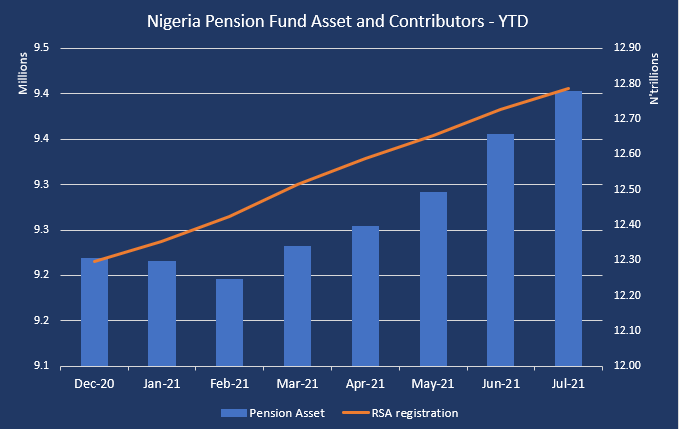

Nigeria’s total pension asset value rose by N123.47 billion in July 2021 to close at N12.78 trillion compared to N12.66 trillion recorded in the previous month. This is contained in the pension funds industry report for the review month as released by the National Pension Commission.

According to the report, the net asset value of Nigeria’s pensions fund recorded a 0.98% increase in the month of July 2021, while 22,349 RSA registrations were recorded in the same month increasing total contributors to 9.4 million.

A cursory look at the data, reveals pension asset value has gained N474.49 billion between January and July of the year. In the same vein, 189,765 more contributors have been registered into the scheme, year-to-date.

Pension Fund managers in Nigeria have been recording stellar performances in their various portfolios year-to-date, owing to their systematic investments, so as to edge other competitors in the industry. Recall, that the competition in the industry has grown significantly since contributors can now easily transfer from one administrator to another.

A recent analysis by Nairametrics shows 70% of the 22 PFAs recorded positive growth across their four retirement savings account funds (RSA I – IV), with Stanbic IBTC, Veritas Glanvills and APT Pension leading the list of best-performing PFAs between January and July 2021.

Breakdown

- As of 31st July 2021, most of the funds were invested in FGN Securities, with N8.1 trillion accounting for 64.2% of the total funds. However, a month-on-month comparison shows that investment in FGN securities declined by 3.2% in the review month.

- Local money market instruments, accounted for 16.5% of the total pension fund asset, with N2.1 trillion. It recorded a significant 21.4% increase compared to N1.74 trillion recorded in the previous month.

- On the other hand, investment in mutual funds stood at N116.26 billion, which is about 0.9% of the entire pension fund. Despite its little contribution, it declined marginally in the review month by 0.1% compared to N116.3 billion as of June 2021.

- In terms of fund type, RSA fund II accounted for most of the funds with N5.59 trillion, representing 43.8% of the industry funds, followed by RSA III with N3.35 trillion, which is 26.23% of the total.

- The RSA V fund accounted for the lowest with N117.28 million.

Source: PENCOM, Nairametrics Research

Source: PENCOM, Nairametrics Research

While the growth in the number of RSA registration seems to be increasing in a linear form, it is still very small compared to Nigeria’s labour force or working population. In context, Nigeria’s labour force data as released by the National Bureau of Statistics (NBS), shows that 30.57 million and 15.92 million Nigerians are fully and underemployed respectively.

Simple computation of the total 46.5 million employed Nigerian indicates that only 20% of the working population is currently captured in the Nigerian pension fund scheme. This is significantly low for a country that boasts of being the largest economy on the continent.

Meanwhile, South Africa’s Government Employees Pension Fund (GEPF) with a lesser population boasts of Africa’s largest pension fund with over 1.2 million active members and assets in excess of R1.61 trillion (N46.3 trillion).

What Nigerians think about Nigerian Pension funds

In a conversation with Mr Daniel Azumara, a Business Developer, he expressed dissatisfaction with pensions in Nigeria, submitting that he had not received any form of information concerning his pensions account since it was introduced to him in his first place of work.

“I have no idea what is going on with my pensions account, or even if my organisation actually remits my quota despite deductions every month,” he said.

He also touched on the fact that Nigerians are not really the saving type, especially when it comes to the unforeseeable future.

“We Nigerians are very traditional people with a similar culture that whatever happens to us is by God, hence we feel no need to save for retirement. If I am being asked if I would register as a pension contributor, without my organisation’s influence, I would not. This is because, we Nigerians are low-income earners and would want to survive first before thinking of saving, much less for retirement,” he opined.

Similarly, Aderotimi Thompson an investment analyst addressed the issue of Nigeria’s pension industry and Nigeria’s low penetration in the space. According to him, he does not feel the need to save in a retirement savings account and would prefer to invest in more flexible investment portfolios.

He also cited that Nigerians are not necessarily concerned about retirement savings, especially when they are not making enough, and even if they want to save, they would prefer to invest in instruments that could give them quick returns.

Bottom line

Nigeria’s pension fund asset has recorded significant growth so far in the year 2021. However, it still has a long way to go in attracting more of the workforce to register and contribute to the scheme. This may begin to happen when Nigerians see impressive growth in their various investment schemes.