The Central Bank of Nigeria has stated that it disposed of N698,480.00 million worth of unfit banknotes in 2020.

This was disclosed in the recently released Annual Report 2020 as compiled by the CBN’s Currency Operations Department.

The destruction of unfit banknotes in Nigeria is regularly carried out by the CBN under strict security and with the authorization of Section 18(d) of the CBN Act 2007, mandating the destruction of currency notes and coins withdrawn from circulation under the provision of section 20(3) of the said Act or otherwise found by the Bank to be unfit for use.

What the CBN is saying

According to the CBN report, the Bank sustained banknotes disposal operations in 2020 to ensure the circulation of clean banknotes. In furtherance of this objective, it deployed eleven (11) Banknote Destruction Systems (BDS) and three (3) Currency Disintegrating Systems (CDS) for currency disposal activities in the period under review.

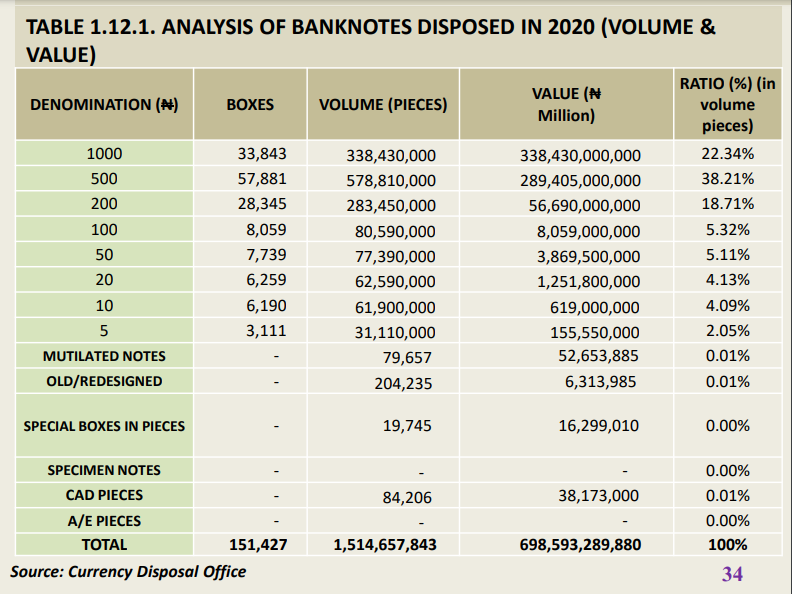

“At end-December 2020, a total of 1,514.66 million pieces (151,427 boxes) valued at N698,593.29 million was disposed, compared with 1,572.17 million pieces (157,217 boxes) valued at N814,437.60 million in 2019. The boxes and value of unfit notes disposed in 2020 decreased by 5,790 boxes, and N1,115.84 million, respectively, below 157,217 boxes, valued at N814,437.10 million in 2019. The decrease was attributed to the suspension of disposal activities due to COVID19 restrictions,” the apex bank stated.

The CBN also stated that the sum of N538.59 million was incurred on currency disposal activities in 2020, compared with N647.82 million in 2019. This was N109.23 million or 16.86 per cent lower than the cost in 2019.

The apex bank has also suffered a decline in the income generated from currency management compared to previous years.

“The Bank generated the sum of N6,499.91 million as total income from currency management activities in 2020, compared with N13,242.91 million in 2019, representing a decrease of N6,743.01 million or 50.92%. The income generated was large, from penal charges on unsorted banknotes deposited by DMBs and charges for authentication of foreign currency deposits with the Bank,” it stated.

The Bank incurred a total of N67,212.20 million, as expenses, on currency operations in 2020, representing a decrease of N17,963.18 million or 21.08 per cent, below N85,175.36 million in 2019.

A total of 79,993 pieces of mutilated banknotes of various denominations. valued at N52.82 million was audited, disposed and replaced in 2020, compared with 865,775 pieces valued at N45.99 million in 2019. This represented a 90.76 per cent and 14.85 per cent decrease, in volume and value terms, respectively.

Renewable alternative for currency disposal

The apex bank has shown willingness to find healthier alternatives to the disposal of the naira. In a circular title RFP NO: CBN/COD/RFP/2020/001, the CBN stated that “banknotes disposal operation is presently carried out in twelve (12) disposal centres across the country weekly where about 100 tons of paper banknote wastes are generated. These wastes are destroyed through open-air burning in sites owned by the Bank or rented, usually from the respective State Governments.”

Due to the negative impacts of wastes disposal by open-air burning such as causing pollution and health hazards, the Central Bank of Nigeria has stated that it’s in pursuit of a more environmentally sustainable method thereby reducing its carbon footprint.

The Central Bank of Nigeria has announced that it is inviting ideas from qualified recycling companies interested in recycling paper banknote waste.

The goal of this Request for Proposal (RFP) is to get competitive proposals from credible organizations that can recycle CBN paper banknote trash into usable items that benefit the country while following HSE standards.