Pension Fund Administrators (PFA) in Nigeria incurred a sum of N18.85 billion as income tax in 2021, a 15.6% increase compared to N16.31 billion spent in the previous year, and 31.4% increase when compared to N14.35 billion incurred in 2019. This brings the total tax expenses in the past three years to N49.5 billion, according to a report by the National Pensions Commission (PenCom).

The report seen by Nairalytics- the research arm of Nairametrics, shows that Stanbic IBTC, ARM Pension, and Premium Pensions declared the highest income taxes in the review year, jointly accounting for 70.4% of the total tax expenditure of the industry.

The list under consideration includes 21 PFAs, that were operating as of the end of 2021, although this list has shrunk in recent times, owing to some mergers and acquisitions, in a bid to shore up their minimum capital requirement to N5 billion as directed by the PenCom.

The PFAs are: Apt (Now merged with Tangerine), ARM, Crusader Sterling, FCMB, and Fidelity as contributing to the tax surge. Others include First Guarantee, Investment One (now GT Pensions), IEI-Anchor (Now Norrenberger), Leadway, NLPC, and NPF. The list also includes Oak, PAL, Premium, Radix, Sigma, Stanbic IBTC, AXA Mansard (now Tangerine Apt), Trustfund, and Verita Glanvills.

Company Income Tax (CIT) is a tax collected on the profits of registered companies operating in Nigeria, including foreign companies doing any form of business in the country. CIT are charged as 30% of the company’s profit, for businesses with turnover from N100 million and above.

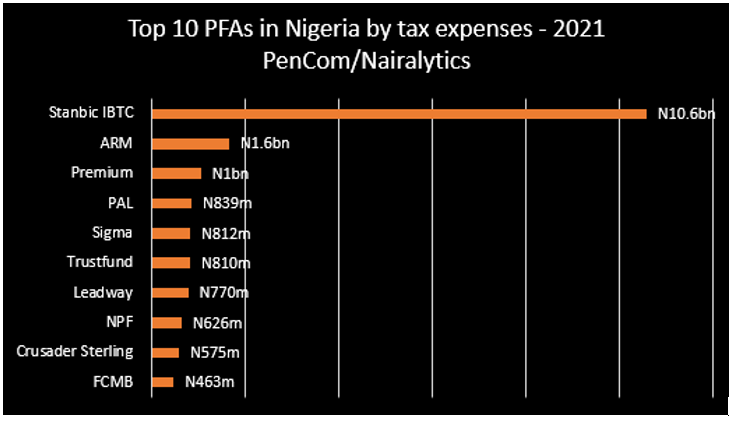

Below is a breakdown of the top 10 Pension Fund Administrators in the country with the highest tax expense in the review year. It is worth noting that the list excludes Pension Fund Custodians.

Stanbic IBTC Pension – N10.58 billion

Stanbic IBTC Pension Managers posted a total of N10.58 billion as tax expense in 2021, which is 21% higher than the N8.78 billion incurred in the previous year. The firms tax expense accounted for 56.2% of the total tax expense by the pensions industry.

A further look at the data shows that the tax expense of Stanbic IBTC Pension Managers, represents 32.5% of the profit before tax at N32.59 billion. Meanwhile, the profit before tax of the company increased by 16% compared to N28.1 billion posted in the previous year.

ARM Pension – N1.65 billion

ARM Pension is a distant second on the list with a total of N1.65 billion incurred as income tax expense, a 16% increase from N1.42 billion deduction in 2020. ARM Pension accounted for 8.7% of the total tax expenditure of the 21 firms.

Similarly, its tax expense represented 31.3% of the N5.27 billion posted as profit before tax.

Premium Pension – N1.04 billion

Premium Pension Limited recorded a total tax deduction of N1.04 billion in 2021, 11% higher than N937.9 million incurred in the preceding year, while accounting for 5.5% of the total industry tax payments in the review year.

The firm posted a profit before tax of N2.99 billion in the year under review, a marginal increase compared to N2.97 billion recorded in the previous year. Meanwhile, Premium Pension incurred 34.7% of its pre-tax profit as tax expenditure for the period.

PAL Pensions – N839.2 million

A total of N839.2 million was incurred by PAL Pensions as tax expenditure for 2021, an increase of 29% from N649.9 million recorded in 2020. PAL Pensions accounted for 4.5% of the total tax deductions recorded by the PFAs under consideration.

With profit before tax growth of 20% (year-on-year) to N2.56 billion in 2021, PAL Pensions recorded 32.7% of its pre-tax profit as income tax for the year.

Sigma Pensions – N812.4 million

Sigma Pensions incurred N812.4 million as tax deduction for the 2021 financial year, representing an increase of 10% from N735.4 million recorded in 2020, and 40% increase compared to N580.3 million recorded in 2019.

In the same vein, Sigma Pensions’ tax expenses for the period represented 33.6% of the pre-tax profit, which had grown by 5% year-on-year to N2.42 billion.

Others include

- Trustfund Pensions – N810 million

- Leadway Pensure – N770.4 million

- NPF Pensions – N626.7 million

- Crusader Sterling Pension – N575.3 million

- FCMD Pensions – N463.1 million

Why rising tax payments matter

Tax collection is a very important revenue bucket for the federal government of Nigeria, accounting for 33.5% of Nigeria’s non-oil revenue in 2021. In order to offset the shortfall recorded in Nigeria’s oil revenue, the non-oil component of the federal government needs to improve.

The Pension industry has been able to improve its tax payments to the federal government in the past three years, despite the covid-19 pandemic in 2020. This is owing to the impressive bottom lines recorded by the Pension Fund Administrators.

This is a crucial contribution by the PFAs in face of the government’s ballooning expenditure profile due to subsidy payments and interest from loan obligations.