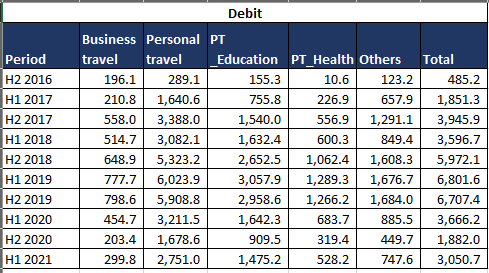

Nigerians spent a sum of $3.05 billion on foreign travels between January and June 2021, representing a 62.1% surge when compared to $1.88 billion recorded in H2 2020.

This is according to data on Nigeria’s balance of payments account, obtained from the Central Bank of Nigeria (CBN). The data also shows that travel expenses by Nigerians to foreign countries declined by 16.8% compared to $3.67 billion recorded in the H1 of 2020. A breakdown of the data, reveals that personal travel expenses accounted for a large chunk of the total expenses recorded in the review period.

As part of our Balance of Payment Series, where we give insight into Nigeria’s economy and where the nation allocates its forex earnings, Nairametrics presents the fourth review series of Nigeria’s balance of payments account. You can read previous articles on the cost incurred by Nigerians on Foreign education, professional services and medical services.

Highlights of the data

Balance of payments is the statement of all transactions made between entities in a country and the rest of the world within a given period. In other words, the balance of payments statement tracks the monetary value of all transactions made by Nigeria with other countries of the world.

The data used for this review showed the following:

- Personal travel expenses in the first six months of the year stood at $2.75 billion, accounting for 90% of the total travel cost by Nigerians in the period under review.

- On the other hand, business travels accounted for the remaining part with a sum of $299.8 million spent.

- A further breakdown of the personal travel component shows that a sum of $1.48 billion was spent by Nigerians on education services during the period while $528.2 million was spent on health-related services.

- Meanwhile, comparative analysis shows a huge gap between the amount spent and received. Notably, a sum of $155.1 million was received into the country from foreign travels, indicating a deficit of $2.9 billion in the review period.

- Notably, also, the data shows that Nigeria received no monetary value from foreign soil to the education and health sectors of its economy. It only received $155.1 million from other personal travels, which would include vacations and visits to the country amongst others.

Source: Nairalytics, CBN

In the past 5 years, Nigerians have spent over $37.9 billion on foreign travel while the nation received only a fraction of $6.82 billion, indicating a balance gap of $31.14 billion.

Nigeria continues to record significant capital flight in basic infrastructural amenities like education and health services with no commensurate returns, which is a problem for the country’s foreign reserve as well as the balance of payment balance. However, it is worth noting that the current account balance deficit is trailing towards a break-even point as recent data suggests.

Source: Nairalytics, CBN

Nigeria’s balance of payment trailing surplus

Nigeria’s current account balance has endured recurrent balance of payment deficit in the past 10 quarters, over the last two years. However, the current account balance deficit has reduced significantly in the recent Q2 2021 report, dropping to its lowest since we started recording a negative balance in Q1 2019.

According to the data from the CBN, Nigeria’s current account balance deficit in the second quarter of 2021 dropped to $424.37 million, this represents about 79.7% decline compared to $2.1 billion deficit recorded in the previous quarter.

The growth was largely spurred by significant gains recorded in the exportation of crude items. Specifically, crude oil export increased from $5.07 billion recorded in Q1 2021 to $9.92 billion in the second quarter of the year. This represents a 96% quarter on quarter increase, while it increased by 130% compared to $4.31 billion recorded in the corresponding period of 2020.

The significant jump in this component of the country’s balance of payment account is largely driven by the positive rally recorded in the global crude oil market. Crude oil has been hitting record highs in recent months as the OPEC+ continues to maintain a tightening stance towards the supply of crude products and economic activities begin to recover from the pandemic.

According to data from Nairalytics, the research arm of Nairametrics, crude oil prices have gained over 100% compared to last year and over 65% year to date, currently trading at over $85 per barrel. This, to a large extent, is good news for Nigeria’s foreign earnings as it accounts for over 85% of our forex income.

What experts are saying

According to Ayodeji Ebo, Head of Retail Investment, Investment Management Group at Chapel Hill Denham, foreign travel expenses increased during the period because of the backlog of students who got admissions and could not travel due to movement restrictions in the previous year. “You know that the world economy is just reopening and a lot of people had to travel based on the backlog of students who could not travel last year,” he said.

He also explained that most developed economies have used education as a means to attract migrants to their countries, hence many Nigerians are using education as an option to leave the country. He stated that the poor quality of education in Nigeria is a major reason Nigerians continue to seek education in foreign countries.

“The quality of education in Nigeria continues to drop while the cost is surging, most people will prefer to pay for education abroad rather than patronise local schools with lesser quality,” he explained.

Considering the continuous intellectual and capital flight, he noted that the only way Nigeria can get out of these recurrent deficits in terms of travel expenses is if the nation improves its business environment as well as the quality of education and health services in the country.

He, however, stated that he does not see the current account balance hitting a surplus anytime soon due to the OPEC+ production cut, which has ensured Nigeria’s inability to earn as much as possible from crude oil export. He also explained that with the decline in export earnings, import is still very much on the high, resulting in the continuous foreign trade deficit.

On the other hand, Akinbamidele Akintola, a capital market analyst believes that if Nigeria achieves higher crude oil production in the latter part of the year and remittances continue to recover, we could be seeing a surplus in the current account balance by the end of the year.

Bottom line

Nigeria continues to spend a huge amount of foreign exchange on foreign services while being unable to receive commensurate inflows in these sectors. This represents a significant chunk of capital and intellectual flight, especially when the country needs more forex earnings to defend its exchange rate against other currencies.