The Federal Government has warned that depot owners selling fuel above the approved ex-depot price in filling stations nationwide will be sanctioned.

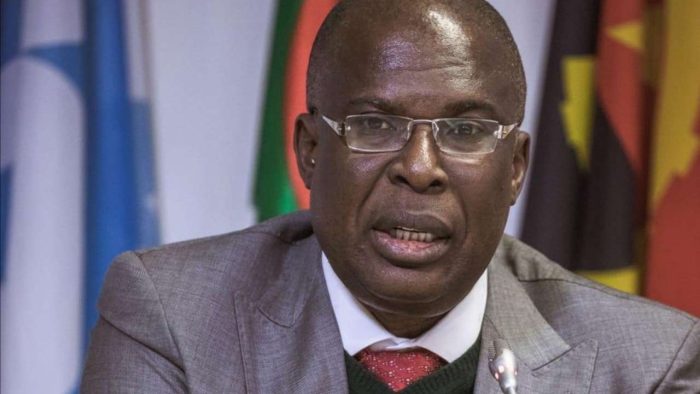

This was disclosed in a statement by the Minister of State for Petroleum, Timipre Sylva in a meeting with newsmen on Thursday evening, on the current fuel crisis in Nigeria.

He stated that Nigerians are suffering because of the high diesel prices, adding that as a deregulated product, when crude prices are high, diesel prices are expected to rise as well.

What the FG is saying

Sylva said, “We are aware, just like President Muhammadu Buhari said in a statement, that there are some depot owners who are taking advantage of the situation by increasing the Ex-depot price.

“I can assure you that there will be sanctions for any of those depots that continues to increase the Ex-depot price as approved. We are going to deal decisively with anyone who tries to take advantage of this situation.”

He stressed that it has been a difficult couple of weeks in the international energy market, citing that a few weeks ago, Nigeria experienced petroleum product shortage, which he says the matter has been addressed and coincided with the geopolitical tension in Ukraine and Russia.

“Prices of crude oil went up exponentially beyond levels expected. As you all know, when crude oil prices rise to that level, it can also affect the derivatives of crude oil.

“Nigerians are suffering because of the high diesel prices, including everywhere else globally,” he added.

He stated that the situation is not peculiar to Nigeria as diesel is a deregulated product and therefore when the prices go up internationally it affects the price also in Nigeria. He added that since fuel tankers are powered by diesel, it has impacted the movement of petroleum products.

“If any deport owner increases price or any fuel station tries to take advantage of the situation, the public should report immediately.

“If we do not get the report, we cannot know what is going on or sanction them.

“We will continue to ensure that the situation is controlled. Queues are coming down in Lagos and other parts of the country. Very soon, this will be a thing of the past,” he said.

In case you missed it

- Nairametrics reported that Nigeria spent a total of N4.56 trillion on the importation of motor spirit (fuel) in 2021 about 128% higher than the N2 trillion spent on fuel importation in 2020, according to foreign trade data recently published by the National Bureau of Statistics.

- This is the highest amount spent on the importation of motor spirit since Nairametrics started tracking the data.

- Nigeria spent a whopping N6.3 trillion on Fuels and Lubricants imports in 2021 dwarfing the N2.83 trillion, N2.5 trillion, and N3.8 trillion incurred in 2020, 2019, and 2018 respectively.