Speculations are rife over which shareholders own more than 5% of FBN Holdings Plc, the financial holding company of First Bank of Nigeria Ltd, one of the largest banks in Nigeria and the oldest at over 125 years.

Discussions across social media platforms monitored by Nairametrics suggest most investors of FBNH are confused over who else has over 5% of the shareholding of the bank. The only confirmation published so far is that of Mr Femi Otedola.

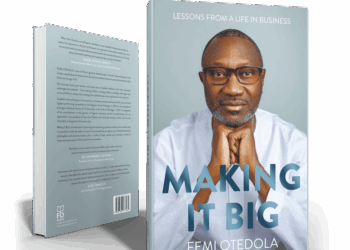

In a press release published on its website on Saturday, October 24 the Exchange confirmed that Nigerian billionaire Femi Otedola has acquired 5.07% of the bank. This appears to be the only official statement from FBNH confirming that a shareholder had acquired more than 5% of the bank. However, varying information about the ownership of the bank continues to circulate across media platforms with social media confusing investors further.

What are they saying?

In one instance, an article published in a national newspaper on Sunday suggested Mr Odukale of Leadway Assurance owned about 5.36% of the bank even though this is not reflected in the annual report of the bank nor confirmed by FBNH in any official press release published on its website or on the Nigerian Stock Exchange.

An article published on Saturday by Nairametrics also referred to a letter purportedly written by FBNH, listing shares owned by Mr Odukale and his proxies and explaining why some analysts faulted the claims. FBNH is yet to deny or affirm the authenticity of the letter.

Earlier on Friday, the bank issued a press release claiming it had not received any official notification of any ownership after Nairametrics reported that Mr Otedola had acquired over 5% ownership of the bank. Thus, it is surprising that a press release is yet to be issued after a newspaper and some online blogs published a list of other shareholders with over 5% ownership.

Why this matters

Being one of Nigeria’s largest banks with over 1.2 million shareholders, a dispute over majority ownership of the bank should be a major concern for investors and analysts covering the bank. As such, one will expect a clarification issued as soon as possible by the bank.

- The Nigerian Exchange should also weigh in immediately on the matter by insisting that the bank and its registrars confirm which shareholders actually own 5% or more than, of the bank.

- This is critical especially when you consider that the annual reports and interim reports of the bank never mentioned any shareholder having up to or more than 5% ownership of the bank.

- Clearing this up will also solidify investor confidence in the Nigerian Stock Market and bolster corporate governance implementation in one of Nigeria’s largest and respected banks.

What next?

One will expect to see a press release from FBNH and the Nigerian Exchange clarifying who actually has majority ownership of the bank.

- We believe investors in the bank and analysts would also like to see a list of shareholders with over 5% published on its website and that of the Nigerian Exchange.

- Another good practice would be for the bank’s investor relations to hold a press conference or analyst call providing better guidance on the impact of these acquisitions on the bank’s corporate structure.

- Shares of the bank closed at N12.25 on Friday, up 1.25%. Investor sentiments have been driving up the share price due to the announcement and could persist as more information becomes available.