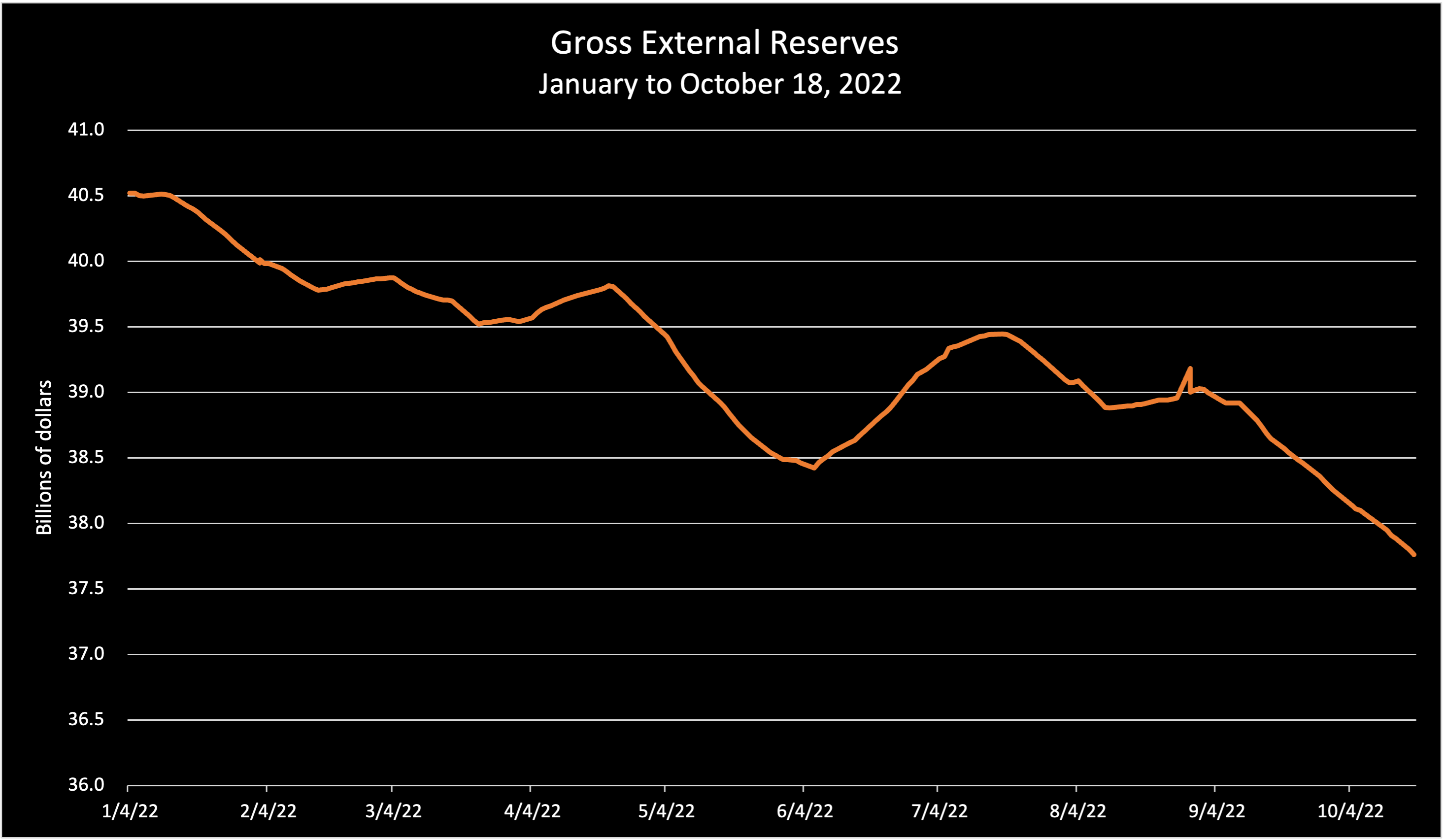

Nigeria’s external reserves fell to $37.7 billion as of October 18, 2022, according to data from the Central Bank of Nigeria (CBN). This is the lowest level recorded this year.

The country’s forex market is facing demand pressure at the black market where forex is trading unofficially, with the naira falling to as low as N745/$1 on Thursday.

However, the exchange rate at the investors and exporters window where forex is traded officially, closed at N441.5/$1 on Wednesday, 19th October 2022, indicating a slight fall of 0.06% from N441.25/$1 recorded in the previous trading session.

External Reserve pressure

Nigeria’s external reserve stood at $37.76 billion as of 18th October 2022, a decline of 0.1% when compared to $37.96 billion recorded the previous day.

- The nation’s foreign reserve has been on a downward trend due to the continuous intervention by the CBN in the official market to maintain the stability of the local currency.

- CBN’s external reserve position is mostly funded via a combination of the government’s share of crude oil exports, foreign loans or grants, and capital importation.

- However, it also uses the reserve to augment forex demand at the I&E window even though the greenback is sold at official rates, rather than the going rate at the black market.

- The current level of below $38 billion is the lowest we have seen this year and is likely to keep trending downward due to flooding and oil theft.

Latest – A recent report indicates us based Bank of America projected that the official exchange rate could likely be devalued to N520/$ in 2023 because it is well above fair value.

- This was disclosed by Bank of America Economist Tatonga Rusike, in a note to clients seen by Bloomberg.

- The exchange rate is currently adjusted via the I&E window and has done so severally this year. However, it has turned out to be inconsequential due to the disparity between the official rates and black market rates.

- The wider the rates the less important the official rate becomes.

Just wondering why the naira keeps sliding, foreign reserves keep depleting,loans portfolio getting higher and higher and the consequences on the economy,and indeed the common man taking it’s toil.

In view of the above 9ne has no option than to question the managers of our economy What’s the matter???. Why is our future getting more and more uncertain? What future are they intent on bequeathing to the next generations?…

Great article