panellists said:

- ‘’Coronation Insurance is working with Access Bank, for example, to develop Business Protection Bundles including basic fire, flood, and limited liability cover as well as limited employee life insurance – providing three years’ annual income – to enable Nigerian SMEs to affordably cover the basics of successfully operating their businesses.

- ‘’More generally, Nigeria needed to look to the experience of other markets that had developed successful SME insurance ecosystems where the government coordinated policy and legislation in tandem with the insurance industry and large and small businesses. While some of this involved compulsory insurance, costs were minimal as it was so widespread. In addition, embedded insurance, included in the price of products purchased, for example, provided a painless method to spread the use of insurance and address trust deficits.’’

Insurance as an investment: From an SME perspective, the panel concurred that insurance was an investment in yourself. By spending a little money each month, even a small farmer could mitigate risk, ensuring that he was placed in the position that he or she was in before the fire, gale, or flood.