Following a sub-par pandemic year that ushered in a dramatic decrease in the total dividend payment for UBA, the lender has been able to shrug-off pandemic related limiting factors that triggered slight concerns about its capital adequacy, allowing the bank to enjoy massive northward swings in varying margins in the recently released 9M 2021 financial statement.

Interest segment sustains resilience – The remarkable performance in UBA’s topline was sustained in the 9M 2021 reporting period, as the lender was able to simultaneously sweat the interest-bearing assets while moderating the interest expended. Interest income inched up by 8.38% to N343.71 billion in 9M 2021, buoyed by a robust growth in the loan book (22.72%), which proved particularly useful in ramping up the interest from term loans to corporates by 3.45%, with this income line item accounting for 37.97% of the total interest income. Similarly, the net interest income was up by 23.25% to N225.86 billion in the review period, benefitting off the aforementioned growth in interest income, as well as a corresponding decline in interest expense, as the lender continues to keep cost of funds low. Also, noteworthy is the 70.33% decline in UBA’s net impairment loss, lending further support to the sturdy topline performance.

Fee-based income growth shrugs off poor trading performance – The waning factor in most banks’ non-interest segment performance is the dramatic decline seen in their trading and foreign exchange segment. However, UBA was not immune to the pared trading segment performance amidst a challenging market atmosphere (relative to the preceding year’s). We saw the bank’s net trading and foreign exchange income dip by 40.23%, but the impact of the decline, alongside a 6.93% increase in operating expense, was easily surged off by an impressive showing in the fee-based segment. Net fees and commission was up by 20.75% to N67.92 billion, supported by a 30.55% growth in fee-based income. Electronic banking income remains the key driver of UBA’s fee-based income, as the line item rose by 50.41%, while accounting for 37.77% of the fees and commission income. While the corresponding expenses in the fees and commission segment also rose by 49.70% , we anticipate some moderation in the electronic banking expense subcomponent; hence, allowing for a more robust performance in the fees and commissions segment in coming years.

Bottom-line mirrors topline growth – Given the impressive performance recorded in the interest and non-interest segments, UBA was able to scale up their profitability in the review period, with the profit before tax and profit after tax surging by 36.50% and 35.61%, to N123.35 billion and N104.60 billion, respectively (as against N90.37 billion and N77.13 billion in 9M 2020). This impressive profit after tax growth was recorded against a backdrop of a 41.67% increase in the income tax expense. Similarly, the earnings per share was up by 36.11% to N2.94 in 9M 2021.

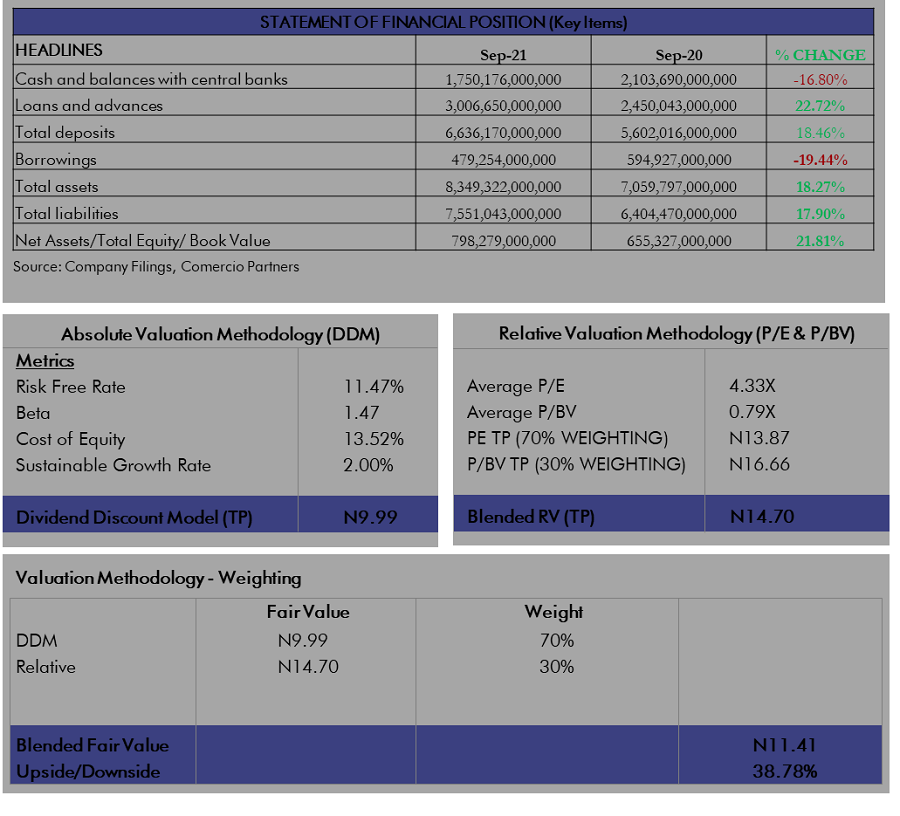

Loan book continues to strengthen – By increasing the total deposit by 18.46%, UBA was able to ramp up its risk assets, with the loan book rising by 22.72% to N3.01 trillion. However, the lender was unable to meet the 65.00% loan-to-deposit (LDR) regulatory minimum set by the Apex bank, as the LDR for the review period stood at 45.31%. Elsewhere, the capital buffer of UBA remains above the 15% regulatory minimum, at 23.90% in the review period.

Room for an upside growth, but with a caveat

UBA has been able to deliver impressive margins, leveraging the electronic banking platform and benefiting from the growing contributions of its African businesses. The stellar performance is expected to persist till year end, allowing for a total dividend payment of N1. Furthermore, the quality of the fundamentals compels a buy recommendation, as the estimated fair value of N11.41 provides for a 38.78% upside opportunity.

However, the stock is currently technically unattractive with the Relative Strength Index (RSI) soaring into the overbought region at 88.33. Nonetheless, seeing the stock fall to the higher handles of N7 should make for an attractive entry opportunity.

Click HERE to download the report.