FBN Quest, Cordros, and Apel Asset led the chart of top-performing stockbroking firms in the Nigerian equities market (NGX) for the month of October 2021. This is according to information obtained from the Broker Performance Report released by the NGX.

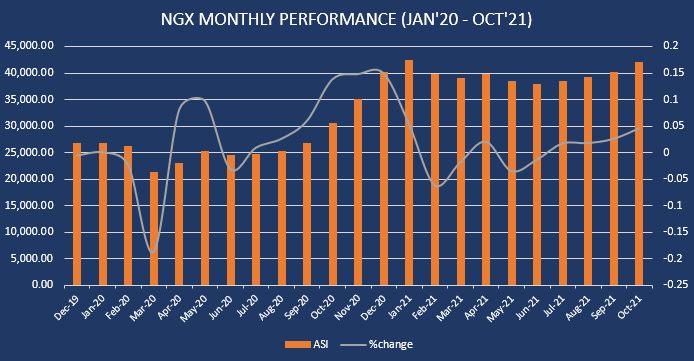

The Nigerian equity market ended trading for the month of October in green for the first time since January 2021, when it printed a 5% gain. The All-Share Index (ASI), a key metric used to track the performance of the NGX, rose by 4.52% in the review month starting off at 40,221.17 basis points and closing at 42,038.6 basis points.

The equities market capitalization also ended bullish having gained N982 billion to close at N21.94 trillion as of the end of October. The performance of the Nigerian stock market was driven by stellar growth recorded in the shares of University Press, Ecobank Transnational, Champion Breweries, FBN Holdings, and AIICO Insurance.

As the rally in the stock market intensifies, stockbroking firms are also cashing in through broking services. According to the NGX report, the top 10 stockbroking firms in October traded about 10.24 billion units of shares with a value of N130.03 billion.

READ: Top 10 Stockbroking firms in Nigeria for April 2021

These figures accounted for 53.44% and 60.93% of the total volume and value respectively of shares traded throughout the month under review. This ranking is part of a monthly review of the performance of stockbrokers in Nigeria. Click here for the best performing firms in September 2021.

Best-performing stockbrokers by value

The top ten stockbroking firms for the period under review traded N130.03 billion worth of shares, representing 60.93% of the total monetary value of stocks traded in the month of October 2021.

- FBN Quest Securities Limited led the top stockbroking firms list by value with a total worth of N19.70 billion, representing 9.23% of the total value for the period under review.

- Cordros Securities Limited came second with monetary worth of shares traded during the period at N17.41 billion, signalling 8.16% of the total value recorded.

- APEL Asset Limited was next on this list with a total of N16.79 billion worth of shares, accounting for 7.87% of the total value traded in October 2021.

- APT Securities Limited came fourth on this list with a total value of N15.64 billion, representing 7.33% of the total monetary worth reported for the period covered.

- Cardinal Stone Securities Limited rounded up the top five with a monetary value of N12.67 billion of shares traded, accounting for 5.94% of the total value traded during the period under review.

READ: Top 10 Stockbroking firms in May 2021 trade stocks valued at N51.3 billion

Other stockbroking firms on the list were Stanbic IBTC Stockbrokers Limited (N12.42 billion), EFG Hermes Nigeria Limited (N11.66 billion), Chapel Hill Denham Securities Limited (N8.44 billion), Meristem Stockbrokers Limited (N8.37 billion), and Rencap Securities Nigeria Limited (N6.89 billion).

Stockbrokers by volume

The top ten stockbroking firms for the period under review accounted for 10.24 billion units of shares traded, and 53.44% of the total volume of stocks traded.

- APT Securities and Funds led the list of stockbroking firms in terms of the volume of shares as it recorded trades in 1.47 billion units of shares, accounting for 7.70% of the total volume traded on the exchange for the month of October.

- Cordros Securities Limited came second on the top performers’ list, having traded in 1.41 billion units of shares, representing 7.37% of the total volume recorded for the reviewed period.

- APEL Asset Limited came next with total shares traded in the reviewed month at 1.36 billion units, accounting for 7.11% of the total volume.

- Cardinal Securities Limited came fourth on the top volume list as it recorded trades in 1.30 billion units of shares, which is 6.82% of the total volume for the month.

- FBN Quest Securities Limited rounded up the top five on the list, recording total volume of 1.26 billion units of shares traded which represented 6.61% of the total volume for the period under review.

READ: Top 10 stockbroking firms in Nigeria traded stocks worth N541.2 billion in H1 2021

Others on the list were Meristem Stockbrokers Limited (1.02 billion units), Morgan Capital Securities Limited (928 million units), Chapel Hill Denham Securities Limited (508 million units), EFG Hermes Nigeria Limited (506 million units), and Readings Investment Limited (447 million units).

What you should know

The NGX ASI rose 4.52% in the month of October 2021.

The NGX market capitalization rose 4.69% during the month under consideration.

The top 10 stockbroking firms throughout the month under review accounted for 53.44% and 60.43% of the total volume and value of shares traded respectively.

It is worth noting that in terms of year-to-date performance, Stanbic IBTC leads in terms of value with N163.42 billion while Morgan Capital Securities leads with 10.63 billion units of shares, in terms of volume.