The United Bank of Africa has published the names, Bank Verification Numbers (BVN) and account numbers of some customers alleged to have violated the forex policy of the Central Bank of Nigeria.

This development is coming after the CBN directed banks to expose customers who engage in fraudulent and unscrupulous tactics to obtain foreign exchange from banks.

The UBA disclosed this in a publication on its website titled, ‘CBN FX defaulters’ on Friday.

What UBA said in its statement

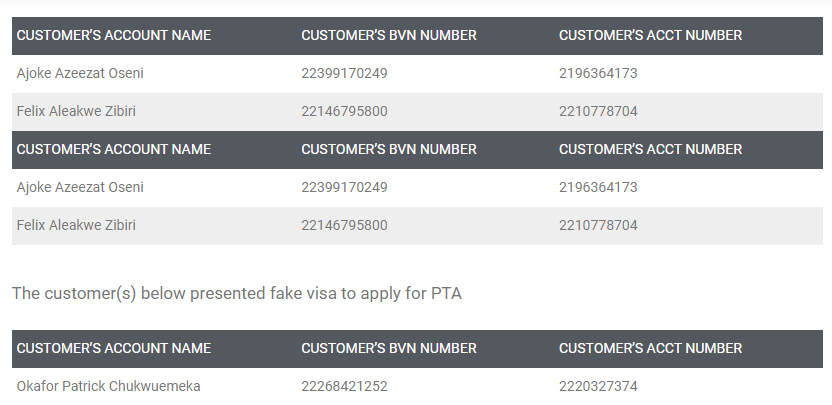

The bank stated, “In compliance with the directive of Central Bank of Nigeria mandating banks to publish the names of defaulters of the forex exchange regulation.

“Based on regulatory directives, the following customers cancelled their trip and failed to return the PTA availed to them despite several mails, text messages and follow up phone calls.”

The bank also included the name of a customer who it said, “presented fake visa to apply for PTA.”

What you should know

- Nairametrics had reported that some deposit money banks acting on the directive of the Central Bank of Nigeria (CBN) have sent notices to their customers warning that identities and Bank Verification Number (BVN) of those who contravene the apex bank’s new forex policy on overseas personal and business travels will be published.

- The banks in their notices also pointed out consequences for those customers who engage in fraudulent and unethical practices with regards to the purchase of Personal Travel Allowances (PTA) and Business Travel Allowances (BTA).

- The banks warned that defaulters of the new foreign exchange policy may face fines, including being prevented from accessing FX from the official FX market, bank account restrictions as established by the CBN, and criminal prosecution.

- The CBN had also directed that travellers who buy foreign exchange from banks for travel purposes but fail to embark on the trip after 2 weeks of their scheduled travel date must return the forex to the banks.

- The CBN Governor, Godwin Emefiele during the Monetary Policy Council meeting which was held on Friday, September 17, 2021 warned that the apex bank will hunt Nigerians who buy forex for Personal Travel purposes and later cancel such trips.

Restrictions and prosecution would have been a better option than exposing their details in the media

That’s your opinion

You must be a sympathizer of fraudsters.

Gaidam ABBA gawo

ABBA KYARI

This is absolute trash!!! I wonder the kind of leadership this country has. This is not a civilized way of doing things for Christ sake.

This is positive development, atleast lets start somewhere, prosecution shall follow afterwards. The beginning of the end of the road for those bent on crippling our economy due to their selfishness. Kudos UBA

Joint

They’re doing rubbish, upon rubbish

Mothafukas publish the real criminals.scams evrrywhere

Sometimes I wonder if this country is being controlled by illiterates. We are cursed in this country nothing goes well at all why won’t there be such act when we have bad economy? Look on a normal note before our government decides to start fighting crimes against the citizens they should make sure they stop corruption from there end and put things to order if not they just wasting there time. Nonsense

Scammers

Something is wrong with Nigeria leaders in all aspect. Political, Social, traditional, religious, just name it. e.g….

But the good thing is all of them will pay for it one day or the other. Nigeria is blessed with so many resources and yet the stupid, wicked, demonic leaders failed to make the country great. Useless and senseless people everywhere. God ll punish all of you.

This is a very good development. Next time publish their picture and the amount they exchange let Nigeria see them for their crimes.

Really something is wrong with one sided Nigeria leadership today . Political, Social, traditional, religious, is full of corruption our leaders today are the most corrupt by appointing only the northerners where is order regions ? they keep borrowing money in name of Nigeria an share among them self injustices is too much, God is watching you all that contributes Sufficent suffering to the great people of Nigerian, cursed will return back because you led people to involve into crime before surviving in Nigeria. is error !

When will the names of people sponsoring terrorism and banditry in Nigeria be published?

I Stay At Home Becuse Covid 19 is Very dieseas For My Life

Fighting criminal behaviour with criminal behaviour cannot be right. Account number and BVN are confidential and shouldn’t be treated in such a frivolous manner. If govt/CBN are serious, they should simply prosecute offenders to serve as a deterrent to others. The lack of punishment for offences is one of the reasons why the country is in such tatters.

So, customers can even have privacy again! You should also publish their account bal. Shit!

we never get our on covin 19 is very inportan to the people

because som are suffer we are prey to get

but nigeria tray for covin 19

good

what uba prepaid card