According to the International Monetary Fund (IMF), enabling the unbanked with mobile phones access to the eNaira will result in 90% of the people adopting the currency.

This was disclosed in an IMF report titled: ‘Country Focus; Five Observations on Nigeria’s Central Bank Digital Currency.’

Nigeria has a large informal economy, where a huge percentage of the population does not have a bank account.

What the report said

The IMF stated that the eNaira should improve financial inclusion as it would help the unbanked. The report said, “For Now, the eNaira wallet is provided only to people with bank accounts, but its coverage is expected to eventually expand to anyone with a mobile phone even if they do not have a bank account. A large number of people do not have bank accounts (38 million people; 36% of the adult population), and allowing those of them with a mobile phone to have access to the eNaira would increase financial inclusion and facilitate more direct and effective implementation of social transfers programs. It is expected that the move would enable up to 90% of the population to use the eNaira.”

The IMF also believes that the eNaira would bring about greater transparency to informal payments and strengthen the tax base in a largely informal economy like Nigeria’s.

It said, “Nigeria has a large informal economy, with transactions and employment equivalent, respectively, to over half of GDP and 80% of employment. The eNaira is account-based, and transactions are in principle fully traceable, unlike token-based crypto asset transactions.

“Once the eNaira becomes more widespread and embedded into the economy, it may bring greater transparency to informal payments and strengthen the tax base. Informal and formal businesses may also benefit if eNaira adoption enhances consumption through greater financial inclusion.”

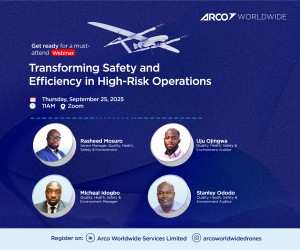

What experts are saying

Dr Omobola Adu, a Research Analyst at GDL told Nairametrics that the eNaira improves transparency in the informal sector which then can help to reduce informality with the right policies.

He said “The adoption of the eNaira will bring about transparency of transactions in the informal economy and as such make activities in the IE more traceable. Hence, the government can easily identify players and put up policies to encourage formalisation.”

“However, the extent to which the eNaira can reduce informal activities will depend on its adoption. If people do not adopt or make use of it, then we won’t see this change or improved transparency,” he added.

It is well