Nigerian Startups are increasingly under attack from Kenyan Government agencies, particularly the Central Bank of Kenya and its Asset Recovery Agency (ARA) over allegations of card fraud and international money laundering.

In the more recent accusations, Flutterwave Payment Technology Limited, Boxtrip Travel and Tours Limited, Bagtrip Travel Limited, Elivalat Fintech Limited, Adguru Technology Limited, Hupesi Solutions, Cruz Ride Auto Limited, and one Simon Ngige were all accused of money laundering with a Kenyan court Kenyan High Court seizing Sh7 Billion ($59 million), from 56 accounts belonging to the FinTechs.

Others include Chipper, Korapay, and Kenyan-based Remix, all embroiled in fraud accusations by Kenyan authorities.

Kenya’s Asset Recovery Agency (ARA) filed 2 suits against the companies forcing the High Court to freeze their accounts on the suspicion that they brought over $50 million (KES6 billion) into Kenya as part of a money laundering scheme.

A few months back, reports emerged in Kenyan media accusing Multigate, and Remix of being involved in a SH25.6 billion ($220.9 million) in wired transactions that took place between October and November 2020.

Nigerian companies Multigate, Flutterwave, and Korapay have denied all accusations vehemently.

How this started

Following the ban placed by the CBN on the utilization of the Nigerian banking system for facilitating cryptocurrency transactions, most FinTech companies gravitated towards Kenya.

- The Central Bank of Nigeria’s ban on facilitating crypto transactions shut out an important source of revenue for valuation-rich Nigerian FinTech startups who were under pressure to scale their operations.

- Kenya was a strategic option considering how easy it is to transact in foreign currencies.

- The East African country has a loose forex policy that allows for easy repatriation of forex out of the country.

- In partnership with internationally recognized global electronic fund transfer companies Visa, and Master Card, Nigerian companies leveraged their technology and scale to facilitate payments for merchants across the country.

Important to add that beyond the FinTechs, some major Nigerian banks such as UBA, Access Bank, GT Bank, and Ecobank, all have a commercial presence in Kenya.

How do the FinTechs operate?

When a customer makes payment through their debit cards, switch channels like Flutterwave, and Chipper Cash work with Visa or Mastercard, and settlement banks to ensure that the merchants get their money, customers get fulfillment and in exchange, they keep their fees.

- Some of these transactions involve foreign currency and this is where the likes of Korapay, Elivalat Fintech Limited, Hupesi Solutions, and several other FinTechs and foreign currency traders come in.

- The foreign currency traders simply match buyers and sellers of forex often leveraging on cryptocurrencies to facilitate tens of millions of dollars in transactions daily.

- The Fintechs also earn juicy fees and spread per completed forex transaction.

- Nigerian FinTechs at the center of the transaction flows increased their brokerage footprint by setting up outlets in Canada, the US, and other major sources of forex, allowing for a seamless deal closure between those who want to buy forex and those who want to sell.

Sometimes, payments are made directly to foreign suppliers in China, Vietnam, or any major manufacturing hub on behalf of Nigerian businesses looking to secure raw material inputs.

In exchange, the Kenyan economy attracts significant forex flows which also helps strengthen its exchnage rate stability.

FinTechs also support the local economy by increasing e-commerce transaction volume for local merchants looking to increase their sales via social media and other online platforms.

Is this illegal

Checks by Nairametrics suggest the transactions are yet to be determined as legal as the Kenyan Authorities are yet to prove any illegality or convict anyone of fraud.

However, the companies are not licensed to operate in Kenya, a situation which the Nigerian companies attribute to delays by Kenyan authorities.

- One of the owners of the FinTech firms embroiled in the controversy, who preferred to speak anonymously as they are still negotiating for an amicable settlement with the Kenyan authorities, informed Nairametrics that even though their central bank Governor may be correct that they are not licensed, the reality is more nuanced.

- “It is a case of regulation lagging innovation as been the case in Africa and even developed economies. Some of us have applied for licenses for years now but they are yet to approve despite meeting all of their conditions,” they remarked.

Regulatory delays in licensing

Flutterwave recently issued a press release explaining that they had applied for a license as far back as 2019 and have been awaiting approval since then.

- “Our attention has been drawn to reports with regards to our operating licence in Kenya. Like many other financial technology service providers in Kenya, our entry into the market was through partnerships with banks and mobile network operators licensed by the Central Bank of Kenya. In 2019, as our operations grew, Flutterwave submitted its application for a Payment Service Provider licence. We have been in constant engagement with the Central Bank of Kenya to ensure that we provide all the requirements and we look forward to receiving our licence.”

Kora Pay on the other hand explains the $250,000, for which it was taken to court was legally deposited in its Kenyan account as part of the capital requirements from the Central Bank of Kenya (CBK) for obtaining a payment service provider and remittance operator license.

- “As part of the capital requirements from the CBK for obtaining a payment service provider and remittance operator license, Kora deposited the sum of $250,000 in its freshly opened bank account. In line with CBK requirements, this amount was left untouched pending the granting of our license. Easily verifiable records of this account will show that the $250,000 deposit is the only transaction carried out on that account to date.”

- “Unfortunately, Kora has been dragged through Kenyan courts on empty, unfounded allegations of money laundering since May of 2022. As a responsible corporate citizen, we have consistently challenged all these allegations in court and will continue to do so; we have documents that support our position. We are confident that the Kenyan courts will come to see that the accusations against us are not only wholly baseless but borderline malicious.”

Is this all politics?

Asides from regulatory delays, several sources within the Nigerian FinTech community have classified these accusations as slander, far from the truth, and politically motivated.

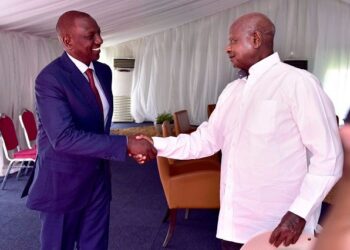

- Rather they attribute the accusations to the hotly contested elections in Kenya between Raila Odinga, 77 years old, (who is supported by President Uhuru Kenyata), and the current Deputy President, 55-year-old William Ruto.

- Nairametrics understand that at the heart of the entire debacle circles around the son-in-law of the Deputy President, Ruto who has a close relationship with a Kenyan FinTech Startup as well as several Nigerian FinTechs.

- The Son-In-law is Nigerian Alexander Ezenagu and he is married to June Ruto, the second daughter of the deputy president of the country.

- Sources suggest the hotly contested election is instigating a string of accusations and counteraccusations against Ruto and his running mate with Nigerian businesses caught in crosshairs.

Just a few days ago, running mate to Ruto, Rigathi Gachagua lost Sh202 million to the State after a Kenyan High Court ruled that the money proceeds from corruption. The money was held in a Microfinance Bank.

A judge ruled that the Gachagua admitted that he received the funds from government agencies without evidence that he supplied any services or goods to the government.

Gachagua on the other hand, claims the money “was money in a fixed revolving fund rotating between three accounts for seven years” and not proceeds of corruption.

What is the way forward?

Nairametrics understands managers of the Nigerian FinTech are working round the clock to resolve the issues with Kenyan authorities.

- However, sources familiar with how Kenyan authorities operate believe the issues will be resolved but not before the elections are concluded.

- The Nigerian companies will also likely face severe fines as a form of an out-of-court settlement, a deal most of them will find acceptable as it exonerates them of any fraud.

- The Nigerian Government is yet to issue any formal press release on this matter.

I presume that even if this situation or allegation is based on politics, Nigerian fintech needs to get licensed to operate in other country even before business establishments for goodness sake. It is the law, it’s been responsible, it’s been accountable, and it’s working well with the rule of the country with clarity. I’m sure they can’t try this with European countries or the Carribbean.