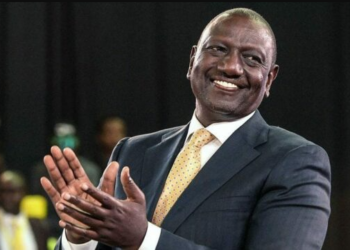

Kenya’s currency, the shilling weakened against the dollar on Tuesday as the country’s election commission announced Deputy President, William Ruto winner of the country’s election the day before.

On Monday, August 15th, the Kenyan shilling was trading at 119.25 shillings per dollar but fell to its lowest level against the greenback on Tuesday, trading at 199.50 shillings.

The currency of East Africa’s largest economy has fallen by 6.46% against the US dollar since January. Kenya’s incoming President would have to confront concerns about dollar supply head-on.

What you should know

- Kenya serves as a commercial hub for East and Central Africa, and is home to the regional offices of large corporations like Alphabet and Visa. Foreign investors frequently trade the country’s equities, bonds, and shilling in Africa.

- But the tea-rich country is currently ranked as the second-worst investment destination in the world by the IMF. Even if the government has rejected this ranking as false, reactionary investors will need more convincing.

- Kenya is also on track to spend a record amount of money on servicing its liabilities this year. Budget documents presented in April show that the East African nation’s debt-servicing costs climbed to 1.39 trillion shillings ($12.1 billion) in 2022.

- The East African nation’s biggest source of foreign currency is remittances by citizens living outside its borders. Inflows in the first six months of 2022 rose 17% to $2.04 billion from a year earlier, according to central bank data.

Furthermore, a survey by Afrobarometer says nine out of ten Kenyans believe the economy is not doing well. William Ruto, being president of Kenya would have four years to change this perception of the economy.