As another election draws near, pertinent questions about the economy are beginning to take centre stage. On the table are issues like inflation, exchange rate, subsidy, debt, budget, revenue, taxation and how the government can interlink these elements to get the country rolling.

The paradox of elections in Nigeria is that they are a blessing and a curse. Every election presents an opportunity for the country to elect new leaders to fix the country. But after the elections, the leaders assume power and avoid making difficult decisions for fear of losing the next elections. The cycle repeats every four years. For example, why has no government had the courage to remove the petrol subsidy, despite its negative effects? It is fear of civic unrest. We know cheap fuel keeps the costs of living down and preserves the social contract between the government and the people.

However, subsidies are a danger to the fiscal health of the country. In the first half of 2022, petrol subsidy claims amounted to N2.6 trillion — a figure above crude oil sale receipts from the Nigerian National Petroleum Company (NNPC) Limited. The federal government is also projected to spend N6.7 trillion on petrol subsidy payments in 2023. Now, The proposed revenue and expenditure budgets for 2023 are N9.73 trillion and N20.51 trillion respectively, resulting in an N10.78 trillion fiscal deficit.

Remove fuel subsidy

Now, not only do subsidy payments stifle the country off oil revenue, but it also adds to the country’s debt as oil prices ascend. The irony is that Nigeria prays for oil prices to go up.

With high oil prices this year, NNPC failed to remit to the federation account for the 7th straight month in September – meaning the country is not only short of revenue to stimulate the economy, but was also starved of foreign exchange earnings to intervene in the currency market. The problem is that petrol subsidy is spent on consumption and yields little to the economy.

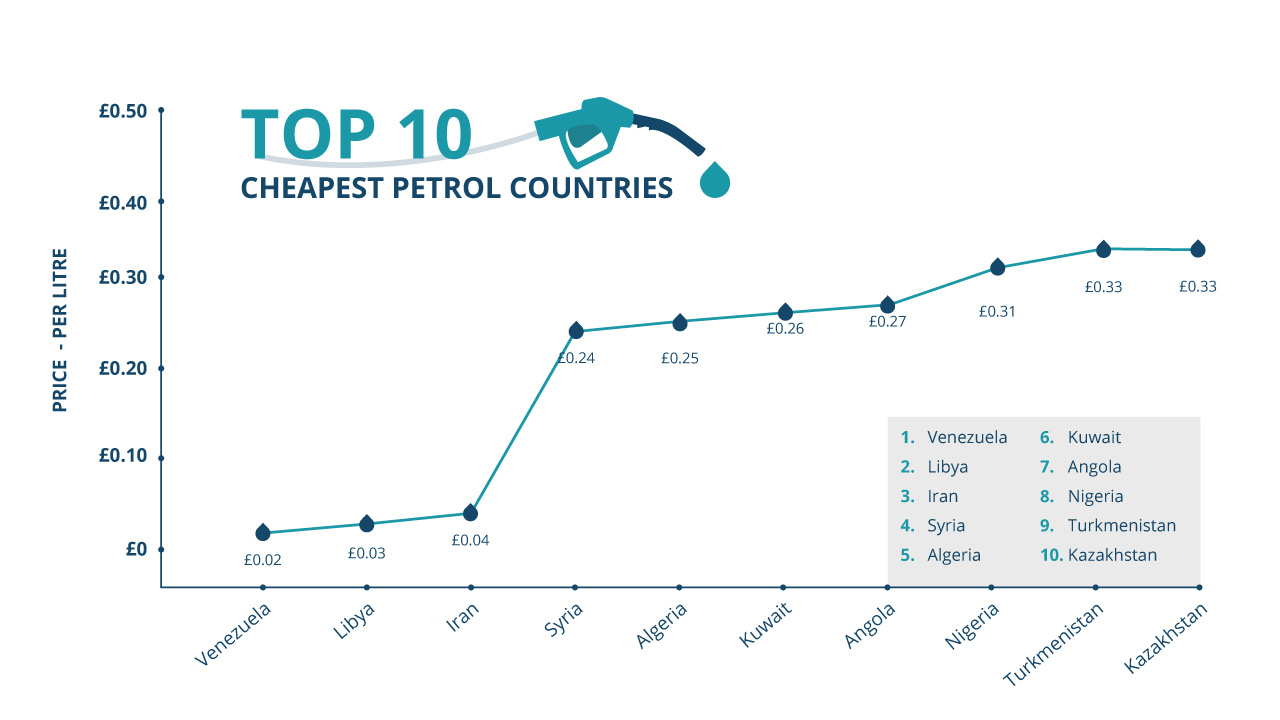

Looking at the diagram below, which of these countries that sell cheap fuel is developed?

But if you remove the subsidy, you run the risk of inflation (Difficult decision 1). Analysts predict a 3-5% uptick in inflation which, as of today is at 20%. But high fuel prices are cyclical such that while they add to inflation – as we witness with developed countries today – they would eventually come down as oil prices come down. With this in mind, the goal should be to tackle what makes Nigeria’s inflation above 20% despite cheap fuel, and that is food.

Food costs are a major factor in high inflation. But while the FAO Food Price Index* (FFPI) -a measure of the monthly change in international prices of a basket of food commodities – marked the sixth monthly decline in a row, food costs in Nigeria keep soaring.

Fix the Forex and exchange rate problem

The reason for the discrepancy would point to the rise in the exchange rate. Nigeria operates a pegged exchange rate where the Central Bank of Nigeria makes interventions in the market to defend the currency. The problem with this is while the bank dollar rate is in the N400+ region, the parallel market, to which everyone has access, is in the N700+ region. Now, this does not make for effective planning for people and businesses that do not have access to bank dollars. Does this encourage foreign direct investment?

Nigeria adopted multiple exchange-rate regimes to avoid an outright devaluation of the naira by keeping a stronger pegged rate for official transactions and weaker exchange for non-government-related transactions.

However, analysts recommend the country adopts a floating exchange rate system so that demand and supply can determine the intrinsic value of the currency. (difficult decision 2). Most economists say a “stable” naira should take precedence over a “strong” naira.

But can the naira be strong when we have debt close to the 50 trillion naira mark?

Debt and money printing leads to inflation. Debt is fine if it can be repaid from the venture you acquired the debt for. But Nigeria fails to understand that. Pro-government analysts point to the country’s low debt-to-GDP threshold to justify borrowings instead of debt-to-revenue ratios – a more important metric that justifies debt sustainability.

Government should be run as a business, guided by fiscal prudence and returns on investment. For example, if the country borrows money to build roads and rail lines, this infrastructure should be commercially viable. A toll on the Lagos-Ibadan expressway and the 2nd Niger Bridge should be encouraged (difficult decision 3). The Lagos-Ibadan expressway accommodates 250,000 vehicles daily, a toll of a certain amount would see revenue increase to repay the loans used to build the road.

In the United Kingdom, albeit for a separate reason, there is a daily Congestion Charge of £15, if you drive within the Congestion Charge zone at certain hours of the day. Using technology, the congestion charges are implemented rather than a traffic-causing tollgate system. All roads around the zone’s perimeter would be monitored by Automatic Number Plate Recognition (ANPR) cameras and every driver would get notified of the toll. Plans for yearly payments should be encouraged to reduce the burden of daily tolls. Citizens can be able to pay online or at local offices where roadworthiness certificates are obtained.

Taxation should be encouraged

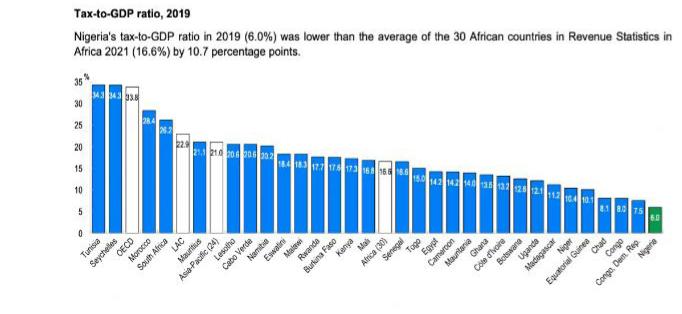

The country needs to encourage taxes as that is another way of funding budgets. Nigeria has one of the lowest Tax-To-GDP ratios in the world. Expanding the tax brackets and increasing taxes on the rich should be explored. The current tax system is ineffective. Quantity but no quality. Nigeria’s tax system sees businesses paying over 50 different taxes and levies officially. For comparison, the world average in 2019 based on 185 countries is 23 taxes.

Increase the country’s annual budget but spend wisely

Speaking of budgets, among the 20 largest economies in Africa, Nigeria currently runs the fourth lowest budget per capita. The equivalent of Nigeria’s budget in 2021 was estimated to be 40 billion United States dollars. This was a far cry from the likes of South Africa which ran a budget of $123 billion in the same year. Egypt ran a $107 billion budget in the same year.

Next year’s budget of N20 trillion is relatively lower than other developing economies and this does not give the government room to spend to meet the country’s needs and spur growth. As of 2021, the Nigerian government’s spending on GDP was 5.11%. For comparison, the world average in 2021 based on 126 countries is 16.69%. But the government has to spend wisely. Recurrent expenditure at 40% is not progressive. Paying salaries and welfare packages of less than 5% of the country’s population of N8 trillion is wasteful and out of place. Government should merge ministries, parastatals, and agencies and as the Governor’s forum recommended – retire federal civil servants above 50 (Difficult decision 4).

Introduce austerity measures

Austerity measures do not only reduce costs of governance, they encourage revenues as citizens would be happy to pay taxes to a prudent government they believe in. Government should engage in the business of optics to regain citizens’ trust. Foreign trips by MDAs, including budgetary-independent agencies such as CBN, FIRS, NPA, NIMASA and NCC should be put on hold periodically. Salary caps should be placed on elected officials; no white elephant projects, and most importantly, implementation of the Stephen Oronsaye report could save the government N1 trillion. (Difficult decision 5).

These are the few issues Nigeria should address. Tough decisions are needed to fix countries and sacrifices have to be made. Some of the most challenging decisions would eventually lead to the greater economic prosperity of the country and the future generation.

From the little I can recollect from Lee Kuan Yew’s book on the founding of Singapore, countries set up industries to be participants in a global market.

In Nigeria, foreigners come to set up industries purely for Nigeria’s market. Therefore they are in eternal need of our petro-dollars.

Nigerians hate their country. They have this craze of junketting to Europe and America for every frivolous reason.

We do not pause to ask why must we import refined petroleum products in the first instance which led to the insanity called fuel subsidy.

Singapore is not an oil producing country, yet it is reported as having the largest refinery in the world. I think I read that Spain has up to 52 refineries.

So if he did not find Dangote building a refinery, Buhari had no plan on how to supply Nigerians with petroleum products.

A country needs stable electricity supply. Sisi of Egypt made his country an exporter of electricity in six years, Buhari will be exiting the presidency at an output of 3000+

Sisi wants an export-oriented industrialisation for Egypt, and he knows how to go about it.

Fuel subsidy might be a problem.

But our number one problem is : we do not know what we want to achieve as a people, nation.