The Federal Government has said that it will intensify efforts to encourage crude oil production so as to take advantage of the global oil prices, hinting at hitting full production by the end of the year.

The move is coming at a time the global crude oil price hit over $100 per barrel following the Russia-Ukraine war.

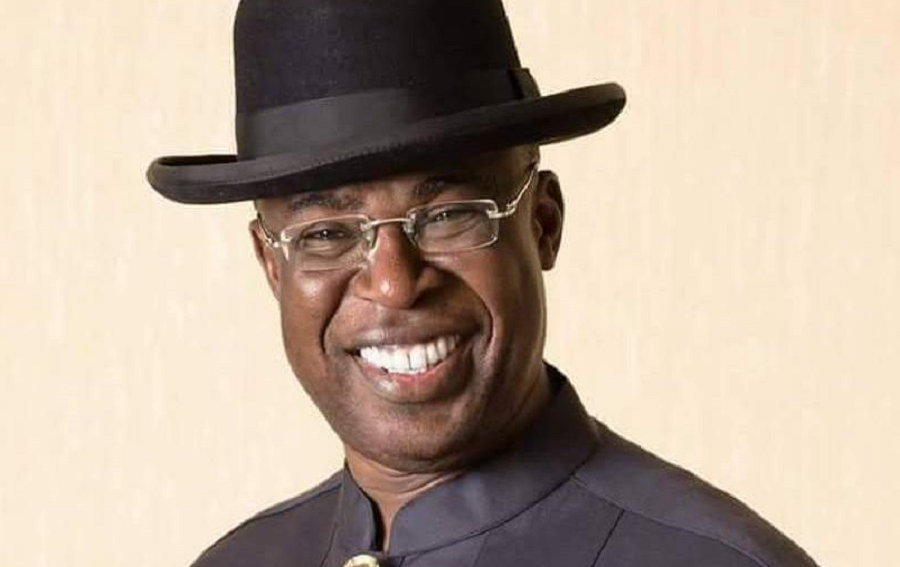

This was made known by the Minister of State for Petroleum Resources, Chief Timipre Sylva, in Abuja, while briefing newsmen on the forthcoming Nigeria International Energy Summit (NIES 2022) slated from February 27 to March 3.

Sylva’s statement was in reaction to the more than 5% increase for the global oil benchmark, Brent Crude, to $103.33 per barrel from $96 per barrel with escalating tensions between Russia and Ukraine.

According to NAN, Sylva said Nigeria’s oil production was not optimal hence it was encouraging increased production.

He said that already Nigeria’s oil production was not where it was few months ago, adding that it needed to move up gradually and before the end of 2022, Nigeria would have completely regained its production.

What the Minister of State for Petroleum Resources is saying

Sylva pointed out that the country’s oil production is not very optimal at this point, adding that they will rather like to have a production that can take advantage of the high price through high input.

He said, “A lot is going on, we are not happy that we are not able to take advantage of high prices, it is our loss, and we are doing everything to ensure that we increase our production.

“In the industry, the price of oil was being determined by a lot of fundamental issues.

“When oil prices go high it means that there are other competing production that will also come up, for example the shale oil producers in U. S. will now find it profitable whereas if it is at a certain level, it will not be profitable for them to produce.

“Once oil prices go up to a certain point, you are encouraging other production that otherwise will not be in the market. We are not happy when oil prices go to a certain level rather it should be at a point which will be optimal for us.’’

The minister described Nigeria as a net importer of Petroleum, adding that when crude oil prices rose globally it could also affect the price of petroleum products which would not be good for the country.

He also said, “It is not as if we are happy with the prices because we are taking from one side and giving away from another side, at the end we are not gaining we are taking from the high prices and also importing high petroleum products.

“We are encouraging more producers to neutralise the market for us.’’

What you should know

- Recall that on Thursday, the Brent crude traded at $100 per barrel on news of Russia attacking Ukraine, which has, in turn, exacerbated concerns that a war in Europe could disrupt global energy supplies.

- The Federal Government had earlier expressed concern over the rising international prices of crude oil, saying the increase is not good for the country.

- Sylva had maintained that Nigeria’s comfort zone in terms of oil prices was between $70 and $80 per barrel, stating that at the moment, Nigeria was not gaining anything from the soaring prices.

- Nigeria’s controversial fuel subsidy regime, which could gulp about N3 trillion this year, coupled with its inability to ramp up production to meet the quota allocated by the Organisation of Petroleum Exporting Countries (OPEC) have combined to limit the gains from the oil price hike.

- Sylva blamed the inability of Nigeria to activate the oil wells it shut down when OPEC instructed producing countries to cut production as well as the lack of investment in the upstream sector for the country’s inability to increase production.