Nigeria’s tier-1 banks — FBN Holdings, UBA, GTB, Access, and Zenith Bank, also known collectively as FUGAZ — have incurred a total cost of N210.5 billion in fees to the Asset Management Corporation of Nigeria (AMCON).

The fee is part of the banking resolution cost statutorily paid by banks to help AMCON support the takeover of failed or failing banks.

The AMCON 2021 Act mandates banks to pay 0.5% of their total assets (inclusive of off-balance sheet) to the Asset Management Corporation of Nigeria.

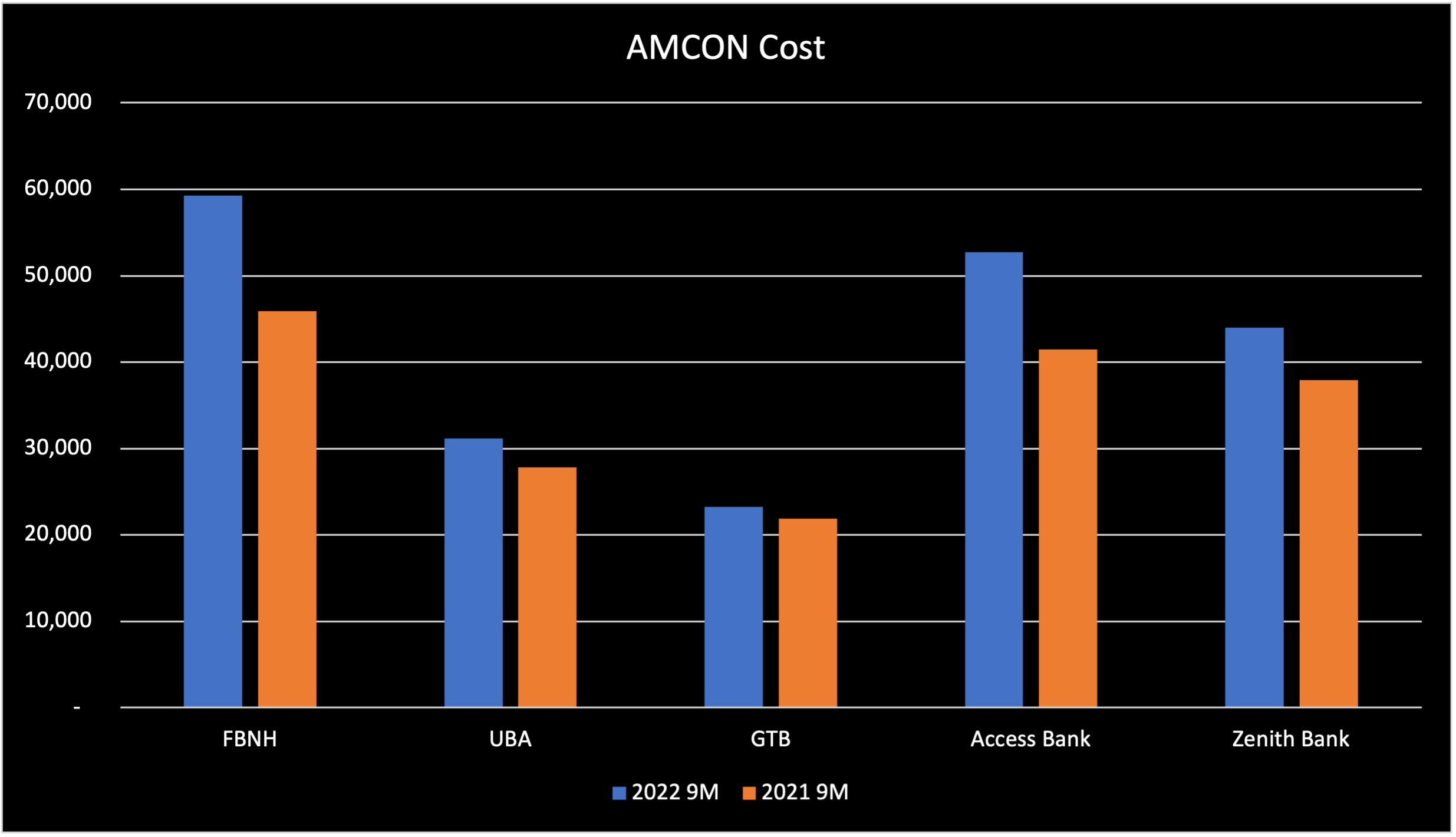

The data: Findings by Nairametrics show a total of N210.5 billion was paid by the banks in the first nine months of 2022 compared to N175 billion in the corresponding period of 2021.

- FBN and Access Bank topped the list with about N59.2 billion and N52.7 billion respectively, representing over 50% of the total amount paid by the five banks.

- This is the first time we are seeing banks cross the N50 billion threshold in 9 months’ financials.

- We believe the final figure could top N280 billion by year-end, making it the highest figure on record for Nigeria’s FUGAZ.

Bank complaints: Meanwhile, Nigerian banks have recently complained about the impact of banking resolution cost on their balance sheet.

- Some banks argue that the fee is a disincentive because the larger your balance sheet the more you pay to AMCON.

- Banks also complain that the Central Bank of Nigeria keeps most of their cash deposits via CRR debits. As such, they should not be paying AMCON or even the NDIC for deposits held by the CBN.

But AMCON quickly explained that the fees are the cost banks have to bear AMCON for bailing them out when things go bad.

- For example, AMCON took over the then Skye Bank, turning it into Polaris Bank. It then spent about N1 trillion through CBN-issued zero-rated bonds in efforts to sustain the bank.

- AMCON and the CBN believe this cost cannot be borne by taxpayers and view the banking resolution cost as financially expedient to safeguard the financial sector.

- The Director General of the Budget office of Nigeria, Ben Akabueze recently suggested that AMCON should increase the amount of statutory contribution made by banks.

Back and forth: At a recent event organized by the Bank Directors Association of Nigeria, bankers and AMCON took turns criticizing and extolling the policies. For now, it is a law and cannot be changed until the law is amended or AMCON’s tenure expires.

Optics: Reports suggest AMCON has only recovered N1.6 trillion through the Economic and Financial Crimes Commission (EFCC) between 2017 and July 5, 2021, out of over N5 trillion in toxic assets.

Chart: AMCON levy incurred by all the tier one banks in the first 9 months of 2023.