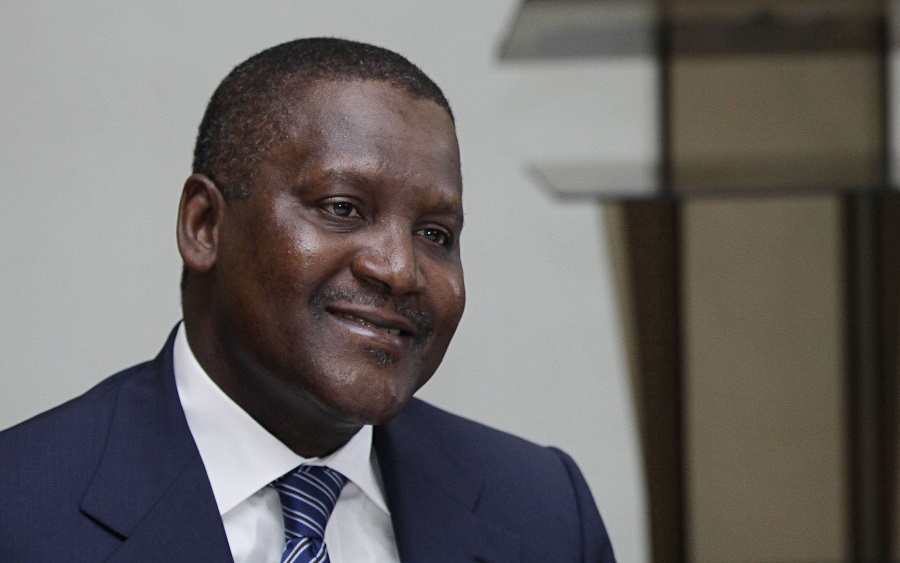

Africa’s richest man, Aliko Dangote, who has made the majority of his wealth from cement production, through his cement company, Dangote Cement, has seen a rapid increase in his wealth in 2021.

He could have made even more and dethroned Sergey Brin, who is the world’s 6th richest man, with a net worth of $126 billion, if he had invested 5% of his wealth seven years ago, into flagship cryptocurrency asset, Bitcoin.

Dangote’s wealth

According to Bloomberg, a significant portion of Dangote’s fortune is gotten from his 86% stake in his publicly-traded Dangote Cement, where the African giant holds shares in the company directly and through his conglomerate, Dangote Industries.

Dangote’s other publicly traded assets include stakes in Dangote Sugar, Nascon Allied Industries, and United Bank for Africa, which are all listed companies on the Nigerian Exchange Group, one of the leading integrated capital market infrastructures in Africa. His stakes in these publicly traded companies are held directly and through Dangote Industries, which also owns closely held businesses operating in food manufacturing, fertilizer, oil and other industries.

Bloomberg also explains that his most valuable closely held asset is a fertilizer plant which has the capacity to produce up to 2.8 million tonnes of urea annually.

In the computation of his net worth, his newly established $19 billion oil refinery that is currently being developed in Nigeria is not included in the valuation because it’s not yet operational and construction costs are calculated to outweigh its current value.

Dangote’s wealth movement over the last 7 years

Dangote’s wealth hit its highest level ever in July 2014, when his wealth traded $26.7 billion. In that month, Dangote Cement’s share price also traded a high of N250 per share, the highest level the share traded that year. Immediately after, Dangote lost 46.82% of his wealth in six months after hitting his peak, following a rapid sell-off that saw his share price trade as low as N153 per share in December 2014.

Since its peaking in July 2014, his wealth has been on a downturn, trading as low as $9.69 billion in the year 2016, when Dangote Cement traded as low as N123. After that, his wealth seemed to have taken a consolidation stance but soon after, a bullish breakout was seen, as his wealth rallied sharply to $16.8 billion on the 5th of March, 2019. Dangote Cement was trading around N200 per share in this period.

The COVID-19 pandemic saw his wealth decline again, as his net worth traded as low as $13 billion on the 9th of April 2020, when Dangote cement traded a low of N117 per share, following a worldwide panic sell-off in global equities. However, after this, his net worth has been on an uptrend, trading as high as $20.2 billion on the first of December, 2021. Dangote Cement traded N280 per share. The rally in the share price is majorly attributable to the share buyback program which the company is engaging in.

What could have been

If, as of the 7th of December, 2014 (7 years ago), when Dangote’s wealth stood at $16.1 billion, and he made the decision to allocate 5% of his holdings which would be approximately $805 million, into Bitcoin, which was trading $375 in that period, he would have seen that allocation rally by 13,416% to currently stand at approximately $109 billion, using Bitcoin’s market price of $50,700 as of the 7th of December, 2021. This would put his total wealth, all things being equal, to stand at $127.9 billion, making him the 6th richest man in the world.

At Bitcoin’s all-time high of $68,789.63, Dangote’s wealth would stand at $166.7 billion, all things being equal, making him richer than Bill Gates, to be the fourth richest man in the world.

If, as of August 2020, Dangote allocated just 2% of his wealth, which at the time, stood at around $13 billion, to meme coin sensation Shiba Inu, Aliko would no doubt be the richest man to ever live, and the world’s first multi-trillionaire.

Bottomline

It’s no doubt that the growth of the cryptocurrency industry over the years, especially in 2021, has taken the world by surprise. The industry has created new wealth and opportunities, with developing nations being the major beneficiaries of this disruptive technology. Many in the cryptocurrency industry have advised individuals to allocate just 5% of their wealth into crypto assets and taking into consideration the analysis above, a 5% allocation may be a risk we all need to take in order to participate in the growth the industry has experienced.