FundBae, Nigeria’s fastest-growing Savings and Investment platform, has just crossed a major milestone – 50,000 Users. FundBae is helping ordinary Nigerians build and preserve wealth through its value offerings; savings, investments and payment. It is steadily growing on Nigerians because of its flexibility and usefulness in helping Users build and sustain a savings habit. What’s more amazing is that FundBae has paid a whopping N14,000,000 in interest, over N2B in volume of transactions and about 40,000 in transaction count since inception.

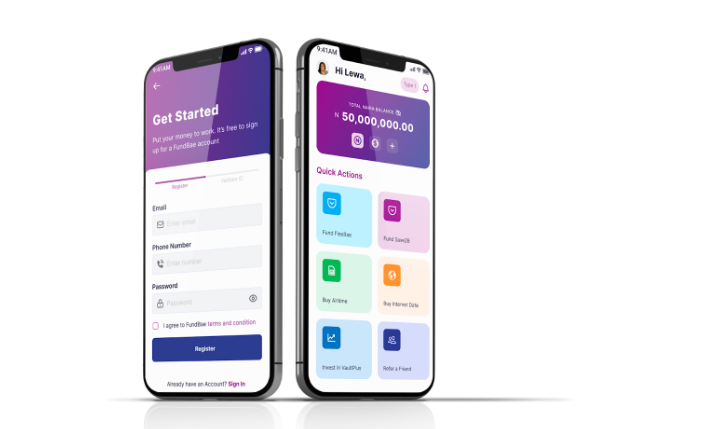

FundBae has always been about User satisfaction, which reflects in its preference for user-centered product development. At the start of 2022, the team got to work; improving service delivery and enriching the functionality of the product to make onboarding simpler and the user journey quicker. The solution was drafted and the journey to creating one of the most adaptable apps that gratifies the evolving lifestyle of our users began. After many weeks of hard but rewarding work, the team is excited to announce our latest version – FundBae 2.5.

The much anticipated upgraded version, ‘Fundbae Version 2.5’ is the true definition of digital financial flexibility. It addresses customers’ pain points and is faster to navigate. In a recent interview with Fundbae’s Chief Technology Officer, Segun Ojo, he shared insights on the new version release; ‘This upgraded version is one that I am excited about because of the upgraded features. With our improved UI/UX, customers can enjoy seamless navigation, set up their tiering level and do much more. The feeling is great with this new release because Fundbae is solving a real need in the life of its customers. It’s been quite a journey up till this point, but we are excited for what lies ahead.’ he said.

FundBae v2.5 offers lightning-fast interbank transfers to third parties. It caters for literally everyone! Put your money in FundBae and transfer it to other FundBae users at zero cost. Customers can also pay recurring bills quickly and safely, without any hassle.

With this new version comes a simpler, easier and faster onboarding process. This was done to remove bottlenecks potential customers face when they hop on the platform to enjoy its amazing benefits. Also, customers can now upgrade their tier or savings level on the mobile app, giving them the power to do much more.

A lot of detail went into the UI/UX of the app to make it user-friendly and aesthetically welcoming. The dashboard is one to watch out for in this upgraded version. As part of this latest update, referral links are now easier to use for those who want to make some extra money by referring their friends and family to the app. There is just something for everyone!

While the need to innovate and re-invent will be an ongoing process with this amazing Savings and Investment app, the goal will always be to adapt the product to fit its customers’ lifestyle and needs per time.

In addition, to ensure safe and secure transactions, FundBae operates strong system security measures against bad actors. Customers can be rest assured that their funds are secure at all times.

FundBae is actively building a community of people that are growing their wealth while in active employment or entrepreneurship. Currently, over 50,000 Nigerians trust FundBae to save and grow their money. Nigerians are beginnning to open their eyes to a platform that offers the best options to manage their funds and evade the fast rising inflation in Nigeria.

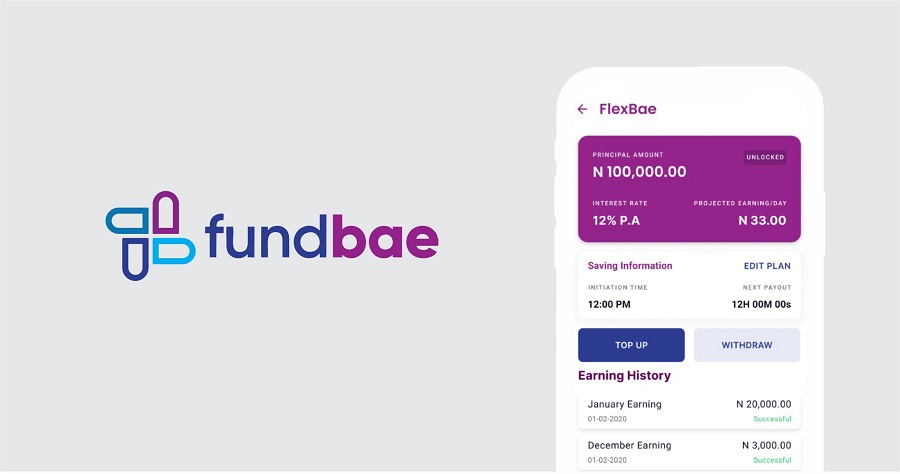

Asides the technological side of FundBae, what’s more surreal is the lives this app is transforming; giving ordinary individuals the power to hit their set saving goals with a feature like FlexBae, without the fear of losing their monies like the common kolo stories we have heard in recent times. Also, FundBae has helped people reach their dreams with the Strict target savings plan –Vault. This plan has helped students and every other individual save seamlessly towards achieving their dreams.

FundBae is also evolving with the times and now features a US-Dollar denominated savings plan as well. There are no worries concerning losing the value of your hard earned Naira with the FundBae dollar wallet which offers you up to 7% interest annually.

Fundbae is a digital financial service offering powered by Vale Finance Limited which is duly licensed by the Apex financial system regulator in Nigeria -The Central Bank of Nigeria (CBN).

There is so much to enjoy and achieve with FundBae version 2.5. Go on to either Android or IOS stores to download FundBae today!

That’s incredible, Nairametrics! How’s 7% interest on dollars savings ever believable?

I trust not a few to go full throttle for it.