This was the running poll during our research meeting this week. Amidst an array of yes and nos, the team unanimously agreed that the answer was not so straightforward.

While Inflation is rising, the situation varies for each country

Over the past couple of months, inflation has been a key ‘ buzzword’ in global markets as it continues to rise, underpinned by factors ranging from the pandemic impact to the Russia-Ukraine war which has led to a surge in fuel prices and the cost of everyday commodities such as wheat.

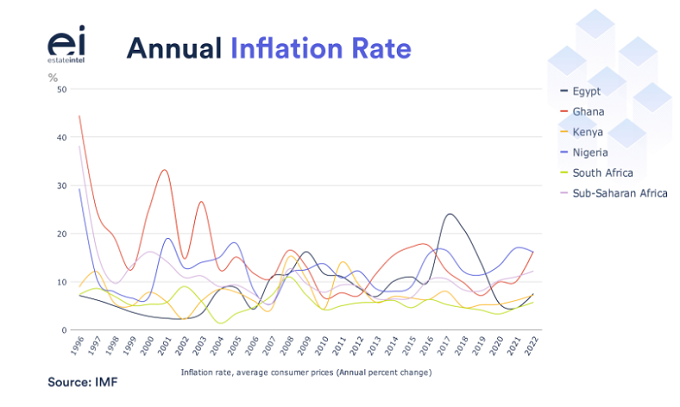

For Africa, the case has not been any different. Inflation in most countries has been at a decade high. Countries such as Nigeria recorded inflation levels at 17% as of May 2022 while Egypt’s inflation rate jumped to 12.1% in March, compared to 4.8% in 2021. On the other hand, Kenya’s inflation rate accelerated to 7.1% in May of 2022, the highest reading since February of 2020

On the brighter side, Sub-Saharan Africa’s inflation average remains low compared to the levels recorded at the turn of the 21st century. This is evidence of the unprecedented economic growth largely underpinned by economic diversification, increased foreign direct investment and generally low debt levels.

Ideally, Real Estate is a good hedge to inflation

Generally, real estate assets are considered as ‘safe haven’ investments given that they have little correlation to stocks and bonds, hence less reactive to market forces.

In instances of rising inflation, the expectation is that rents rise along with the prices of goods and raw materials with typical lease clauses allowing for rent to be marked up to market hence protecting the investor in terms of net income. This has been seen in practice in cities such as Accra, where property owners increase their rental prices annually by at least 10% to 15% to beat inflation among other factors.

However, the case is not so simple. Across Africa, rental income is usually influenced by a lot more factors outside of inflation ranging from the levels of supply, market affordability to currency fluctuation, generally impacting the market performance.

With rising ‘Cost side’ inflation, office and residential affordability remains a challenge

In our previous analysis, we noted that the office market in cities such as Accra and Lagos is already being impacted by existing supply glut. As such the markets are seeing high vacancy levels ranging from 12% to 36% (Lagos) and 20% to 25% (Accra) in Grade A and B offices respectively in the year to January 2022. As such, while leasing activity has started to recover with a few more new entrants expected to make a comeback later in the year the high ‘cost-side’ inflation is expected to impact on the occupiers’ affordability directly affecting new enquiries in the sector.

A similar scenario is expected to play out with the residential sector. Overall, the sector has seen an uptick in demand, especially for the mid to low-end segments of the market. In Lagos for example, the young professional housing segment is driving this demand resulting in hotspots in areas such as Yaba where Estate Intel has observed the price of a 2-bedroom apartment appreciated by 25% in the 5 years between 2017 and 2021. And in Accra, the low to mid-end properties are also seeing high occupancy rates due to the domestic nature of demand. As such areas, such as East Legon, have seen the price of a 2-bedroom apartment appreciate by 52% between 2017 and 2021.

However rising inflation is likely to impact on general affordability by impacting on the household disposable income in the majority of the cities hence impacting new takeup.

Commodity price shocks are pushing up building materials prices, leaving developers in limbo

Additionally, most countries have recorded an increase in the cost of building materials due to supply chain and inflation challenges. This is posing a challenge to developers and investors as they are unable to pass on the additional costs to the buyers.

So far, the rising cost of building materials in Kenya has pushed construction costs by an average of Sh3,000 per square meter, forcing constructors to hold ongoing projects. On the other hand, the Nigeria Tribune indicated that most of the developers have jacked up their house prices by 40 to 50 per cent in the year to April 2022, citing exorbitant building materials’ prices, high cost of funds and labour; and high cost of securing planning permit and documentations.

Egypt has seen been the most affected with the prices of building materials increasing by up to 92% in March, according to a report issued by the Central Administration of Building Materials of the Ministry of Housing, Utilities and Urban Communities.This has been underpinned by the war as well as production cuts on cement imposed in July last year to ease the existing supply glut. This is expected to result in project delays as developers attempt to mitigate the impact of these higher input costs on current projects

With Currency Fluctuations and interest rates on the rise, it is a slippery slope for real estate

Further, weakening currencies are set to continue to impact consumer demand and institutional financing progress in the market in addition to inflation.

Already, market entry by international developers and investors across major African cities has seen a rising wave in new office buildings and shopping centers subject to dollar-denominated leases. However, currency depreciation and the parallel dollar market in markets such as Lagos and Accra, coupled with the acute shortage of dollar liquidity in markets such as Nairobi and the imposition of capital controls is weighing on retailers, corporate occupiers, developers, and investors alike.

The cost of lending too, remains high with central banks across the continent raising their interest rates in a bid to curb inflation. However, these increases are expected to have minimal impact with regards to reducing consumer spending due to the informal nature of the market. However, the cost of capital is expected to increase inadvertently impacting the financing of ongoing real estate projects. Kenya for example raised its benchmark rate by 50 basis points to 7.5% for the first time in 7 years. This was closely followed by the Central Bank of Nigeria’s increase in the interest rate, from 11.5% to 13%, the first in six years. Further, Egypt’s central bank increased its lending rate from 10.25% to 12.25%.

The Alternative Opportunity

Overall, while these scenarios are expected to play out in the short term, it will be interesting to see how the market performs in the long term. Africa’s real estate market is currently being underpinned by rising demographics. With populations growing and cities urbanizing at a faster rate, demand for housing and social services such as healthcare and student accommodation is expected to continue to rise. As such, this sustained demand in these asset classes is fundamentally expected to act as a hedge against inflation towards real estate investors.

We love your feedback. Let us know your thoughts on the impact of inflation on real estate by sending us an email at insights@estateintel.com

I will love to vote whom my choice want