Globally, businesses and individuals bank on insurance as a protection plan against future occurrences. Meanwhile, in Africa and Nigeria, a lot of people are yet to tap into the potential.

Adebowale Banjo, co-founder, Mycover.ai believes this is a result of the lack of education and understanding of insurance as well as the issue around accessing the product. In his view, technology can help to improve insurance education through social media and technology platforms via their brokers or directly from insurance companies.

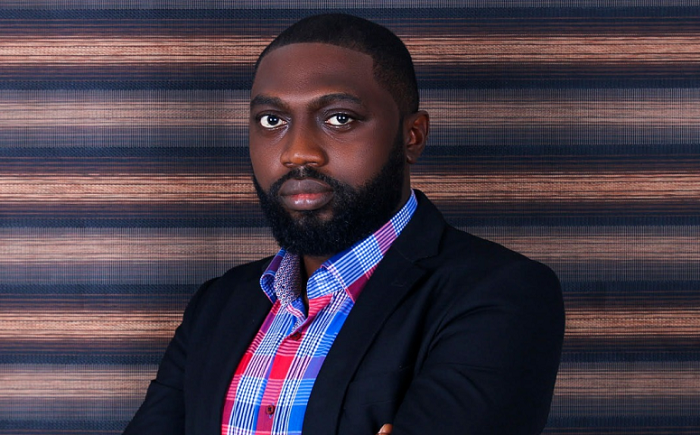

In an interview on Business Half Hour show by Nairametrics, Banjo who is a proficient executive with experience in Business Development, Strategy, Product Development and Business Analysis involving both start-ups and growth organizations, explained how the insurtech platform is using technology to improve insurance by using its API to ensure people access insurance.

“We have built an open insurance API that allows other innovators and businesses to embed insurance offerings into their existing product and services and what we are seeking to achieve with this is to help insurance companies distribute insurance products faster and cheaper and to create a better experience for users of insurance product and finally to create a safety net for Africa,” he said.

He explained that the platform makes use of technology to speed up the process in terms of what it takes to report a claim and also to simplify how documents are submitted as people are conversant and comfortable with communicating online.

He said, “The idea for us is to simplify access to insurance to give people great experience when it comes to buying insurance products, using insurance products and lodging claims on insurance products. Today we have a variety of products on health insurance, travel insurance, home insurance, life insurance, gadget insurance amongst others.

“We are making the distribution of insurance to be simple; we have our B-B-C platform which is our open insurance where we make it easy for other businesses to distribute insurance to people.

Speaking on the challenges in the course of building the platform, he stated that taking business ideas to fruition usually comes with a lot of bottlenecks, from trying to convince the very first person to partner with, to trying to get people to see the vision the same way that you do and getting people on board.

“We have had some of those challenges but I think getting people to understand and appreciate insurance has been the biggest change. But we are beginning to make headway in that regard, particularly because of the way we position that product in terms of the ease of access, distribution, making the tone of communication more friendly and acceptable.”

“In terms of challenges that I see in our expansion, it is just being able to find the right people to work with and grow in terms of tech talent to build the best products. There is a lot of focus on tech in Nigeria at the moment but the talent is not just enough to do the kind of things that you want to do and that’s why we expect that over the next couple of years, a lot of attention will go into structured education for young people so that more people can come into the tech space and the talent pool can grow,” he said.

Banjo added that he believes the startup bill also helps in terms of providing a regulatory framework for businesses to engage with regulators and with the government as they seek to expand within and outside the country.

NOTE: Don’t miss out on the next Business Half Hour programme brought to you by Nairametrics. Tune in to Classic 97.3 FM every Monday by 8:00am to get inspired by startup founders and top business executives.