Despite the galloping increase in financial inclusion in Africa seen in recent times, insurance penetration remains low on the continent.

But ETAP, an insurance platform that uses gamified driving pattern-based insurance to optimize the value proposition and accelerate insurance penetration believes that Africa, particularly Nigeria, has all the ingredients that are needed to achieve significantly deepened insurance penetration and especially, auto insurance penetrations.

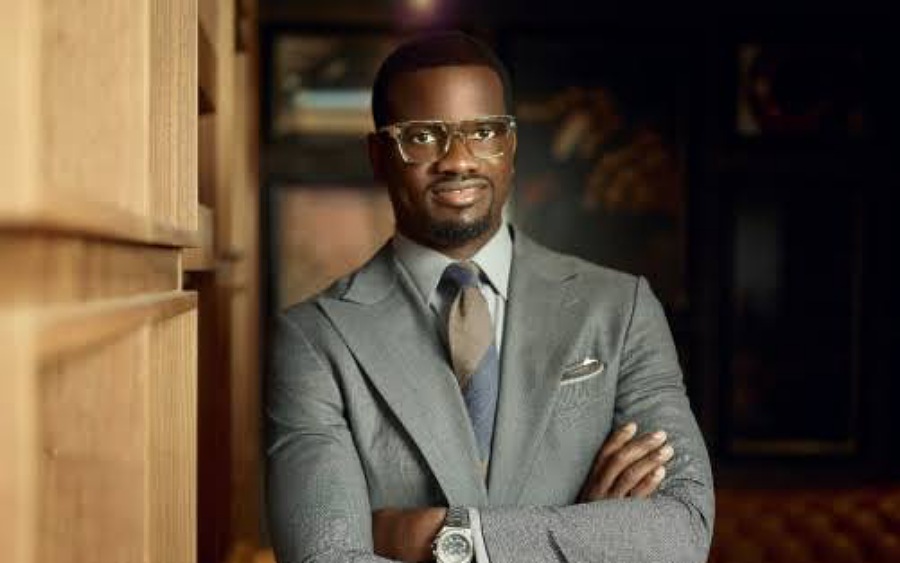

In a Business Half Hour Programme by Nairametrics, Ibrahim Babalola, CEO, ETAP explained how the insurance is enabling drivers to insure their cars in 90 seconds, as well as make claims and have them settled in three minutes using advanced mobile telematics to show drivers how they perform and reward them for driving safely.

He explained that ETAP, an acronym that stands for ‘Easy as Taking A Picture’ is built on the belief that car insurance should be that easy, adding that the company is an auto-focused insurance technology that is backed by global investors like the Toyota company in Japan and other global investors.

“Drivers get safe driving points every time they don’t drive like a crazy person on the road and they can then spend this same driving point within the app on petrol, Shoprite vouchers to buy things on Jumia, movie tickets, coffee, and others.”

“You get a driving score for every trip that you take based on how you’ve accelerated, how you break, how you return when you are cornering properly etc. and the average of all the driving scores that you get would directly impact on what your premium would be at renewal. So, the higher your driving score, the lower your insurance premium would be.”

He added, “We think that insurance should be shared value. This means that providers can gamify and incentivize a behavioral shift in customers such that they are behaving in a certain way and they will be rewarded.

Beyond this, Babalola explained that ETAP also enables flexibility in insuring by allowing subscribers to pay daily, weekly, monthly, or however they choose to. He noted, “Essentially, we reimagine how people view insurance and how they enjoy insurance. Through our recent partnership with MTN, we are able to reinforce this as MTN subscribers get to use ETAP on their phones without data.

He added, “ETAP has raised one of the largest pre-seed funding for an insurance technology company in Nigeria today. Earlier this year, we announced the pre-seed round of $1.5 million, essentially with global investors that are backing our approach to solving this problem.”

While the insurance market is bedeviled by factors ranging from cultural problems to accessibility and availability issues in terms of how to insure cars, Babalola noted that ETAP is helping to close the gap by allowing subscribers to navigate the platform via their smartphones.

He said, “If you think about the accessibility problem in terms of, how people access insurance. For something that is fundamentally important, it has to be a bit more accessible. I think we have to know how to get it now because it’s not near as accessible and there’s a very poor retail distribution which ultimately leads to that high customer acquisition cost for the insurance companies.”

According to him, “ETAP car insurance products in Nigeria today use technology to do a proper risk profiling and give you personalized pricing because we think that no two individuals have the same risk profile and consequently no two individuals should pay the same premium. What you see as you start to appropriate appropriately profile risk is that less risky customers would end up paying significantly less than they’re paying.”

Babalola also identified other challenges as; complicated and unclear processes associated with buying insurance and particularly around claims payment, the lack of an automated process of renewal, very limited payment flexibility, and no provision of like shared benefits.

Speaking on regulatory issues in the insurance industry, Babalola gave credit to the insurance regulator for essentially innovating by working with the Nigeria Insurance Association, NIA to create the NIID, a database where insurance companies have to submit policies that are created and claim to allow law enforcement officers easily confirm policy numbers. He however advised that enforcement be reinforced to make this work.

While insurance is said to be incomplete without claim payment, ETAP is able to make the process very simple for customers by automating “everything, including the previous assessment, which today, the traditional process is that they will send somebody to your house to take pictures of your car, or ask you to send pictures of your car, which does not necessarily show the real condition of the car because you can be sending pictures that you took last month.”

“You can get your policy number from the app. You get your policy documents in your e-mail as well as your certificate and everything that you need to show a policeman.”

On its projection plan for the next five to ten years, Babalola noted that ETAP is working with traditional insurance companies to optimize their products by giving them some of its technology to build on. On the longer term, however, he said the insurtech plans to go beyond car insurance.

He added, “ETAP will launch in Ghana this quarter and we’re just wrapping up the finalities in that market. Our plan is to scale very fast, which you see from the type of investors that have invested in us including the Toyota Corporation. So, every country where you have a Toyota presence and the likes of Suzuki, Mitsubishi, and Yamaha are primary markets for us to expand. It’s a huge opportunity because of the penetration.”