Flour Mills of Nigeria Plc has announced its half-year unaudited financial results for the period ended 30 September 2022, revealing a 38% increase in revenue to N720.576 billion from N522.821 billion in 2021.

The overall revenue growth was driven by improvements in the food and agro-allied segment of the Group, despite inflationary pressure and slim household wallets.

The miller said that the food segment contributed 61.84% of the total revenue with N445.671 billion, followed by the agro-allied segment which contributed 21.35% of the revenue with N153.901 billion.

The overall revenue increased by 38% to N721 billion compared to H1 2021, propelled by a favourable mix and some exchange-related pricing. Operating performance in the Food segment remained solid, notwithstanding a challenging environment with increased input prices and a somewhat softening volume base.

The financial report, which was released to the Nigerian Exchange Group (NGX), showed that the company’s cost of sales increased 39% to N651.789 billion compared to N468.406 during the same period in 2021.

The increase in the cost of sales affected profit after tax which dropped by 46% to N5.700 billion in 2022 from N10.528 billion in 2021.

What the company is saying

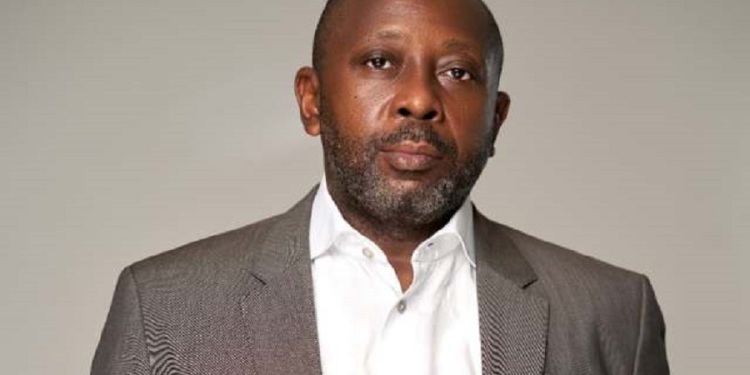

Commenting on the half-year financial result and the Group’s strategic imperatives in the years ahead, Mr Boye Olusanya, the Group Managing Director/Chief Executive Officer, said:

- “The group’s operating performance in the Food segment remained solid; profit before tax for AgroAllied remained at the level achieved the previous year. The Sugar segment recorded a significant rebound compared to Q2 2021/22 as anticipated due to a normalized competitive playing field, increased route-to-market expansion into both new and rural markets, and increased customer engagement.

- “The Group is integrating the Honeywell business to realize the synergies anticipated with a focus on restructuring the balance sheet to reduce FX exposure and ensure manufacturing stability. This is expected to lead to strong results in the long term.

- “As we can see in the H1 22/23 report, the Sugar segment recorded a significant rebound compared to H1’21/22, a clear demonstration of the Group’s continuous and significant investment in the sugar value chain and across all our key value chains and sectors. As the Group continues to make headway in our backward integration activities through various strategic efforts, we remain committed to feeding the nation, every day.

- “Also, our investment in product innovation and supply chain optimization was sustained in furtherance of the execution of our long-term strategy.

- As part of the Group’s strategic roadmap, FMN continues to put in place a business continuity plan to safeguard its supply chain and food production processes to ensure that Nigerians can continue to have access to their daily nourishment”.

38% increase in revenue! It’s like some companies are raking in a lot in this inflationary time. A few will just hide under the guise of inflation and increase their product prices without any serious justification.