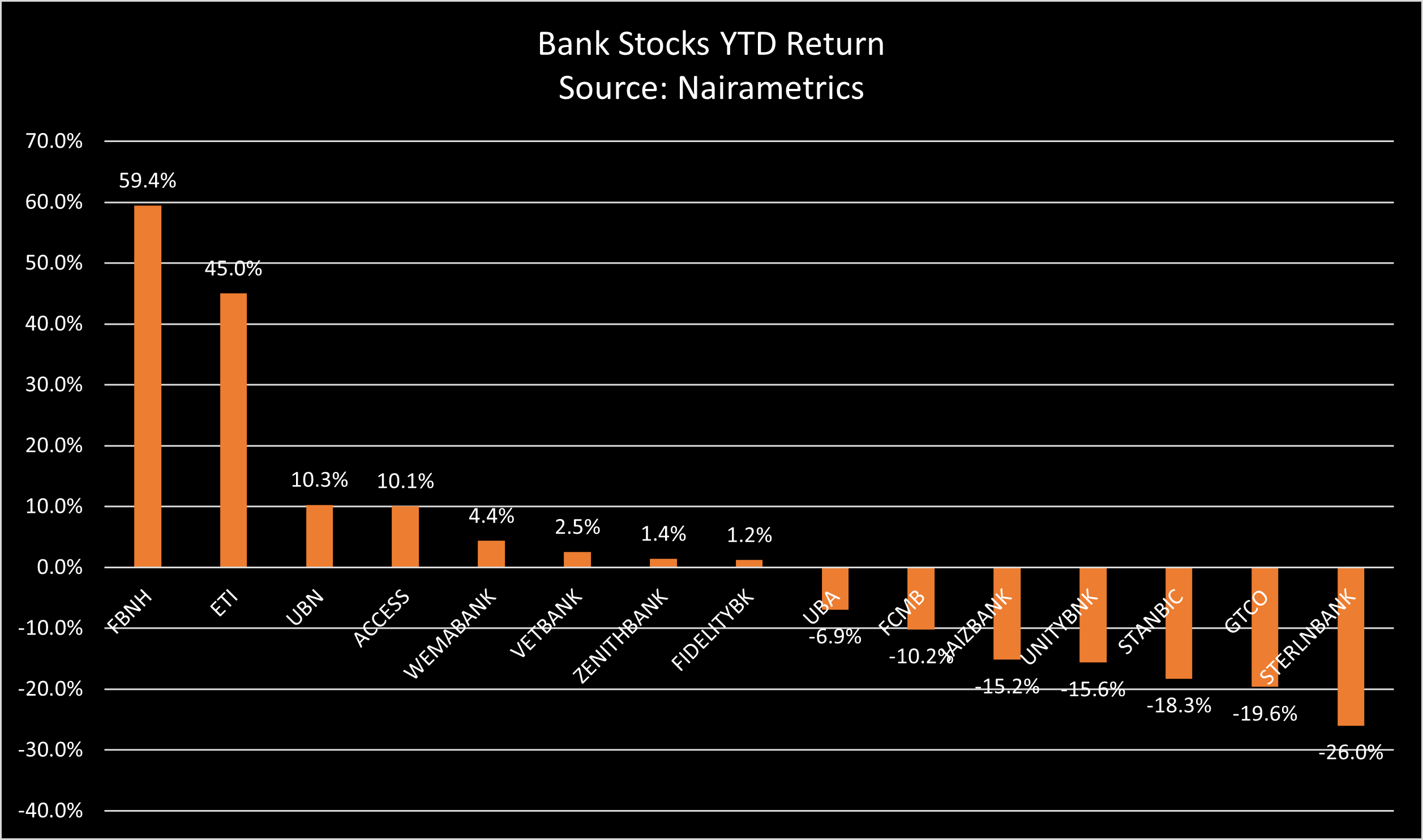

Owners of Nigeria’s oldest bank and a member of the FUGAZ, FBN Holdings topped the list as the best performing banking stock for 2021. FBNH posted a Year to Date return of 59.44% for the year beating all other quoted banks on the NSE.

FBNH opened the year with its share price at N6.9 per share before rallying all the way to N12.7 per share its highest price this year. The stock closed the year at N11.4 per share. Ecobank (ETI) came second with an impressive share price return of 45% for the year.

FBNH share price appreciation is mostly attributed to the scramble for its shares by investors following the revelation that Billionaire investor, Femi Otedola had acquired a majority stake in the bank. The share price was around N7.5 for most of the second and third quarters of the year. However, the rally began in late September when news got out that Femi Otedola was acquiring the stock.

How FUGAZ performed

- For the rest of the FUGAZ, 2021 was not such a good year as they struggled to hold on to 2020 gains.

- Access Bank gained 10.06% while Zenith Bank closed flat at just 1.4% additional gain from how it closed in 2020.

- GTB Holdco and UBA performed poorly with their share prices closing negative territories. GTB Holdco was bottom with -19.63% and UBA next with -6.94% returns.

- GTB performance was a highlight of how such a bad year the bank has had in 2021. The dip in share price performance also mirrored the drop in pre-tax profits in the first 9 months of 2021 compared to 2020.

Tier 2 Banks Struggle

- Union Bank was the only tier 2 bank with a double-digit return of 10% for the year ended December 2021.

- Wema Bank, Fidelity Bank posted 4.35% and 1.19% returns for the year. The rest all posted negative returns for the year.

- StanbicIBTC failed to meet up with the impressive run of 2020 recording an 18.27% negative return in 2021.

- Sterling Bank was the worst-performing banking stock for the year with a negative return of 25.98%. This is also surprising considering improved financial performance during the year.

HoldCo’s Struggle

- The year 2021 was also a year for Bank Holdco as we saw GTB adopt a Holdco structure while Access Bank obtained approval to go holdCo

- However, apart from FBNH, all Bank Holding Companies performed poorly during the year posting negative returns.

- Investors struggled to find value in the HoldCo structure as it appeared the subsidiaries in the HoldCo had higher value individually compared to the sum of the parts.