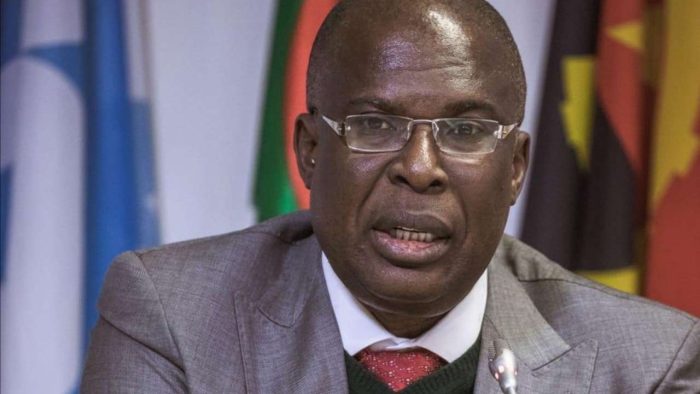

Nigeria’s Minister of State for Petroleum, Timipre Sylva has disclosed that Nigeria and its OPEC partners are not comfortable with high prices of oil, which have been triggered by ongoing Ukraine-Russia tensions. He disclosed that a much more comfortable price range for Nigeria would be between $70-$80.

Sylva disclosed this in an interview with Bloomberg on Wednesday morning.

He also revealed that Nigeria should be able to meet its OPEC production quota fully later in the year and that Nigeria is looking for more African sources of funding to improve production capacity.

What the Minister is saying about oil prices

The Honourable Minister stated that at OPEC level, he is hopeful that prices will hover around $70-$80, which will be sustainable for Nigeria till end of the year.

He said, “We are not comfortable with very high prices. We would be comfortable with prices between $70 and $80, at this point the tensions are not being created by us that have affected prices.

“I don’t know what will get us to change our plans, but we are watching the situation. Right now, things are not really clear for us to now make major decisions because the tension in Europe can just go away tomorrow,

“And now there are discussions going on with Iran. If they have a nuclear deal with Iran, there would be more volume in the market, but for now, it’s best to sit and watch before taking any decisions.”

On meeting OPEC quota numbers, Sylva said Nigeria is working hard on that, adding that what happened was Nigeria had to cut back. He said, “You can’t really cut back mathematically. At the end of the day we over complied. In trying to cut down, we cut down too much and now to come back has not been too easy for us. We need investments.”

He added that Nigeria is working hard to ensure it meets up with its production quota, stating “with the kind of prices we are seeing, we are not happy, we should be back on track later this year.”

On plans to attract investments, he said, “Africans cannot be completely dependent on foreign investments for energy investment and is looking at setting up an investment bank that will investment through multilateral funding for investments.”

Brent Crude prices are currently $96.37 as at 1:30 pm West African time, on Wednesday, February 23, 2022.