The Debt Management Office (DMO) of Nigeria has released its FGN bond issuance calendar for the third quarter of 2022. This is contained in a document released by the DMO on its website.

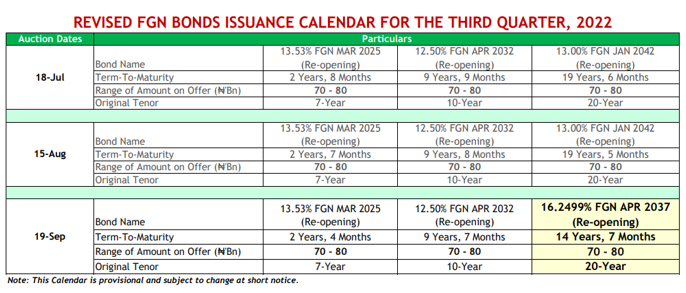

According to the press release, the issuance for the quarter under review will be held on 18th July, 15th August, and 19th of September, all of which will be in three tranches each.

Breakdown

Bonds that will be issued on the 18th of July 2022 include 7-year 13.53% FGN March 2025 Bond with a maturity term of 2 years and 8 months, a 10-year 12.50% FGN April 2032 due 9 years and 9 months, and a 20-year 13.00% FGB Jan 2042, maturing in 19 years and 6 months.

Similarly, on 15th August and 19th September, the 7-year 13.53% FGN March 2025, 12.5% FGN April 2032, and the 20-year 13.00% FGB Jan 2042 will be re-issued.

Also, for each of the tranches to be issued, the Federal Government seeks to raise between N70 and N80 billion.

About FGN Bonds

- FGN Bonds are debt securities (liabilities) of the Federal Government of Nigeria (FGN) issued by the Debt Management Office (DMO) for and on behalf of the Federal Government. The FGN has an obligation to pay the bondholder the principal and agreed interest as and when due.

- When you buy FGN Bonds, you are lending to the FGN for a specified period of time. The FGN Bonds are considered as the safest of all investments in domestic debt market because it is backed by the ‘full faith and credit’ of the Federal Government, and as such, it is classified as a risk-free debt instrument.

- According to the Debt office, the bonds have no default risk, meaning that it is absolutely certain your interest and principal will be paid as and when due. The interest income earned from the securities is tax-exempt.

You mean revised bond issuance calendar?