FinTech or Financial Technology is a broad term used for technology and innovation that deliver financial services through software. Unlike traditional finance provided by conventional brick-and-mortar-based institutions, FinTech tends to be more online-based to improve delivery, convenience, and cost. It includes online saving and deposits, loans, remittances payments, credit, and assets trading, including cryptocurrencies.

Nigeria has a huge number of financially excluded individuals

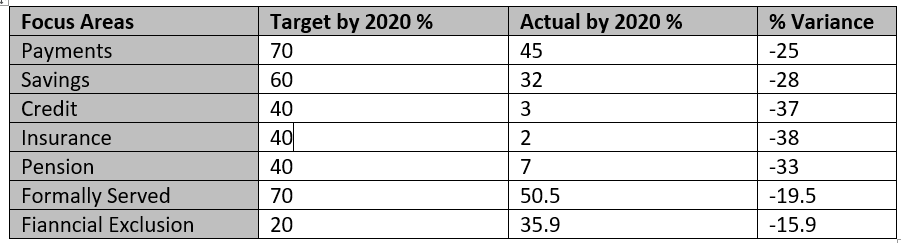

FINTECH is especially important in countries like Nigeria with a larger population but low financial inclusion rates. According to the Enhancing Financial Innovation & Access (Efina), 35.9% or 38.1m Nigerians are financially excluded. This means they do not use any financial products and services, both formal or informal. That number is the population of Ghana, or Senegal and Zimbabwe combined.

The survey conducted by EFINA finds that although the percentage of financially excluded adults decreased, the actual number of financially excluded adults increased from 36.6 million in 2018 to 38.1 million in 2020 (see Figure 1). This increase in financially excluded adults is because the population is growing faster than the rate of financial inclusion growth.

Figure 1.

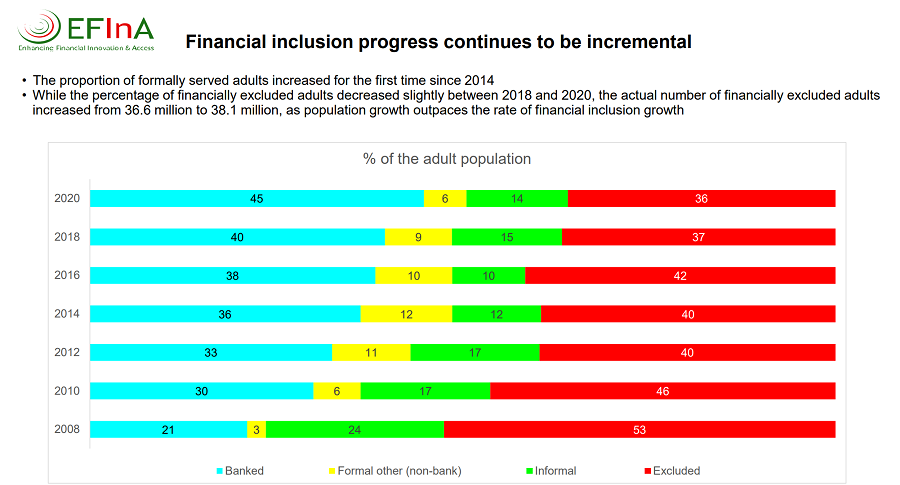

Nigeria failing in target on financial inclusion

Nigeria has failed to meet the Central Bank of Nigeria (CBN) National Financial Inclusion Strategy Targets (NFIS). The NFIS was adopted in 2012 and articulated a demand-and-supply-side with regulatory barriers to financial inclusion. It was built on four strategic areas: agency banking, Mobile Banking/Mobile Payments, Linkage models, and client empowerment.

As of 2020, Nigeria failed to meet the targets; the original target was to see Nigeria achieve 20% of the exclusion rate of adults in the financial system; the actual was 35.9%

Figure 2: NFIS summarises the targets and actual achievements.

Source CBN, EFINA

Source CBN, EFINA

Formal banking has underperformed

The traditional commercial banks in Nigeria have focused on the formal space. 93% of Nigerians employed in the formal sector have a formal bank account. However, only 59% of Nigerians in the informal sector have a bank account, with only 26% of farmers having a bank account. Farmers in Nigeria are the largest adopters of formal, non-banking services.

CBN has defined its mandate of maintaining the external reserves and safeguarding the value of the Naira to include “increased access to finance for MSMEs as a result of financial inclusion.” The CBN says credit made on the back of mobilized savings will lead to greater productivity and stabilize the value of the Naira. The NFIS has a target to drive the percentage of the adult population with a credit product through a regulated financial system from 2% in 2010 to 40% in 2020. The actual achievement is 3%. Without credit, no economy can grow, SMEs cannot expand.

What about Payments? According to Efina, “bank growth has been driven by the use of digital financial services, savings, remittances abd agents. Payments, in particular, have seen a gain of 13% from 2018 to 2020, the highest recorded amongst the services provided. Yet only 28% of Nigerians have used digital means to make a payment, only 13% have used digital means to receive income, and only 7% have remitted digital cash. There are 106 million adults, only 28% are active digital financial services users, to put this in context.

FinTech sector is growing in Nigeria

McKinsey reports Nigeria is home to over 200 FinTech standalone companies. Between 2014 and 2019, they raised more than $600 million in funding. In 2019 alone, Nigeran FinTech attracted about 25% of $491.6 million raised by African FinTech. A survey by Ernest & Young in collaboration with the FinTech Association of Nigeria (fintechNGR) reported that 57% of FinTech startups generated annual revenues of over $5 million.

According to McKinsey, key adoption metrics for uses of FinTech in Nigeria are Access and Convenience. Nigeria FinTech is concentrated on serving consumer lending, payments, and savings. There exist FinTech opportunities, especially in the SME and Corporate space.

Figure 3: Focus Area of Nigeria FINTECH

Nigeria needs FinTech

FinTech savings apps are very popular with Nigerians, especially in savings options. They offer rates much higher than Nigerian banks. Cowrywise, for instance, offers 7% on a savings account.

According to EFINA, only 27% of Nigerians are “financially healthy”. this means they can manage day to day, build and maintain reserves, plan and manage risks. By risk, for instance, they can raise N45,000 in 7 days and can recover from a financial shock. There is a positive correlation between digital financial services and financial capability. The higher the digital finance services usage, the higher the financial capacity.

FinTech needs to do more

McKinsey estimates that FinTech accounted for only 1.25% of retail banking revenues in Nigeria in 2019. According to Efina, less than 30% of adult Nigerians use products or services from non-bank formal financial institutions. Only 4% utilize money, about 25 utilize microfinance banking. These are not good figures. In terms of awareness, only 22% of Nigerians are aware of mobile money services by no bank financial services providers.

Nigerian FinTech is also expensive. I did a survey of a few FinTech operators and their approach to credit. Overall comments were that FinTech turnaround time was faster, but almost everyone using FinTech to access loans complained about the very high cost of loans. A few examples are; Migo Money Inc 25% a month, Fairmoney 8.7% a month.

CBN needs to be flexible

I have earlier written about how the CBN guidelines on Payment Service Banks (PSB) are stifling competition in the financial services space CBN PSB Guidelines. By mandating very high capital requirements for the PSBs, CBN is discouraging competition. The CBN’s NFIS document highlights that Ghana was able to increase her mobile money user population by 72% within the first year of the “provider neutral regulatory” release.

CBN notes that “Nigeria can also attain a significant increase in mobile money penetration if it opens the field to more players, particularly non-banks that can offer payment and other financial services while regulating healthy competition.” One then wonders why the CBN is not taking its advice and allowing FinTech to offer credit, deposit, and other banking services to more Nigerians and raise the level of financial inclusion.

How can I take part in this

Great articles you have here.