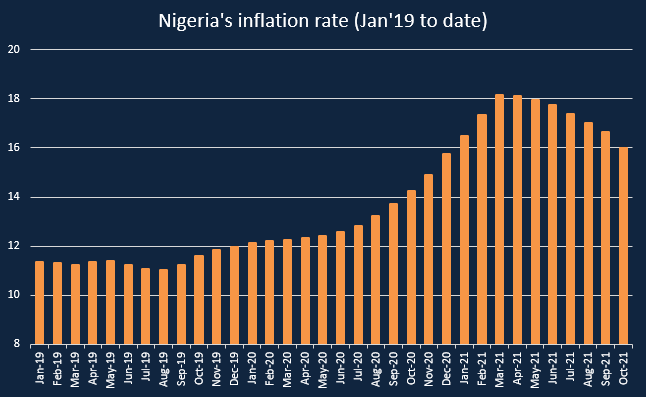

Nigeria’s inflation rate for the month of October 2021 dropped further to 15.99% from 16.63% recorded in September 2021. This is according to the recently released Consumer Price Index report, released by the National Bureau of Statistics (NBS).

On a month-on-month basis, the CPI increased by 0.98% in October 2021, a decline compared to 1.15% increase recorded in the previous month. Nigeria’s inflation rate has continued to decline in the past seven months, after hitting a peak of 18.17% in March 2021.

It is worth noting that Nigeria’s inflation rate for the year so far has averaged 17.28% between January and October 2021, while the 12-month average change currently stands at 16.96%.

Food index

The highly monitored composite food index dropped by 1.23% points to 18.34% in October from 19.57% recorded in the previous month. On a month-on-month basis, the index rose by 0.91% compared to 1.26% increase recorded in September 2021.

According to the report, the rise in the food index was caused by increases in prices of food products: coffee, tea and cocoa, milk, cheese and eggs, bread and cereals, vegetables and potatoes, yam and other tubers.

Core inflation

Core inflation which excludes the prices of volatile agricultural produce stood at 13.24% in October 2021, down by 0.51% points when compared with 13.74% recorded in September 2020. When comparing the core index to the previous month, it increased by 0.8%, which is lower than the increase of 1.24% recorded in the previous month.

Core inflation in the month of October was driven by an increase in the price of gas, fuels and lubricants for personal transport equipment, vehicle spare parts, non-durable household goods, solid fuel, passenger transport by road, passenger transport by air, garments, cleaning, repair and hire of clothing, major household appliances whether electric or not, wine, clothing materials, other articles of clothing and clothing accessories and liquid fuel.

State inflation

In the month under review, all items inflation on a year-on-year basis was highest in Bauchi (19.63%), Gombe (19.33%) and Jigawa (19.07%), while Kwara (11.82%), Edo (13.31%) and Rivers (13.66%) recorded the slowest rise in headline year-on-year inflation.

In terms of food inflation, Kogi state recorded the highest increase with 23.69% followed by Gombe with 23.29% and Jigawa (21.91%), while Edo (13.16%), Rivers (14.46%) and Adamawa (15.42%) recorded the slowest rise in year-on-year food inflation.

According to the report, in analysing price movements under this section, note that the CPI is weighted by consumption expenditure patterns which differs across states. Accordingly, the weight assigned to a particular food or non-food item may differ from state to state making interstate comparisons of consumption basket inadvisable and potentially misleading.

What this means

As the Central Bank continues to ensure increased spending in the economy by leaving the benchmark interest rate at 11.5%, inflation rate continues to moderate from the significant upsurge recorded in the previous year.

However, the fact still remains that the average price of goods and services in the country increased by 15.99% in October 2021 compared to the corresponding period of 2020, indicating that the purchasing power of Nigerians has eroded further.

Despite the drop, the gap in disposable income for the common man keeps widening. An aberration.