I usually write out my Christmas list in July and start to look for deals. I buy my gifts by November, especially on Black Friday, to take advantage of the deals. I like Amazon; I can compare prices and save my list all year round.

This year I bought a lot of stuff (I can explain). On checking out, I noticed Amazon gave me three options to pay:

- Use a card, 5% cashback.

- Pay in equal installments with no interest charged for 12 months.

- Pay in equal installments with no interest charged for 18 months.

Yes, no interest. No APR, just the total divided by months. If your bill is $500, you pay $28 for eighteen months. I picked the eighteen-month option, and the monthly bill was so small I added a few more items because my budget could have that level of monthly payments (don’t do this at home).

I wondered why Amazon was being so nice? Why are they offering me the opportunity to buy on their site and forgo earning interest on my purchases if I use their credit card?

So, I decided to research the world of Buy Now Pay Later (BNPL).

Buy Now Pay Later

Buy Now Pay Later (BNPL) are interest-free installment loans offered to small, short-term purchases. Think of this as paying in installments for a dress but instead of laying away until you make total payments, you take the dress but pay later. The difference with BNPL and other credit purchases is that outstanding payments are not charged any interest.

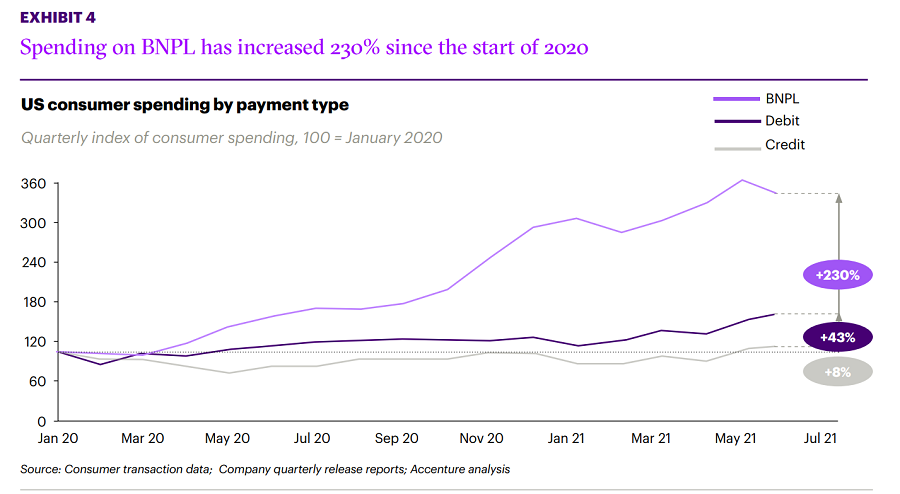

BNPL offers a simple, easy-to-understand, and convenient way to budget by matching monthly income to monthly expenses for the consumer. It is also a low-cost method of acquiring assets. A report by Accenture on the BNPL industry says users of BNPL services choose not to own credit cards because they want to avoid interest, fees, and debt. The Accenture report says, “spending on BNPL in the US has increased up by 230% since the start of 2020.” Figure 1 shows that BNPL is best suited to smaller purchases.

Figure 1. Potential Cost to Customers for Different Credit Types

The key benefit of BNPL to consumers

BNPL’s benefit is its consumption smoothing effect. A TV for 100,000 is a significant purchase in any currency; however, paying N8,333 a month for a year for the same TV is easily digestible and drives more purchases. Just as I bought more items because my monthly bill was below my spending target, Accenture confirms that “basket sizes” were 17% higher in value when BNPL was used.

Nigeria’s low consumer spending power

Nigeria’s minimum wage set in 2019 is about N30,000, about $72 a month using official exchange rates. From this wage, the average Nigerian family, according to the National Bureau of Statistics (NBS) report titled “Consumer Expenditure Pattern report for 2019,” spends 57% of their income on food.

Food inflation has reduced the purchasing power of consumers in Nigeria. On Jumia, the online retailer, a 50kg bag of rice retailed from N27,000 to N33,000. This cost equates to the monthly minimum wage in Nigeria. The manufacturers have attempted to solve the declining purchasing power of the Nigerian consumer by reducing the quantity per pack of their products. Thus, the markets have an abundance of single-use sachets with smaller amounts on offer.

On the Jumia website, you can buy a 10kg bag of rice with groundnut oil and seasoning for about N18,000. It is cheaper to buy the 50kg bag, but many Nigeria cannot afford the 50kg bag. So, in this case, “being poor becomes more expensive.” BNPL can help solve this problem.

How BNPL fixes the problem

BNPL, while creating $590 million in cost savings, has enabled merchants to gain $8.2 billion in new revenues, according to the Accenture report. When merchants offer BNPL to shoppers, they buy more. The Accenture report profiles Afterpay, a BNPL vendor. It states that the average merchants obtained 13% more new customers when BNPL was offered.

BNPL can be a win for consumers. A Nigerian consumer can buy the 50kg bag of rice and spread payments over 12 months, at N2,500 a month. Paying in installments eliminates the need to save up in bulk and allows an interest-free repayment plan matched to monthly income. This repayment plan increases the number of households that can buy 50k bags of rice, increasing revenues to merchants and farmers. Many families contribute to buying a cow and sharing the meat because one family cannot bear a cow’s cash cost. With BNPL, one household can purchase the same cow without the need for a sizeable immediate cash outlay.

BNPL vs Credit Cards

Merchants have long adopted plastic via debit and credit cards to boost revenues by offering consumers more choice at Point of Payment. BNPL extends this choice, but the business model directly challenges the concept of traditional consumer finance, especially credit cards. For example, I choose to pay my Amazon bill with the Affirm option (Affirm is a BNPL vendor that signed a deal to offer that service to Amazon clients). The Amazon credit card that I use offers a 5% cashback plus a 30 day no APR charge. Still, Affirm was offering 18 months with absolutely no charge apart from my monthly bill. Like I alluded to, I increased my purchases because of the offer. If I were going to pay a fee or Annual Percentage Rate (APR) on my purchase, psychologically, I would have avoided making more purchases.

The Accenture report tracks the adoption of BNPL in America. In figure 2, we see a plot of adoption by US consumers from January 2020. BNPL has a massive 230% adoption rate with only 43% by traditional credit card. Consumers save an equivalent of $6 per order using Afterpay translating to $459 million in savings to Afterpay alone. Users of BNPL are also twice as likely to make repayments as credit card users.

Figure 2: Adoption of BNPL In America

The Nigerian BNPL ecosystem

Nigeria has BNPL vendors, including Easybuy, Credpal, CDCareNG, Altmall, CreditClan, and Carbon Zero. I have not used them, but it shows that BNPL has created a foothold in the Nigerian market.

The Nigerian BNPL has successfully customized its offering. CreditClan, for instance, is building a niche in education BNPL, allowing payments of schools fees to be done monthly. Femi Bejide, the founder, says they are also offering monthly rental payment plans under their BNPL plans. In terms of growth, even with systematic headwinds, they have grown Quarter on Quarter at more than 100%.

A critical consideration for Nigerian consumers is the price differential. At the same time, merchants have the risk of default as their essential top-of-mind worry. Overall, Femi believes BNPL is a $2 trillion market space and that the Nigerian BNPL companies are hardly scratching the surface of the potential market.

Is BNPL a threat to traditional banking in Nigeria? Specifically, consumer finance? In my opinion, I say yes because of the ease of adoption. CreditClan, for instance, can approve a loan in 3 minutes, according to its founder. The ease of getting credit and paying off is essential in Nigeria when, according to available data from the Enhancing Financial Inclusion and Access (EFINA), less than 5% of Nigerians have accessed a loan from a formal banking institution.

How to use BNPL

Tie BNPL purchases to your budget. If you spread payments, your cash balance will go up as you are not making immediate payments. That cash is technically not yours, but you can save it in a safe investment like a bank deposit, don’t spend it. BNPL is simply the reversal of tradition, and you usually save than spend; now, you are spending and saving. Match spending to a budget.

It is tempting to look at BNPL as an emergency fund to cover unforeseen but very critical expenses, don’t do it. The zero interest charge only applies to the covered duration.

I would deploy BNPL to purchases that can be paid off within the duration selected. The advantages of BNPL only kick in if the consumer can pay off the outstanding within the repayment date.

Great finansial guidte to help save some money.