Stanbic IBTC ETF, VETBANK ETF, and Afrinvest equity fund led the list of best performing mutual funds in Nigeria in the month of January 2022 as the industry net asset value (NAV) grew by N13.21 billion in review period.

This is according to analysis carried out by Nairalytics, the research arm of Nairametrics on the weekly data obtained from the Securities and Exchange Commission (SEC).

A cursory glance at the data shows that 48.5% of the listed 134 funds recorded positive growth in January 2022, while 27.6% of the listed funds closed flat and 23.7% of the funds recorded price decrease in the review month. However, on the average, the market recorded a 0.02% negative ROI in the month under review.

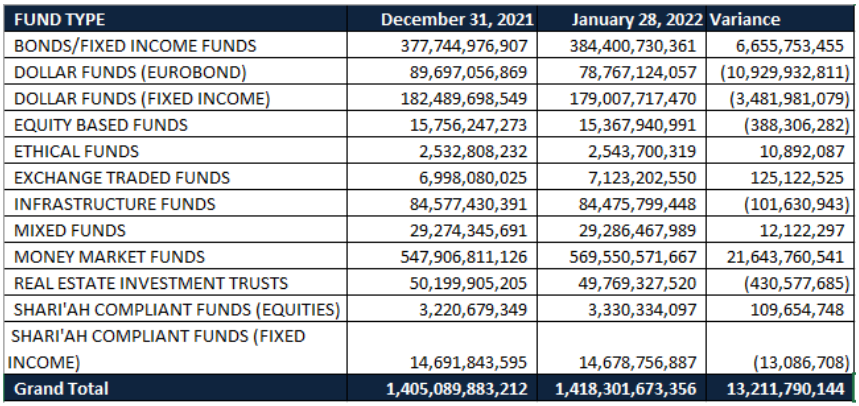

According to the data from the Securities and Exchange Commission, the industry net asset value increased from N1.41 trillion recorded as of 31st December 2021 to stand at N1.42 trillion by the end of January 2022. This represents a 0.9% marginal month-on-month increase.

The increase in the industry’s asset value is attributable to the N21.64 billion appreciation in the net asset value of money market funds to stand at N569.55 billion as of 28th January 2021, which is N21.64 billion higher than N547.91 billion recorded as of the end of the previous month.

On the other hand, the net asset value of dollar funds (Eurobond) recorded the highest decline in the review period as it dropped by N10.93 billion between 31st December 2021 and 28th January 2022.

Nairametrics tracked the performance of these mutual funds by calculating the percentage change between the offer prices as of 31st December 2021 and 28th January 2022.

Below are the top-performing mutual funds in January 2022 based on their returns. We also highlighted their performance in terms of changes in net asset value and included profiles of the funds as described on their websites.

Coronation Balanced Fund – Coronation Asset Management

The Coronation Balanced Fund is a mixed fund which aims to achieve capital appreciation over time while mitigating volatility associated with investing in Equities through a diversified portfolio that includes Fixed Income Securities such as Treasury Bills and Other Money Market Securities.

According to information obtained from the website of Coronation Asset Management, the asset allocation range for the fund is 50% – 70% in equities, 10% – 40% in treasury bills, 0% – 20% in bonds, while 10% – 40% in commercial papers, banker’s acceptance and other money market instruments.

31st December 2021

Fund Price – N1.25

28th January 2022

Fund Price – N1.30

Return – 4.1%

Ranking – Fifth

The Coronation Balanced Fund is the only mixed fund that made it into the list of best performing mutual funds in the review month, having recorded a 4.1% gain in its offer price. In the same vein, the net asset value rose marginally from N112.91 million recorded as of 31st December 2021 to N115.1 million by 28th January 2022.

AXA Mansard Equity Income Fund – AXA Mansard Investments Limited

The AXA Mansard Equity Income Fund is aimed at investors with high-risk appetite seeking income and strong potential for capital growth through an array of stocks. It is also targeted at investors who wish to reduce concentration risk and benefit from diversification and professional management.

According to the information on the company’s website, the fund is best suited to long-term investors with a relatively high appetite for risk assets.

31st December 2021

Fund Price – N131.26

28th January 2022

Fund Price – N136.74

Return – 4.2%

Ranking – Fourth

The net asset value of the AXA Mansard Equity Income Fund increased marginally by 0.9% in January to N250.83 million compared to N248.62 million recorded as of the end of December 2021.

Afrinvest Equity Fund – Afrinvest Asset Mgt Ltd

The AEF is an Equity fund which invests in shares of companies listed on the Nigerian Stock Exchange with sound fundamentals and strong track record of above average financial performance in addition to a high level of trading liquidity and potential for capital appreciation in the short to medium term.

The minimum subscription of the fund is N50,000 with subsequent multiples of N10,000.

31st December 2021

Fund Price – N165.04

28th January 2022

Fund Price – N173.81

Return – 5.3%

Ranking – Third

The fund recorded an increase of 5.2% month-on-month in its net asset value to close at N361.87 million from N344.06 million recorded as of the previous month.

VETBANK ETF – Vetiva Fund Managers Limited

The Vetiva Banking ETF “VETBANK ETF” is an open-ended Exchange Traded Fund managed by Vetiva Fund Managers Limited. The VETBANK ETF tracks the performance of the constituent companies of the NGX BANKING Index and replicate the price and yield performance of the Index.

The NGX BANKING Index comprises of the top 10 banks listed on the Nigerian Exchange Limited (“NGX”) in terms of market capitalization and liquidity and is a price index weighted by adjusted market capitalization.

31st December 2021

Fund Price – N4.11

28th January 2022

Fund Price – N4.44

Return – 8.0%

Ranking – Second

The price of VETBANK ETF gained 8.0% in the review period, representing the second best performing mutual fund in January 2022. Likewise, the net asset value grew by the same margin to close at N 374.05 million.

Stanbic IBTC ETF 30 Fund – Stanbic IBTC Asset Mgt. Limited

The Stanbic IBTC ETF 30 is an Exchange Traded Fund, which aims to replicate as closely as possible, the total return of The Nigerian Exchange Group 30 Index.

The Stanbic IBTC ETF 30 Fund is an open-ended fund that replicates return fully in terms of price-performance as well as income from the underlying securities of the index. The ETF provides investors with exposure to the securities in the NSE 30 index which spans across various sectors and operates a very aggressive risk profile.

31st December 2021

Fund Price – N68.50

28th January 2022

Fund Price – N77.55

Return – 13.2%

Ranking – First

The best performing fund in January 2022 is the Stanbic IBTC ETF 30 Fund managed by Stanbic IBTC Asset Mgt. Limited, having gained 13.2% in price. The net asset value recorded a marginal increase in the investors’ subscription from N463.6 million in the previous month to N 475.2 million in the review month.

What you should know about mutual fund

- Mutual Funds are investment entities that pool funds from a number of investors and invest those funds in diversified portfolio securities such as equities, stocks, bonds, money market instruments and similar assets.

- Mutual Funds are operated by professional fund managers, who invest the fund’s capital and attempt to produce capital gains and income for the investors.

- The profit derived from the diversified pool of investments is shared to investors in the funds annually or semi-annually or as stipulated in the fund prospectus.