Fintech in Nigeria continues to play a pivotal role in bridging the country’s financial inclusion gap. From easy access to loans to flexible savings, fintech is revolutionising banking through its digital financial services, which are closer to the people than what the traditional commercial banks are offering.

The potential in these digital banks has seen global venture capitalists pumping their funds into fintech in Nigeria. As more fintech spring up by the day, the market is becoming highly competitive as the target customers now have many choices from the array of companies offering innovative financial services via mobile apps.

Opera’s Africa fintech startup, OPay, is one of the leading fintech platforms driving the digital financial services revolution in Nigeria today. The company launched its mobile money platform in Lagos in 2018 on the popularity of its internet search engine in Africa.

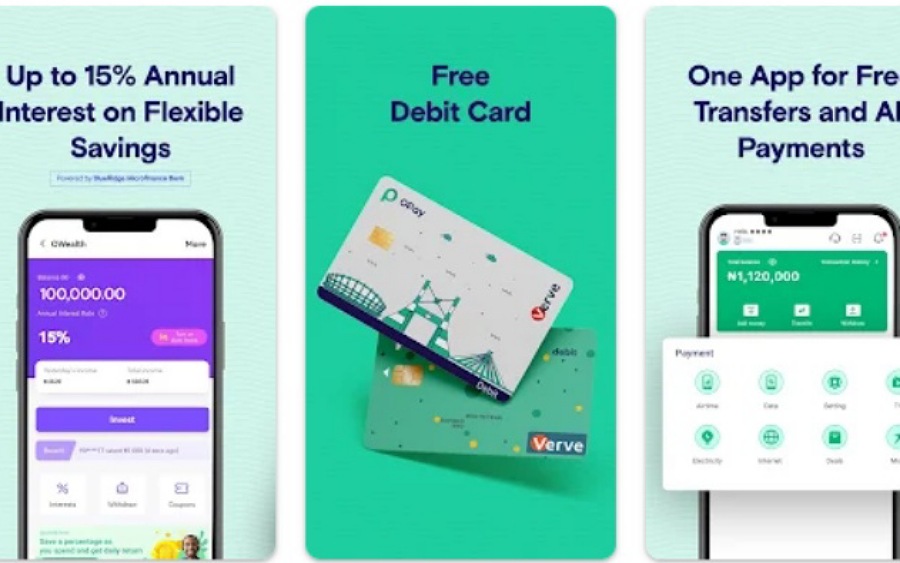

OPay’s mobile money service gives users the ability to pay for utilities, make P2P transfers, and save as well. The company also offers an offline banking service through which users that don’t have smartphones can still carry out transactions.

With over 10 million downloads, Opay’s app is obviously one of the most-downloaded fintech apps in Nigeria as of today. Going by the number of downloads, there is no doubt that Opay is offering services to a large chunk of fintech customers in the country.

By design, the app looks cool with its green background color and simple user interface. However, at a 33 MB download size, the app is on the heavy side and may not be comfortable for users with low RAM.

Users’ reviews

As of the last count, over 240 users of the Opay app have reviewed it on the Google Play Store based on their experience. While the app enjoys tons of positive reviews, several issues experienced by the users point to the fact that the app could be better than it is. Here’s what the users are saying:

For Dauda Olamilekan, the Opay app is the best because of its flexibility. However, the absence of a push notification from the app for credit and debit is a concern. “Opay is the best among the rest. I love it. Very easy to do whatever you want to do with your money. But the only issue I have is that until you log in to the app you cannot know whether the account has been credited or not. I suggest Opay should make true phone messages easier so that it will be easy to know if the account has been debited or credited,” he said.

Shamsudeen Sani also gave the Opay app a thumbs up on the Google Play Store but was short of giving it a 5-star rating. “I would have rated it 5 stars, but I’m having issues that I would like to be fixed. Firstly, the hotline is always busy. I’ve called it several times but I only wasted my airtime without reaching you. Besides, one can not lodge a complaint directly on the app because it’s limited to certain suggested ones, which did not cover many things,” he wrote.

For Love Ifejiofor, she prefers Opay to any traditional bank app because of its zero fees on transactions. “Amazing app is all I can say. It is better than traditional bank apps. The most intriguing feature for me is that there are no fees charged for transactions. Also, I ordered the physical debit card, which was delivered to me after two weeks. As soon as I activated it, the six hundred Naira I paid for the card was refunded. I’m speechless. Great job Opay. I only suggest you increase your bonuses or discounts on airtime recharge,” she said.

However, Franklyn Adagbon sometimes experienced downtimes on the app, which he said was frustrating. “The app sometimes refuses to open; it would show “system busy, please try again later”. This can be very annoying, especially when you’re trying to make some transactions with the app. And it’s definitely not an issue of poor connectivity because I use a 4G network and other apps and downloads work properly. Please developers kindly look into this.”

For Frank Ogbonna the Opay app is excellent when it comes to transactions. “The only problem is that the app doesn’t lock when you leave it or when you’re not making use of It; it’s always open, unlike other banking apps that lock immediately you leave the app. Someone can easily click on the app on your phone and get to see things in your account. At least when you open your app you have to make use of your biometric or pin to access the app. Please do well to add these features in your next upgrade.”

While every other thing seems to be going well for the app, some users are unhappy with the customer service on the app. According to Omonvicky Ayeni, “this app used to be okay, but recently no week goes by without experiencing downtime and the most annoying part of it all is the way customer service act as if it’s not a general issue. Whenever you contact them, they make it look like the fault is from your network provider. I keep hoping with the new updates the issue will be resolved but that’s not the case. What is the essence of updating if you can’t make your app operate smoothly? I’m losing trust in the credibility of the app.”

Victor Osunhon, was also frustrated by the poor customer service on the platform. “If I could rate less than 1 star, I definitely would. I downloaded this app two days ago and my experience has been an absolute nightmare. I transferred funds to my Opay but I haven’t been able to transfer out of it since I opened the account. The customer service (both call and live chat) is poor and incompetent and once I’m able to remove my money from the account, I’ll be sure to close the account and delete the app. I’d advise anyone hoping to open an account not to,” Osunhon wrote.

Raymond Etim is also another user with a terrible customer service experience on the Opay app. “If one has a problem and contacts the customer care service via call or chat, it’s a total waste of time and airtime because your problem won’t be attended to. If one has an emergency that needs prompt attention, your customer care service is unreliable. I’ve had my share of gross frustration. Do something about it before I go on Twitter! Apart from these points, I enjoy the app,” he wrote.

Bottomline

While the Opay app is doing well with its services, there is definitely room for improvement of the app. Good enough, the users are not shying away from pointing out the issues, which gives the app owners the clue as to what the next updates should address to deliver a better quality experience to the users. More importantly, the app needs to do better with its customer service.

Opay can play a vital role in revolutionlising in fintech industry.