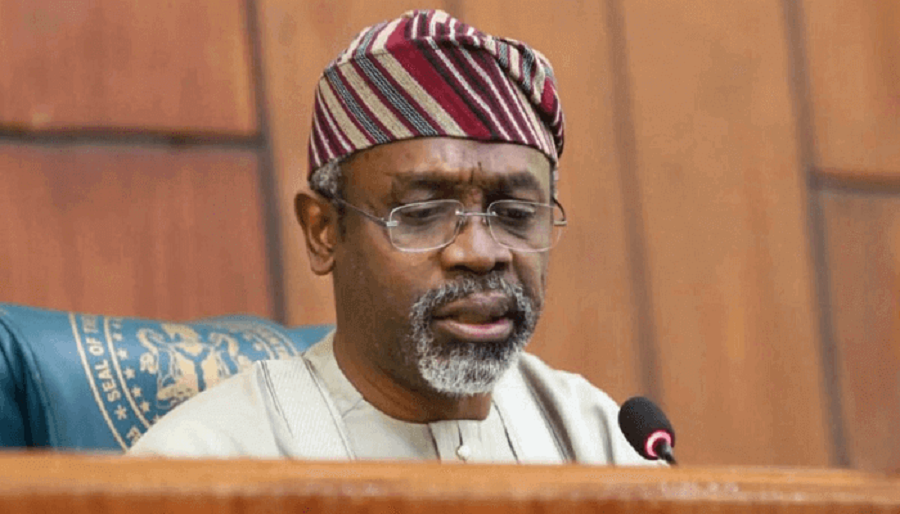

The Speaker, House of Representatives, Rep. Femi Gbajabiamila has stated that the signing of the Petroleum Industry Bill is a victory for all Nigerians and would enable new investments into the sector.

Gbajabiamila disclosed this on Monday after the PIB was signed into law by President Muhammadu Buhari, according to the News Agency of Nigeria.

What the Speaker said

Gbajabiamila stated that the PIB was “a victory for Nigerians and a landmark achievement that ended the two-decade-long journey of the PIB.”

He added that Nigerians will benefit from the signing of the PIB through employments due to investment in the sector and expressed optimism that with the Petroleum Industry ACT 2021, Nigerians would also benefit from reduced fuel prices as there would be competition among the industry players.

“As I said before, this is a landmark achievement. It has been 20 years in coming. This 9th Assembly will be recorded on the right side of history for this big score,” he stated.

He urged investors to take advantage of Nigeria’s oil and gas sector as the law provides.

In case you missed it

Nairametrics reported yesterday that President Muhammadu Buhari signed into law the Petroleum Industry Bill (PIB) 2021 that was recently passed by the National Assembly.