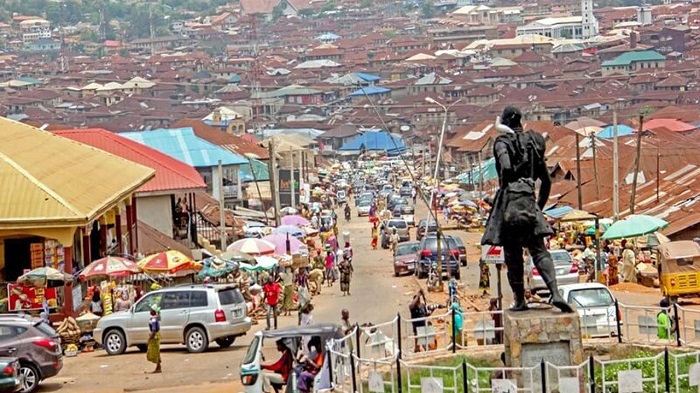

Oluyole is a renowned middle-income neighbourhood located in Ibadan, Nigeria. The area is bordered by Apata in the North, Elebu in the South West, Challenge in the South East, and Iyangaku in the East.

This city is a mixed-use city, mainly consisting of large industrial areas. The industrial market in Oluyole (the largest in Ibadan) is approximately 351,000sqm, with some of the top companies being: Pepsi, Procter and Gamble, Sumal foods group, 7up company, and Zartech amongst others.

There are also a lot of retail and institutional buildings in the city. Alaafin Avenue, in particular, is a popular road that hosts several schools and hospitals including: Oluyole Private School, Sunshine De-Gold school, The Vine Hospital and Maternity Center, Christ Ambassadors International College amongst many others.

The residential market in Oluyole is mostly owner-occupied and mainly located in extensions of the main city.

Some of the residential properties we track in this area include:

- RATCON Estate by Ratcon Construction

- Cedar Haus Gardens by Cedar Haus Realtors

- Anike’s Court

- Avenue Road Apartments

So far, Estate Intel is tracking 84 residential properties in Oluyole. Based on our analysis, the average rent for a 3-bed apartment is N1,109,254 and the same currently sells for N20,200,712 representing a yield of 6.82% per annum. Overall, Oluyole has seen its rental prices and sale prices grow by 2.3% and 3.4% respectively over the past 5 years. As such, we believe the market direction over the next year will be neutral.

Click here to view the full Oluyole Residential market Analysis, which gives a more in-depth analysis of other market data that we track including; sales and rental rates, yields, supply drivers, stock breakdown, occupancy rate, and information on key contractors who are active in the market.

We love your feedback. Let us know your thoughts on the Oluyole Residential Market by sending us an email at insights@estateintel.com