The Federal Government has revealed that 6,054 youths have so far benefited from the Nigerian Youths Investment Fund, with the receipt of between N300,000 to N3 million.

The fund which is an initiative of the Federal Ministry of Youth and Sports Development and funded by the Central Bank of Nigeria (CBN) was flagged off in October 2020 and is expected to cater to youth-owned businesses and investment needs in the face of the Covid-19 pandemic outbreak.

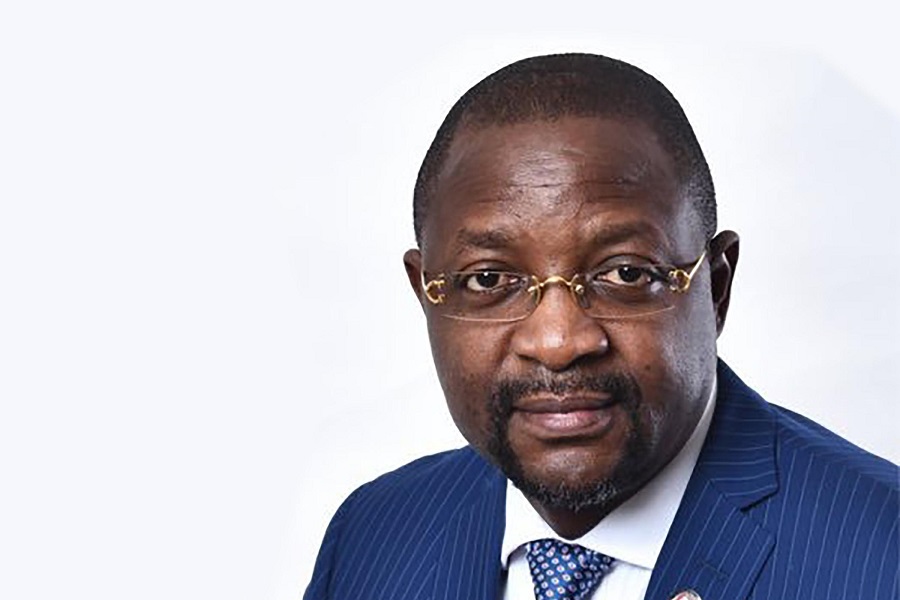

According to NAN, this disclosure was made by the Minister of Youths and Sport Development, Mr Sunday Dare, while appearing before the House of Representatives Committee on Youth Development on Monday, in Abuja, to defend his ministry’s 2022 budget proposal.

What the Minister of Youths and Sports Development is saying

Dare stated that the Federal Government was in a hurry to get support for Nigerian youths noting that 6,054 have at this moment benefited from the Nigerian youths investment fund.

Dare has also disclosed that the ministry has released the names of the beneficiaries on its website, including the amount they received and the sector in which their SMEs operated.

He said, “Our goal is to ensure that we increase the number of beneficiaries, which is why we have developed as a ministry our own loan management system.

“The loan management system will give us 100 percent control, it will also open the door for us to access the N25 billion directly from the finance ministry.

“The initial amount that we wanted from the Central Bank of Nigeria was N12.5 billion out of that amount only N3 billion has been made available, which was disbursed using the CBN’s financial framework.’’

Dare pointed out that countries that hope to fight youth unemployment should have a deliberate policy on investing in the lives of the youths adding that Nigeria has a massive youth’s population with most of them waiting for opportunities in digital skills to upscale themselves and make themselves entrepreneurs.

The minister noted that other areas the youths desire opportunities include in the areas of education; technical and otherwise, stressing that they are also looking for opportunities that would make them included in government.

What you should know

The N75 billion Nigerian Youth Investment Fund (NYIF) was set up by the Federal Government to invest in the innovative ideas, skills, and talents of Nigerian Youths and to institutionally provide the Nigerian youths with a special window for accessing much-needed funds, finances, business management skills, and other inputs critical for sustainable enterprise development

The loan provided under the NYIF has an interest rate of 5% per annum and a tenor of 5 years with a moratorium of up to 12 months.

The youths who wished to apply as individuals or a non-registered business could draw up to N250,000, while youth-owned registered businesses could apply for up to N3 million.

Hello Sir Which Data Start the payment

Stop long waiting about desburse to many waisting time please mr sunday dare

Please specify date for traine