The Federal Government says that the old Port Harcourt Refinery which is currently undergoing complete overhaul and rehabilitation would become operational by December 2022.

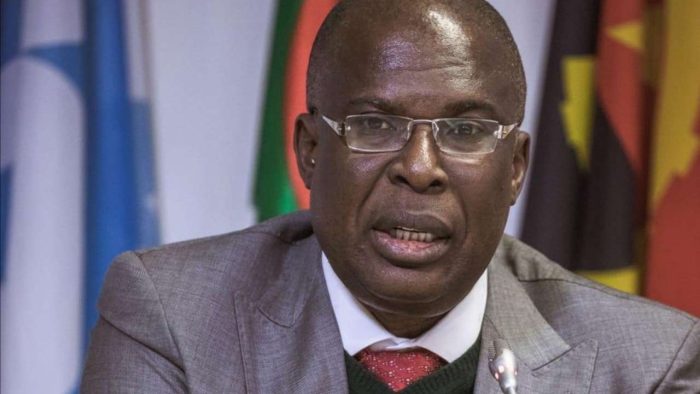

This was made known by the Minister of State for Petroleum Resources, Timipre Sylva while briefing State House correspondents at the end of the Federal Executive Council FEC, meeting presided over by President Muhammadu Buhari on Wednesday at the Council Chamber, Presidential Villa, Abuja.

Sylvia said the development of the compressed natural gas (CNG) is still in progress, adding that it was one of the steps that must be achieved before the removal of petrol subsidy.

What the Minister of State for Petroleum Resources is saying

On the state of the ongoing repairs of the country’s refineries, Sylva said one of the two refineries, the old one with 60,000 barrels-per-day capacity, would be functional by the end of 2022, just as works are also progressing on both the Warri and Kaduna refineries.

The minister said, “The rehabilitation of the refineries is ongoing. As we said earlier, the old refinery in Port Harcourt, which is about 60,000 barrels per day capacity, will be functional by December and, of course, we still have some time in the contracting time to conclude the rest of the Port Harcourt Refineries.

“Works in the Kaduna and Warri refineries are also in progressing very well. We will soon be embarking on an inspection visit and some of you journalists will be able to go with us to ascertain for yourselves what the extent of work is.”

Going further, Sylva said, “On the CNG development, it’s very much in progress. That is part of the promises we made, part of the things we want to put in place before the removal of subsidy. Subsidy has still not been removed because some of these conditions that were agreed upon have not been met and we’re definitely working assiduously to ensure that all the facilities are in place, the pumping stations and the conversion kits.

“I can assure you that work is going on very much in that regard. We may not be in a position to announce exactly what we are doing now or where we are, but I can assure you that work is very much ongoing.”

What you should know

- Recall that the Federal Government had on March 17 approved $1.5 billion for the rehabilitation of the Port Harcourt Refinery, an amount which many had described as too much for the project.

- The Nigerian National Petroleum Company (NNPC) Limited had on April 6, 2021, signed an Engineering, Procurement & Construction (EPC) contract with Tecnimont SpA, a subsidiary of Maire Tecnimont for the rehabilitation of Port Harcourt Refining Company.

- The NNPC while giving the reason the Federal Government is spending the huge sum of $1.5 billion on the 2 refineries in Port Harcourt, said that the funds were approved for the complete rehabilitation and not turnaround maintenance.

- Sylva had earlier in March 2012 assured that the federal government will complete the rehabilitation of the Port Harcourt Refinery, saying it would be functional within 18 months