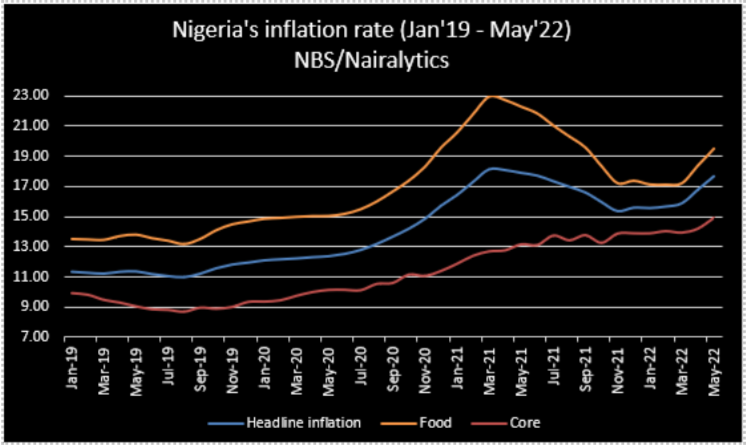

Nigeria’s inflation rose to its highest level in 11 months, rising from 16.82% recorded in April 2022 to 17.71%. This is according to the recently released Consumer Price Index report, released by the National Bureau of Statistics (NBS).

The consumer price index, which measures the rate of inflation rose by 17.71% year-on-year in May 2022, which is 0.89% points higher than the 16.82% recorded in the previous month (April 2022). On a month-on-month basis, the headline index increased by 1.78% in May 2022, compared to the 1.76% increase recorded in the previous month.

Similarly, the urban inflation rate increased to 18.24% (year-on-year); this is a 0.27% decline compared to 18.51% recorded in May 2021. On the other hand, the rural inflation rate increased to 17.21% in May 2022 (year-on-year) basis; this is a 0.15% decline compared to 17.36% recorded in the corresponding month of 2021.

Food inflation

- The closely watched index rose by 19.5% year-on-year in May 2022, representing a 1.13% points uptick compared to 18.37% recorded in the previous month and 2.78% decline compared to the corresponding period of 2021 (22.28%).

- This rise in the food index was caused by increases in prices of Bread and cereals, Food products, Potatoes, yam, and other tubers, Wine, Fish, Meat, and Oils.

- On a month-on-month basis, the food sub-index increased to 2.01% in May 2022, up by 0.01% points from 2.0% recorded in April 2022. Also, the average annual rate of change of the Food sub-index for the twelve-month period ending May 2022 over the previous twelve-month average is 18.68%, 0.05% points decline from the average annual rate of change recorded in May 2021 (19.18%).

Core inflation

The “All items less farm produce” or Core inflation, which excludes the prices of volatile agricultural produce stood at 14.9% in May 2022 on a year-on-year basis, up by 0.72% points compared to 14.18% recorded in April 2022 and 1.75% points higher than the 13.15% recorded in May 2021.

- In the month under review, the highest increases were recorded in prices of Gas, Liquid fuel, Garment, Solid fuel, Cleaning, Repair and Hire of clothing and Passenger transport by road.

- The average 12-month annual rate of change of the index was 13.83% for the twelve-month period ending May 2022; this is 2.33% points higher than 11.5% recorded in May 2021.

States with the highest inflation

In terms of all-items inflation, Bauchi State recorded the highest at 20.62% in the month of May 2022, closely followed by Akwa Ibom and Rivers with 20.34% and 19.95% respectively, while Kwara (15.45%), Kaduna (15.69%) and Jigawa (16.15%) recorded the slowest rise in headline Year on Year inflation

Considering the food index, Kogi state recorded the highest food inflation in May 2022 with 22.79%, followed by Akwa Ibom at 22.47% and Kwara State with 22.21%. On the flip side, Kaduna (16.46%), Anambra (16.54%) and Jigawa (16.91%) recorded the slowest rise in year-on-year food inflation.

Backstory

Nigeria’s inflation rate rose to its highest level in 8 months after the headline index grew by 16.68% year-on-year in the month of April 2022, compared to 15.92% recorded in the previous month. Food inflation also rose to 18.37% as a result of the global energy and food crises, pushing Nigeria’s food inflation rate to its 7-month high.

What this means

- The purchasing power of Nigerians is constantly and continually eroded by the rising prices of food and services in the country. This implies that the value of money is worth as much as it was in the previous month. Although inflation seems like a common event in the country from times past, the pace at which the rate rises is somewhat worrisome.

- The Central Bank in its last monetary policy meeting raised the benchmark interest rate from 11.5% to 13% in May 2022, in a bid to curb the galloping inflationary pressure in the country, which has been attributed to global energy and food crises.