Our Nairametrics audience will be familiar with GDP term as an acronym for Gross Domestic Product. This is a macroeconomic indicator that simply seeks to quantify economic transactions done in an economy for a specific period.

To most economists, the idea behind the importance of GDP as a macro-economic indicator is that transactions should be done in exchange for monetary compensation (economic value), therefore the more value-linked transactions are done by an entity or a country, the wealthier the entity or country should be.

Consequently, as a key measure of a country’s economic wealth, most economists prefer a continuous and sequential increase in the quantity and value of economic transactions done in the country

- (i.e., economists and policymakers’ preference is for everyone to keep doing more and more business transactions every single quarter…. all things being equal).

Unfortunately, as everyone knows, all things are NOT always equal. Therefore, from time to time, there will be events that happen which will adversely affect people’s ability to do business transactions, let alone do more business transactions compared to the prior period.

Threat to Nigeria’s GDP

From a Nairametrics perspective, it is likely that ongoing price inflation for energy products and the resultant actions being taken by businesses pose an adverse threat to Nigeria’s GDP growth rates.

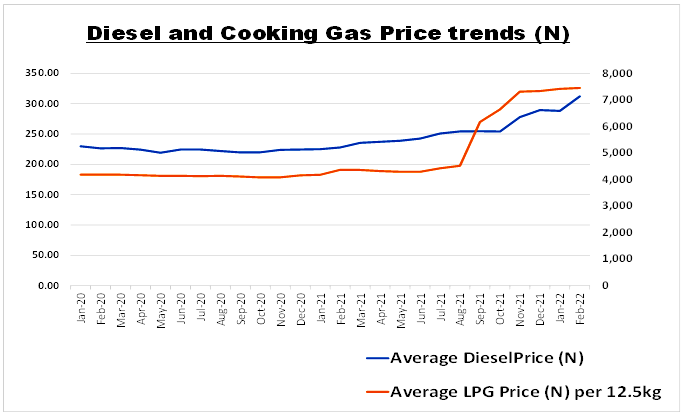

Specifically, over the past twelve months, businesses have been under significant cost pressures driven by the increases in key energy inputs for business operations such as diesel (AGO), cooking gas (LPG) even aviation fuel (ATF). However, the spikes in energy prices in March-2022 have been simply astronomical.

For context, consider that a company operating one 100KVA-generator for 12 hours daily would require daily average consumption of 144 litres of diesel. Over the past 12 months, that organization has seen its diesel bill alone spike from a unit rate of N250/litre average in 2021 to N311/litre in February 2022 and now a unit rate of over N650/litre in March 2022.

- This creates a net cash outflow of paying N93,600 daily compared to “only” N36,000 daily a few monthly prior (i.e., paying N2.8million monthly from N1million monthly) just on diesel consumption alone.

- The spectrum of Nigerian businesses affected are diverse… think hotels, large restaurants, mini-estates, serviced apartments, large bakeries, large agro-processing units etc.

This new cost base is simply NOT sustainable and poses significant demand contraction threats to various sectors of the economy.

As a direct result of the new cost base, Nigerian business owners (who are typically ultra-resilient) have been forced to take dramatic actions such as either withdrawing some services, temporarily shutting down operations or reducing office working hours.

- Note that a reduction in office working hours to 9am-5pm from an 8am-6pm translates to a 20% downtime (i.e., 8hours schedule vs 10 hours schedule)

- This action of Nigerian businesses reducing working hours or withdrawing services, therefore, begs the question of which of the country’s GDP sectors are most at risk from aggregate demand contractions due to the alarming spikes in energy costs.

Nigeria’s GDP Sectors

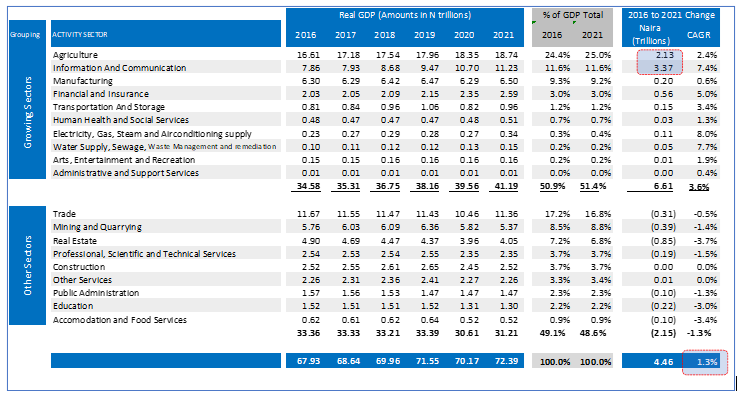

Looking through Nigeria’s Real GDP (adjusted for inflation) trends over the past 5 years, a few things are apparent.

- Over the past 5 years, Nigeria’s Real GDP grew by N4.46 trillion to N72.3 trillion (2021) compared to N67.9 trillion (2016) reflecting a compounded annual growth rate of 1.3%

- Remarkably since 2016 the N4.46 trillion of growth can largely be attributed to only two sectors: Agriculture (N2.1 trillion expansion) and Info/Communications (N3.3 trillion expansion).

- Furthermore, only 10 out of 19 sectors (just half the economy) has grown since 2016, whilst other sectors have declined in aggregate.

In other words, under the current state, only half the economy currently contributes to GDP growth. Thus, the risk of economic contraction can potentially be viewed from the perspective of these GDP “growth” sectors.

Arguably, excluding agriculture, all the GDP “Growth” sectors are susceptible to demand contractions as a result of astronomical energy price increases (i.e., key sectors such as Telcos, Manufacturing, Financials, Transportation, Health and social services, Utilities, Arts/Entertainment are all susceptible to aggregate demand contractions as energy prices spike and businesses reduce operating hours)

Broad-brush estimates show that demand contraction higher than 1% across these key GDP sectors will result in a recession for Nigeria’s economy. This is especially if ongoing actions by businesses to shut down operations, withdraw services/products, or reduce business hours persists through July/August 2022.

So, what can be done?

From a short-term perspective, we note that recent energy price spikes are not peculiar to Nigeria, likewise it is worth pointing out that countries across the globe have begun announcing policy measures to mitigate the impact of rising energy prices on their citizens.

- Specifically, countries such as Spain, UK, Canada even our west African neighbour Ghana have announced some fiscal measures (no matter how little) to provide relief to citizens through tax breaks and/or direct subsidy payments.

- In Nigeria, the CBN governor recently commented on the need to potentially intervene to ensure the supply of petroleum products. However, details of the relief packages are yet to be made public.

- For purposes of expediency, it is preferable that the details of the relief package are announced sooner rather than later to enable businesses to take advantage.

If necessary, we suggest that this short-term support be in the form of direct relief for core businesses inputs such as diesel. The economic justification being that should businesses go bankrupt, and the Nigerian economy collapses then the opportunity cost to the Government will lower tax receipts across VAT and Corporate Taxes.

- The government should immediately mandate the NNPC to increase its import diesel at twice the current consumption capacity to help alleviate the supply glut we are experiencing.

- In addition, the CBN must provide forex via a special window to allow for the importation of diesel into the country.

- The intervention of the CBN and the NNPC must be for a protracted period that ends when the global energy crisis abates.

- Another potential compromise could be to provide short-term diesel price intervention to importers which can be linked to the opportunity costs impact on FG’s VAT receipts and corporate taxes.

- As an example, a 6-month policy to provide a limited and targeted diesel intervention to importers funded by 10% of FG’s VAT and corporate tax receipts as opportunity costs will provide capacity for short term funding. The taxes can be subsequently recouped from businesses over time as prices stabilize.

From a longer-term perspective, the Federal and State Governments need to revisit the entire spectrum of energy sources available to the nation to reverse the unrelenting expansion of our import bill. Remarkably our imports energy products remain a stubborn part of the top 10 imports each year.

- The obvious long-term solution here will be to kickstart local production of diesel, especially will the imminent launch of the Dangote Refinery.

- The government also needs to commission more modular refineries strategically located in the 6 geopolitical zones in the country.

In conclusion

To be clear, these energy price spikes have only become more alarming in the past few weeks and the future cannot always be predicted with infallibility.

- However, available data suggest that there is an ongoing shortage of key energy products and very low inventory across the globe.

- Furthermore, as countries reopen and demand for mobility increases, the supply gap which has been occasioned by sanctions-driven unavailability of Russian oil products will simply mean higher prices to compensate for the shortage.

- Consequently, energy costs may potentially remain elevated through the third quarter of 2022 with the risk of wealthier European nations rationing energy products to meet domestic demand.

- Thus, policy actions to support Nigerian businesses will be preferable sooner rather than later.