The Nigerian All Share Index closed the first half of 2022 with a gain of about 21.17% year to date (YTD) making it one of the best-performing stock markets in the world.

Global equities markets have had to stomach a rout as investors react to higher interest rates as central banks prioritize combating inflation over easy money.

In the United States, the S&P Index which measures the broader stock market has fallen by as much as 20% this year. Over in Europe, the London FTSE is down by about 3% while the German DAX is also down by a whopping 19.3%. In Africa, the Johannesburg Stock Exchange is down by 11%, and Ghana is down by about 8%. Kenya is down 16.9% and Egypt of 10% as of June 29, 2022.

Only very few countries have done better than Nigeria according to data from our source.

NGX Performance

As stated, Year to date June 30th, 2022, NGX All Share Index is up 21.17% as of June 30th, 2022, slightly down from 21.51% as of May 31st YTD.

- This is also the first time since 2018 that stocks have posted a positive return in the first half of the year.

- Despite snapping a half-year losing streak, stocks still posted a loss Month to date in June losing, 0.28%.

- According to data from Nairametrics research, about 64 stocks posted gains in the first half of this year out of a total of 158 stocks on the NMRSIndex (Nairametrics Relevant Stock Index). Another 54 posted gains and the rest remained flat at 0% returns year to date.

- In terms of sector performance (looking at the stock exchange data for July 1, 2022), the Oil and Gas Index has been the best performing with a gain of 57.44% this year.

- Nigeria’s Consumer Good Index is also up 5.88% while the Industrial Good Index gained 7.21% in the first half of the year.

- The Banking and Insurance Index, often a bellwether for the economy both lost 1.69% and 8.88% respectively.

Top Gainers

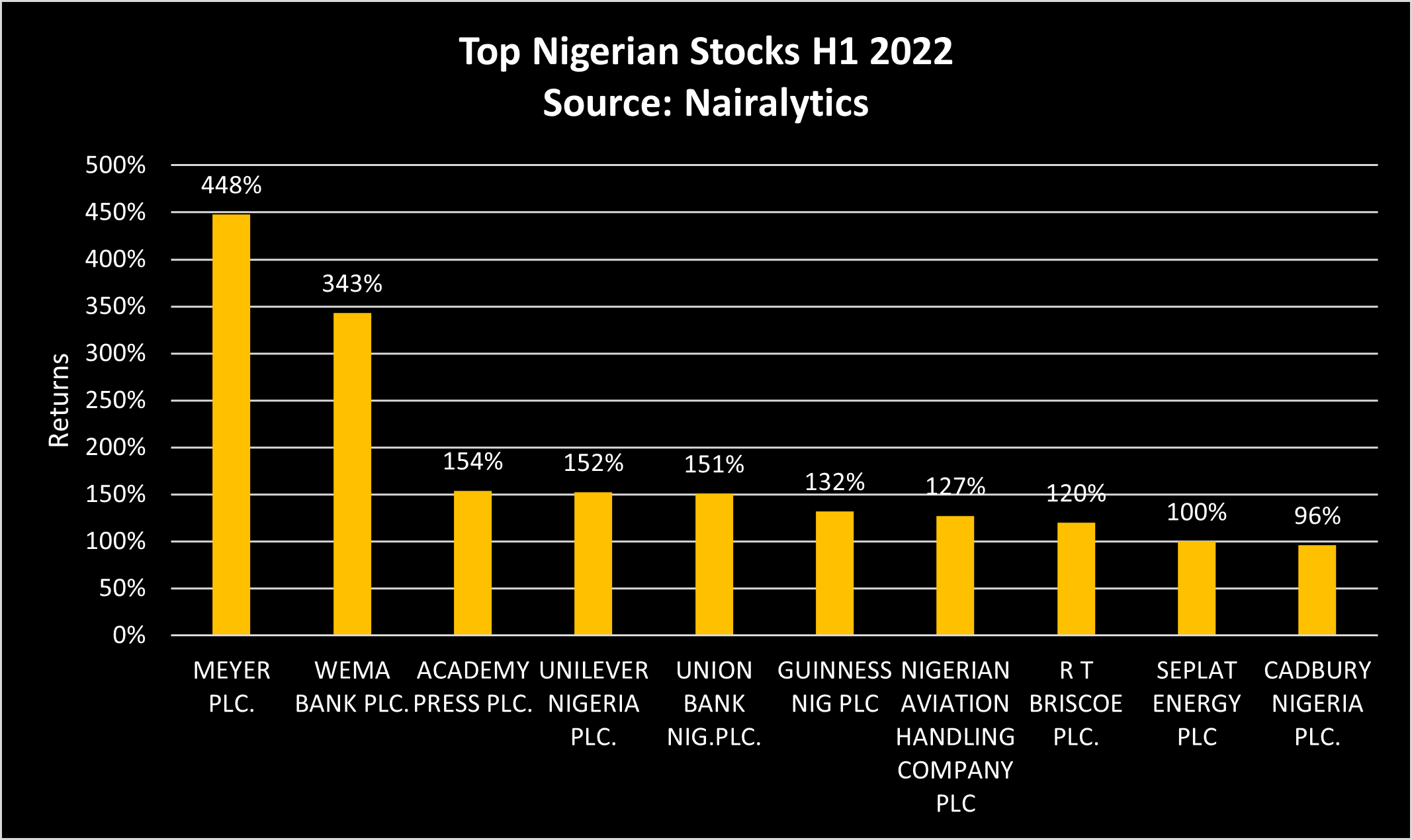

The top gainers for the first half of the year did not entirely reflect the broader index performance and featured most penny stocks.

- In the first half of the year, Meyer Plc, Wema Bank, Academy Press, and Unilever all topped the gainer’s chart with over 150% gains.

- According to our data, 9 stocks gained over 100% while 52 stocks in total posted double-digit gains in the first half of 2022.

- Nairametrics expects stocks to perform weaker in the second half of this year.

My first investment with this great company give me a profit of over $4,000 us dollars and deliver since then the never fail to deliver and I can even say the are the most sincere brokers I have known.

Please kindly contact expert Alexandra semenova. Send a mail to her company for more guidance 👉👉alexandraandnyc@gmail