At the recently concluded MPC meeting by the Central Bank of Nigeria (CBN), the CBN Governor, Godwin Emefiele responded to rumours on social media about CBN making enquiries on the legality of the operations of abokiFX.

Emiefiele, while responding to questions after the MPC meeting on Friday, September 17, 2021, referred to Mr Olumide Oniwinde, the owner of abokiFX as an illegal FX dealer who will be prosecuted for endangering the Nigerian economy.

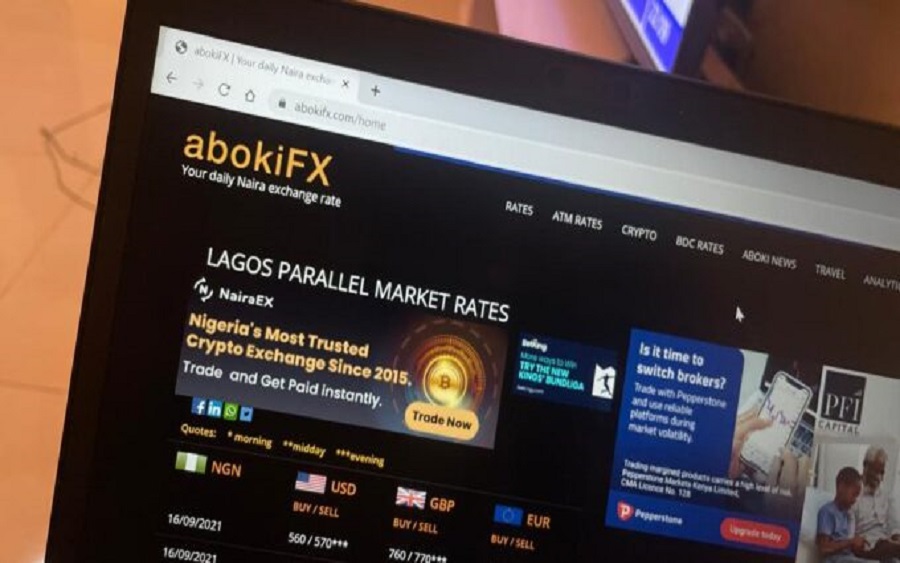

AbokiFX is a website that publishes the parallel market exchange rate of the Naira against other currencies of the world on a daily basis.

According to the governor, Mr Olumide Oniwinde started the abokiFX operation in 2015 and has since milked the economy by taking position, while manipulating the exchange rate. He stated that “The CBN act section 2, does make it clear that only the Central Bank can determine the value of the naira, and yet a single individual living in England continues to manipulate the exchange rate and make huge profit which he withdraws through an ATM in London.”

He explained that despite the company filing the same figures of 1,000 pounds in its financial statements for the past 4 years, Mr Oniwinde and the company has over 25 bank accounts in Nigeria with about 8 banks both in naira and dollar with significant turnover.

He also confirmed that the apex bank wrote a memo to banks to provide the information about abokiFX as he stated that the CBN has been studying the activities of abokiFX in the last two and half years.

“There was a particular time I asked our colleagues to call the so-called owner of abokiFX, that we want to understand his model and how he came about advertising those rate, we find him as someone, a Nigerian who lives in England and conducts this nefarious activity on our economy.

“It is economic sabotage and we will pursue him, wherever he is, we will report him to international security agencies, we will track him, Mr Oniwinde, we will find you, because we cannot allow you to continue to conduct an illegal activity that kills our economy.” Emefiele said.

Mr Emefiele reiterated that their preliminary findings suggest that the website was built and is being used purely for the purpose of foreign exchange manipulation and speculations. “They get naira loans, use to purchase dollars, take a position, change the rate over a given period, sell the dollars they purchased and make a profit, this is completely illegal, unacceptable and we will pursue them,” he explained.

Why this matter

The recent clampdown on the owner of abokiFX by the Central Bank is in its bid to defend the naira against other currencies as the variance between the official rate and the black market continues to widen.

Recall that the apex bank, two months ago discontinued the sales of forex to BDC operators in the company, due to alleged acts of sabotaging the country’s economy.

The CBN under Emefiele has fared worst than any other administration.

All his policies to strengthen the Naira are short-termed and unsustainable. AbokiFx isn’t the reason why the Naira has fallen facedown to other currencies.

Chasing shadows!

The word capture is bushy andl devoid of decorum,is Oniwinde a monkey to be captured?,beg comot for my face?♂️

Mr Emefiele,what about the banks aiding him?

If the guy is really guilty of manipulating the value of the naira, whether alone or in collaboration with a group of black market dealers, then he should be prosecuted and made to return all his illicit profits. But if found to be innocent, then he should be cleared and not made the scapegoat of our poor fx management decisions. The economy is very unproductive in terms of contribution to global trade and the fx value is a reflection of that. Corruption, exploitation and multiple taxation of businesses by government agencies and regulators has given the country a very bad image before top Western investors who now prefer to set up their operations in smaller and more friendly neighbouring countries. And this trend is set to worsen for Nigeria with the implementation of ACFTA.

Well said Stanley. However, I think the real “cahuna” is the lack of demand for Naira outside Nigeria largely (IMO) due Nigeria’s elite preference for so-called hard currencies and violation of international economics principle that says if a person in country A wants to buy something from country B, he goes to FX market in his country to buy country B’s currency to pay for the goods. Nigerians (governments & individuals) are too willing to collect dollars rather than Naira for Nigerian goods ( oil & non-oil goods), thereby effectively killing demands for Naira. It’s that simple!

It is really surprising that only the actions of private individuals and their companies are often interpreted by the government as working against the economy. The government itself has never seen a situation in which it has erred in its policies. I believe claiming that the economy is being sabotaged by mere action of a company is a vague statement to be made by any public official. Because government measures to increase the value of the naira have failed to yield the expected results, the government is now manufacturing evidence to blame the low value of the naira on the actions of an individual and his company. Recently, the government, through the CBN, ordered Money Transfer Service operators like Western Union, Ria, and the like, to pay out all inflows from Nigerians in the diaspora in dollars instead of naira. The goal was to increase the value of the naira, to increase our foreign inflow volume, and perhaps to increase the availability of dollars for international settlements. But unfortunately, the reverse has been the case, as the value of naira has continued to go downhill and Nigerian households are reaping the benefits in many ways. Companies are still finding it difficult settle international payments due to dollar scarcity. Actually it is illegal to ask that money sent home be paid out only in a foreign currency, which is not the national currency of the country in question. It is also an economic sabotage if the government fails to have confidence its own national currency. But who would prosecute the government on this? The government seems to be jealous of the success of innovative private sector firms, but has failed to be able to manage its own organisations to be as profitable or successful. They come up with unfavourable fiscal measures against these startups instead of working with them and developing collaborative strategies. They are now planning to build a digital currency. Hitherto, the government, through the CBN, had clamped down on operators of digital currencies ostensibly because they were making profits. Companies rely on digital currencies to settle international payments given the scarcity of dollars, which cripples their business. But the government turned against it, and is now building its own digital payment ecosystem. What a hypocrisy!

The allegation against AbokiFX makes no sense to me. How can someone abroad be so influential to be responsible for the Exchange rate of the Naira? Emefiele has responsibility to manage Nigeria finances and Exchange rate of the National currency. His explanation was daft, patronising, and insulting intelligence of the citizens of Nigeria. He was merely passing the buck and betraying his glaring incompetence. I think Emefiele should be sacked for gross incompetence and unbridled negligence. Can anyone in Nigeria or even Emefiele’s CBN do anything to determine the Exchange rate of British Pound Sterling?? Truth be told, Nigeria’s lack of productivity, high unemployment, and culture of Consumer of goods they have to import are the reasons the National currency has low value.

This government is really confused